Record Positive Divergence As We Near An August High

This is an abridged version of our Daily Report.

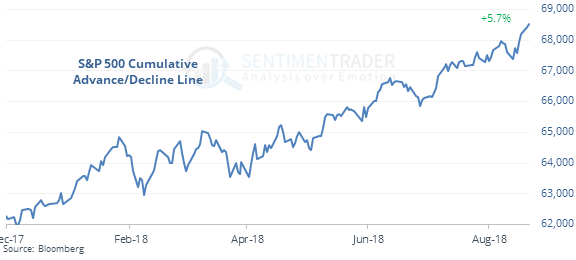

A near-record positive divergence

The S&P 500’s Advance/Decline Line is more than 5% above its high from January, showing that even as the index itself has struggled to hit a new high, a majority of stocks in the index have consistently climbed higher.

Such a big lead over the S&P price index itself led to higher prices every time.

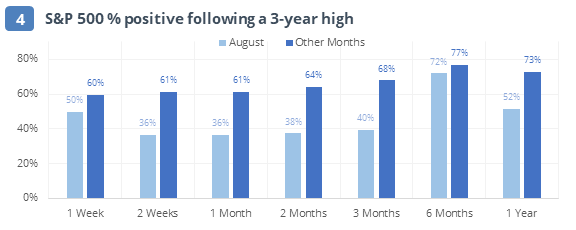

A bad time for a new high

If the S&P does finally reach a new high, the calendar is a stumbling block. Out of all months, new highs in August led to the worst forward returns.

No other month saw such poor follow-through, more consistently than August.

World rebound

After investors fled funds focused on equities outside the U.S., the MSCI World Index (excluding the U.S.) has now rallied for five straight days after hitting a 52-week low.

Coffee stained

Coffee has been the most-hated contract for a while and along with sugar, pessimism is rampant. It’s soured so much now that the Optimism Index on coffee dropped to a lowly 10, one of the lowest readings seen among any contract in nearly 30 years.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |