Record Gaps As Investors Pour In

This is an abridged version of our Daily Report.

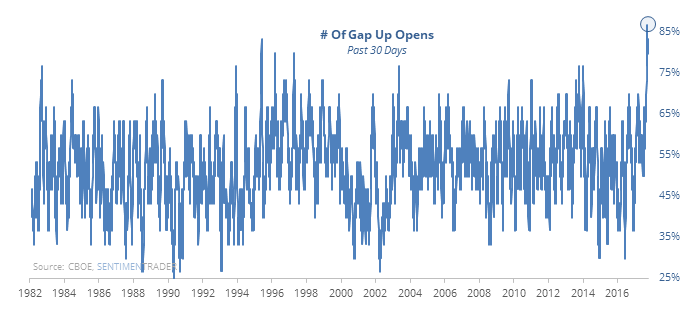

Green every morning

Stocks have been gapping up in the morning almost every day. During the past 30 sessions, more than 85% of them have seen the futures open higher than the prior close.

That is – by far – the most since futures began trading in 1982.

Everyone in the pool!

Trading activity at E-Trade and TD Ameritrade is skyrocketing. So far this month, they have accounted for about 34% of the transactions on the NYSE. That’s more than triple where it was at the low in 2016.

There are no words

The S&P 500 surged more than 1% and closed at a multi-year high on Friday, yet fewer than 55% of the issues on the NYSE advanced on the day.

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers moved to an all-time record long position in sugar, totaling almost 100,000 contracts. That’s more than 10% of open interest, the first time they’ve held so much since 2004.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.