Record Exposure As Small-Caps Drop And Commodities Suffer

This is an abridged version of our Daily Report.

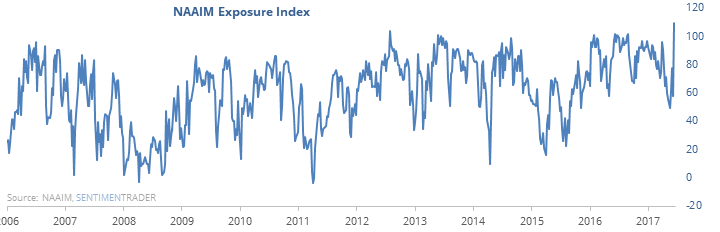

Record exposure

Active investment managers saw a record jump to record exposure and record aggressiveness toward stocks this week.

There is a tendency to think this is automatically a contrary sign, but it has not been a consistent signal in the past, with gains in stocks going forward after every time managers went leveraged long the stock market.

Where’s the cheer in small-caps?

The small-cap Russell 2000 has slid to a multi-week low as it has borne the brunt of recent selling pressure. When that has happened in bull markets during December, it rallied every time over the next several weeks.

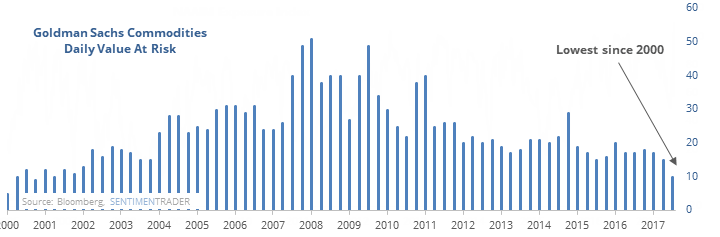

Commodity apathy

Commodity funds are closing as assets leave amid persistent declines. The ratio of commodities to stocks has hit a generational low.

In the midst of the negativity, hedgers have been buying contracts, especially “soft” ones.

MLPs find some love

Over the past 5 days, the average Optimism Index for the master limited partnership fund AMLP has been above 80, the highest in almost a year. According to the Backtest Engine, when the 5-day average has been above 80, AMLP has struggled to hold any gains over the short-term.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.