Receding sentiment

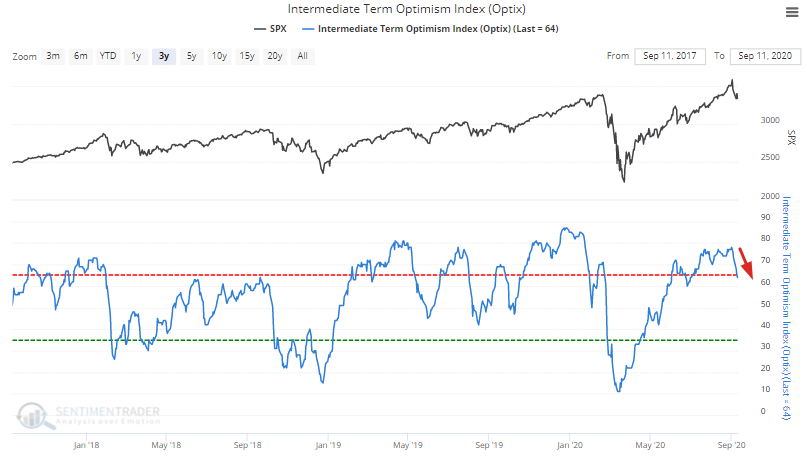

Optimism is receding as the stock market continues to be volatile. The Intermediate Term Optimism Index turned down from an extremely high level, dipping below the threshold that we define as "excessive optimism":

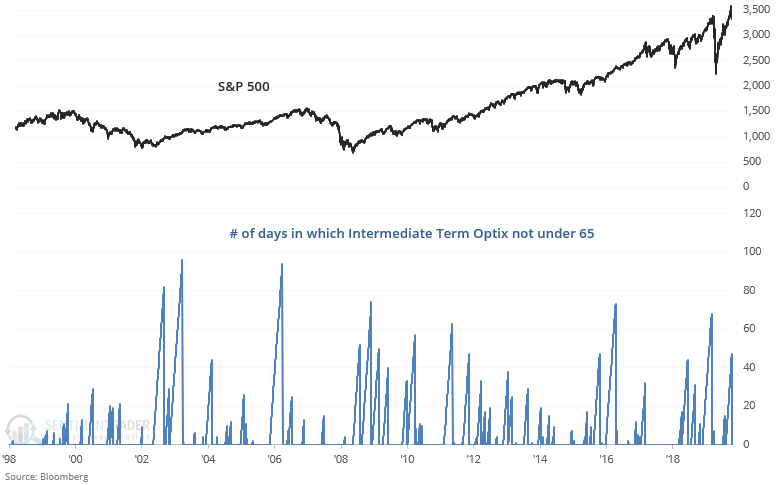

This marks the end of a relatively long streak in which Intermediate Term Optimism was high:

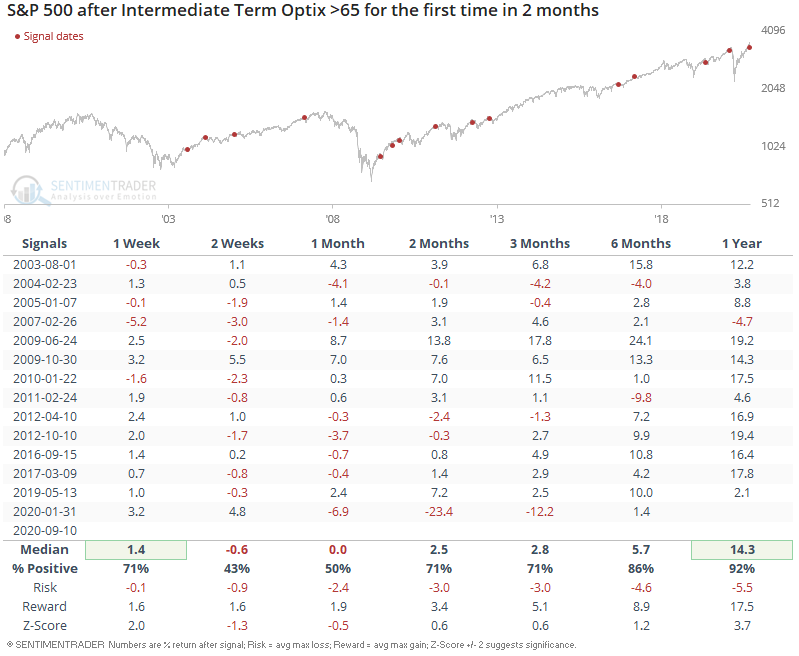

When this happened in the past, the S&P could pull back further over the next 2-4 weeks. But over the next year, this almost always led to more gains for the S&P 500. (This is normal for waning momentum and sentiment.) The one exception occurred near the stock market's peak in 2007:

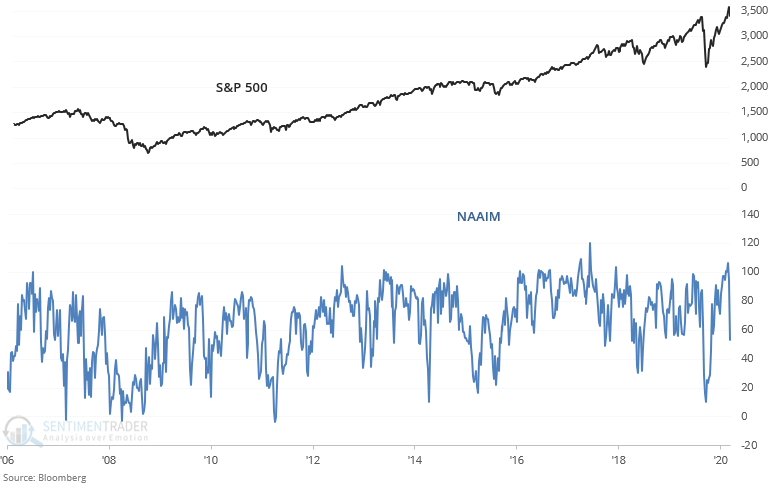

Similarly, active managers are pulling back:

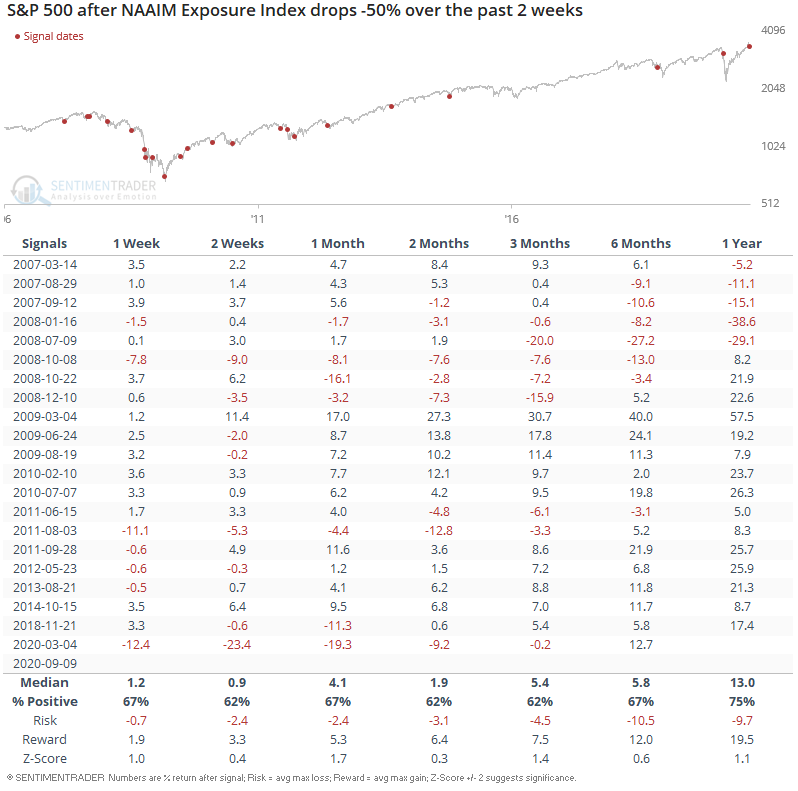

Here's what happened next to the S&P after the NAAIM Exposure Index dropped -50% over the past 2 weeks:

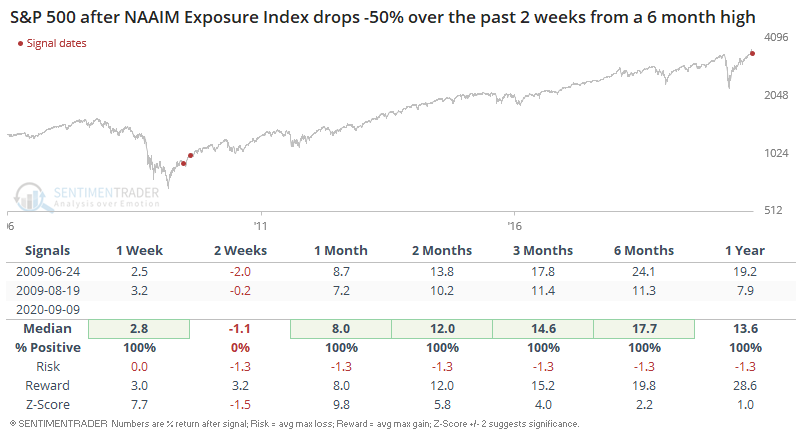

Interestingly enough, there were only 2 cases in which this occurred after NAAIM was at a 6 month high. Both cases occurred after the last recession and major bear market:

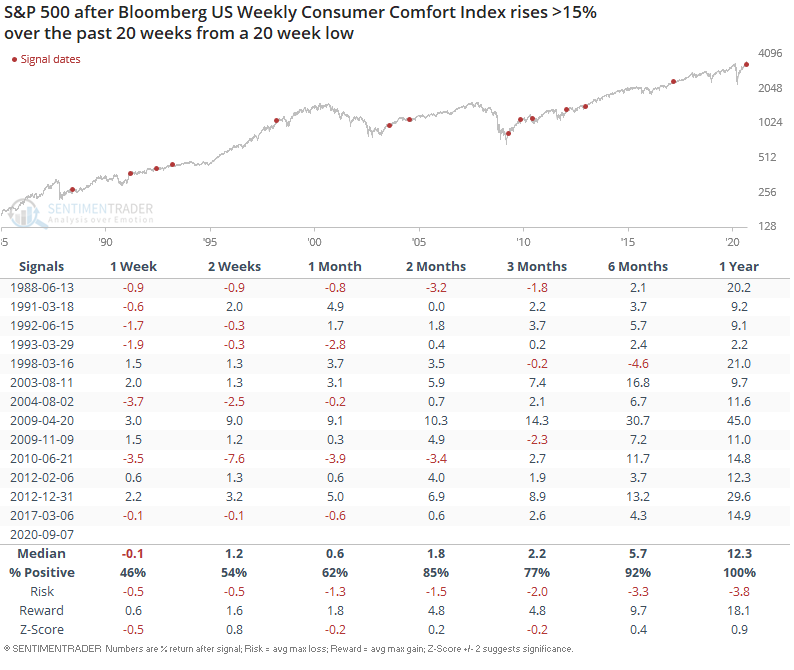

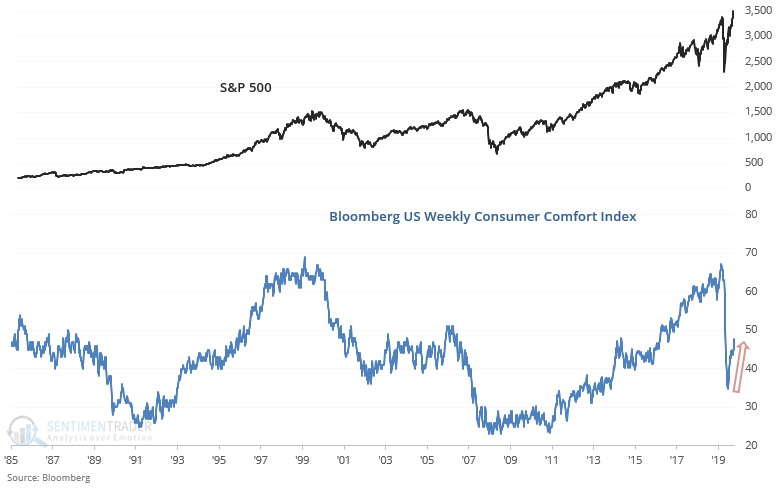

The U.S. economy continues to improve, and Bloomberg's US Weekly Consumer Comfort Index is rising:

Historical cases in which consumer comfort jumped from a 20 week low always led to more gains for the S&P 500 over the next year. This was a hallmark of post-recession bull markets and recoveries: