Rebound in U.S. and tech stocks

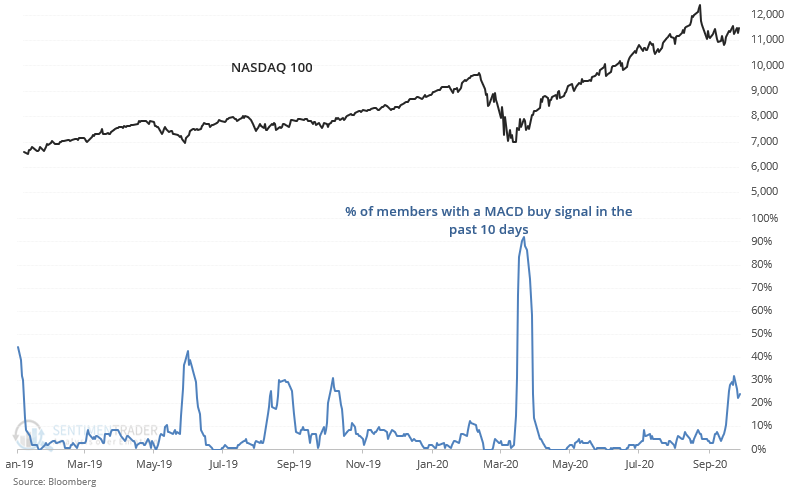

The U.S. stock market's rally from April - August was primarily driven by tech stocks. After a brief pullback, some tech stocks are starting to rally again. More than 30% of the NASDAQ 100's members triggered a MACD buy signal in the past 10 days:

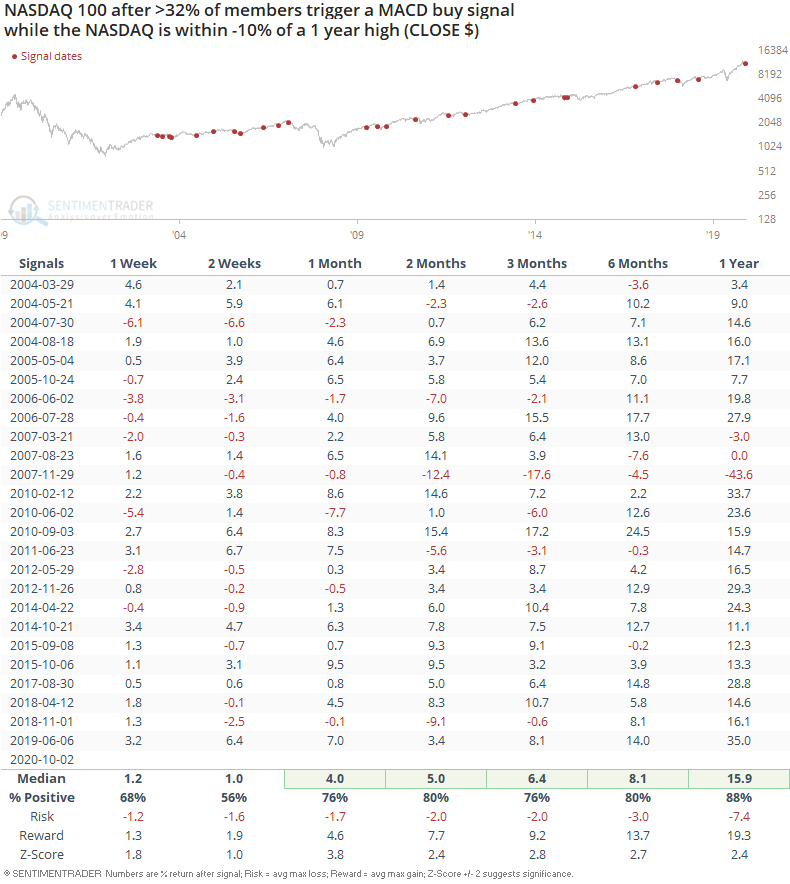

When this happened in the past while the NASDAQ was within 10% of a 1 year high, the NASDAQ usually pushed higher over the next few months. This didn't always mark the exact end of a correction, but betting on bearish outcomes going forward didn't usually pay:

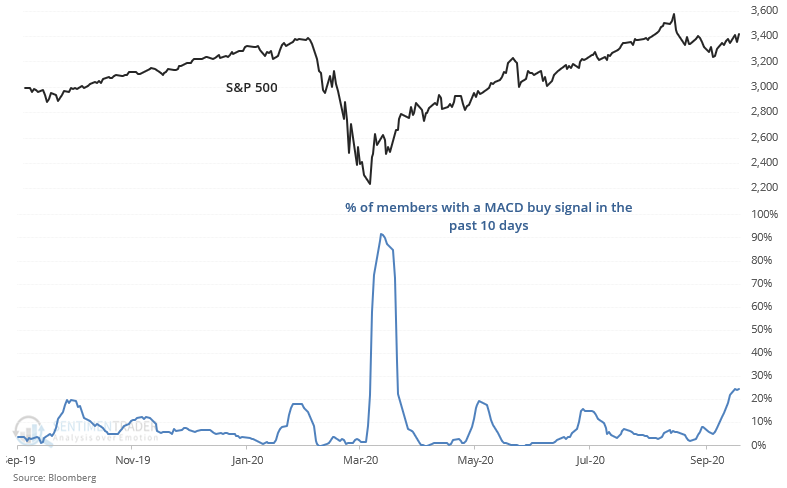

A smaller % of S&P 500 members have triggered a MACD buy signal, demonstrating that once again, tech stocks are trying to lift broad indices:

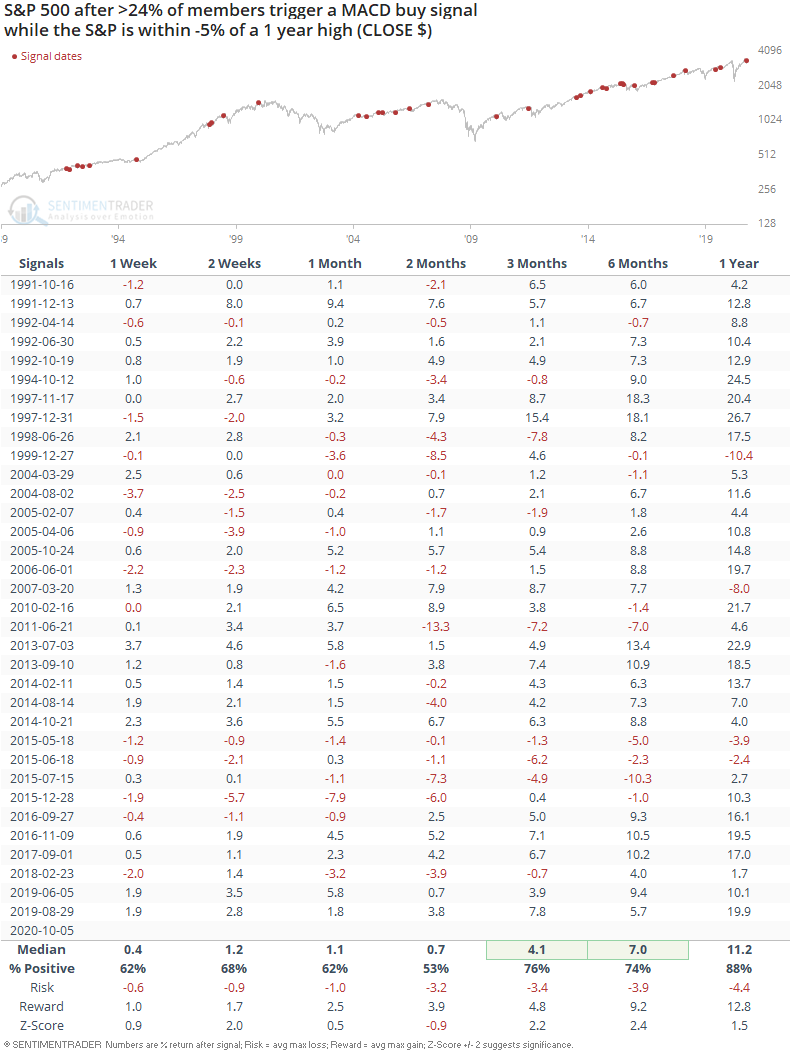

But nevertheless, this led to more bullish than random outcomes for the S&P 500 over the next 3 months:

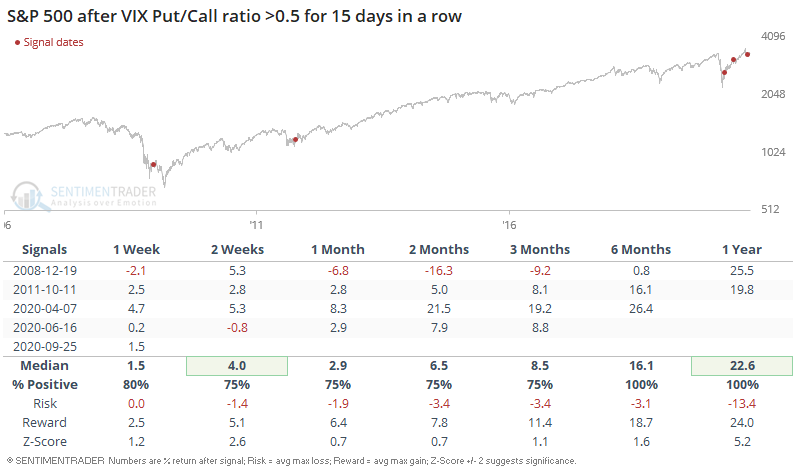

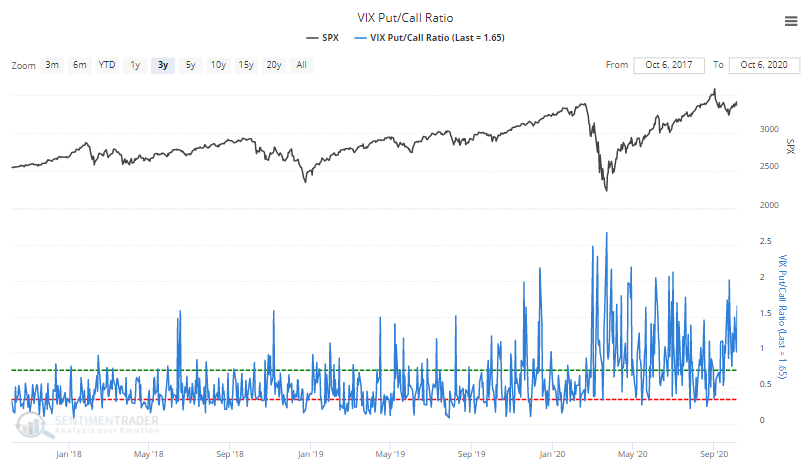

And as Helene Meisler noted, the VIX Put/Call ratio has been consistently high.

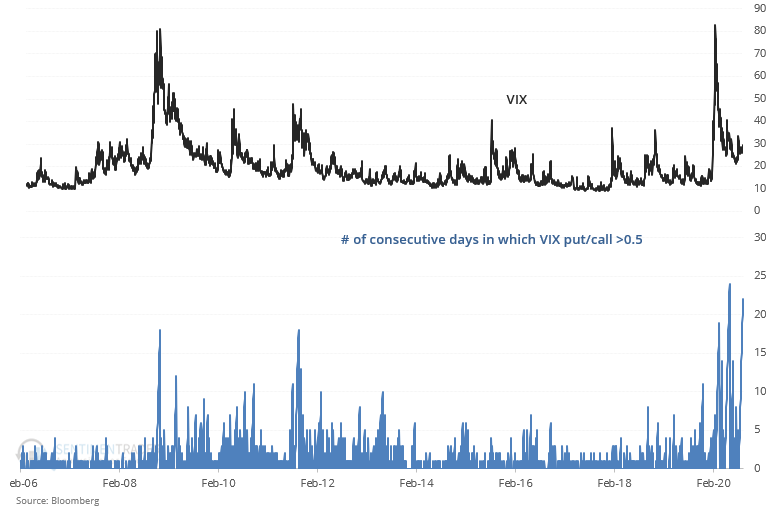

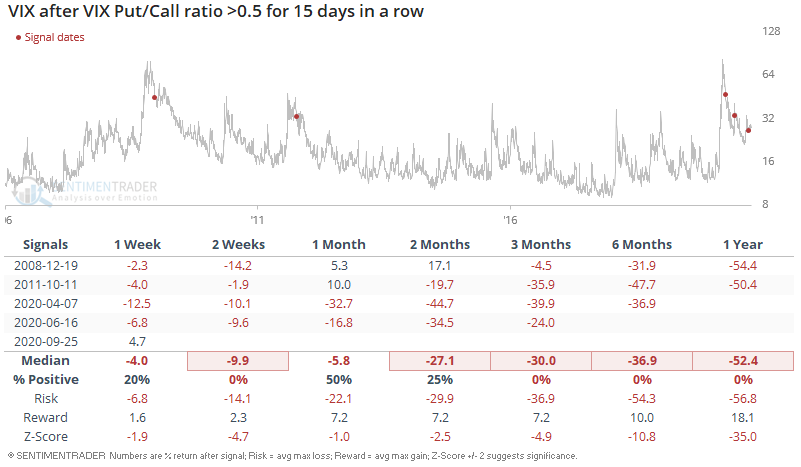

This is the 2nd longest streak in which the VIXC Put/Call ratio was above 0.5:

Less extreme historical cases all led to VIX falling over the next few months...

...and the S&P 500 rallying...