Reasons for caution in the euro and Canadian dollar

Key points:

- Seasonality on the euro and Canadian dollar has entered a weak window

- Options traders appear to be betting on further weakness

- After similar behavior, the currencies weakened short-term, then strengthened

Euro is deeply oversold, but...

Almost every currency has plunged against the U.S. dollar. Seasonal tendencies and options bets suggest it could continue.

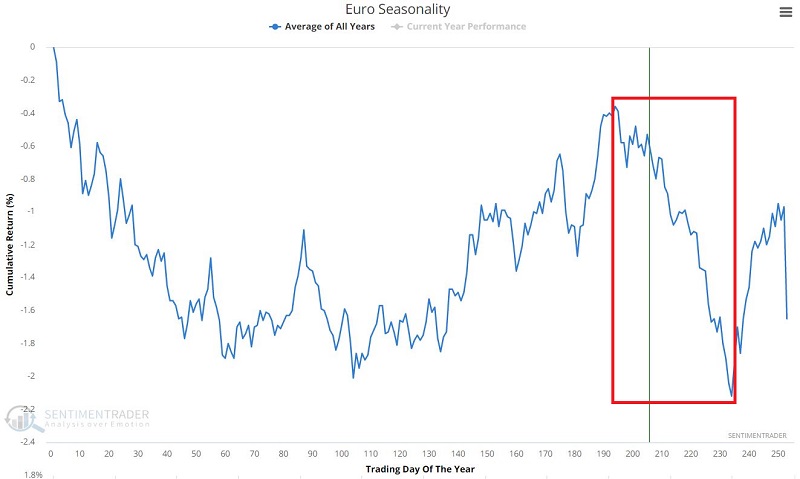

The chart below displays the annual seasonal trend for the euro. That this market is currently within a seasonal period of unfavorable results. This period extends from the close on Trading Day of the Year (TDY) #194 through TDY #234. For 2022, this period extends from the close on September 29 through November 24.

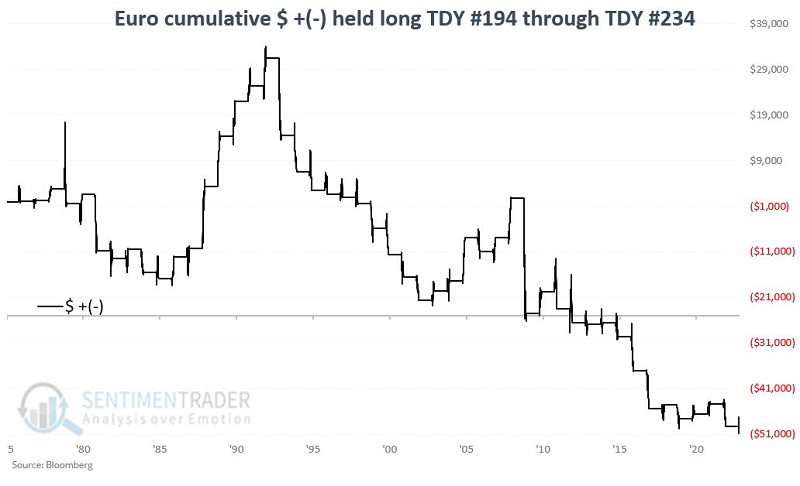

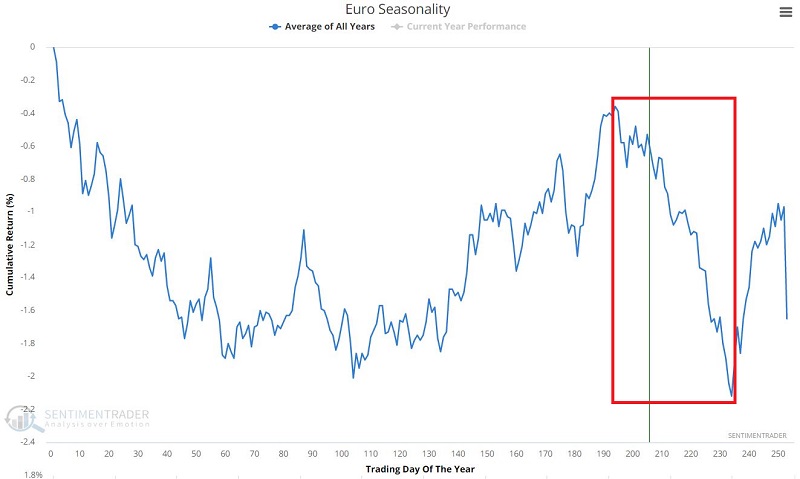

The chart below displays the hypothetical equity curve from holding a long position in euro futures only during this unfavorable period since 1975.

During these windows, the euro declined more often than rallied, with larger average and maximum declines during the bad years then gains during the good ones.

The euro has been on a relentless decline since May 2021. Conventional wisdom argues that no market can trend forever and that a rebound should be in the offing. Nevertheless, seasonality suggests that traders remain patient before jumping in on the long side.

Canadian Dollar facing a long seasonally unfavorable period

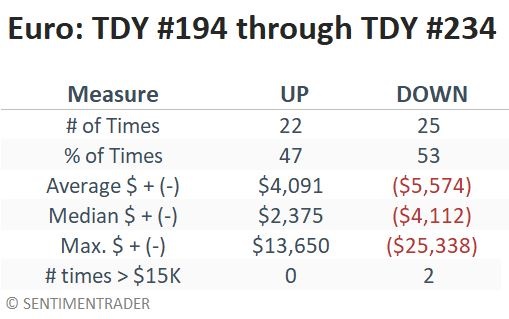

The chart below displays the annual seasonal trend for the Canadian Dollar. Note that this market has just entered an extended seasonal period of typically adverse results. This period extends from the close on Trading Day of the Year (TDY) #205 through TDY #60 of the following year.

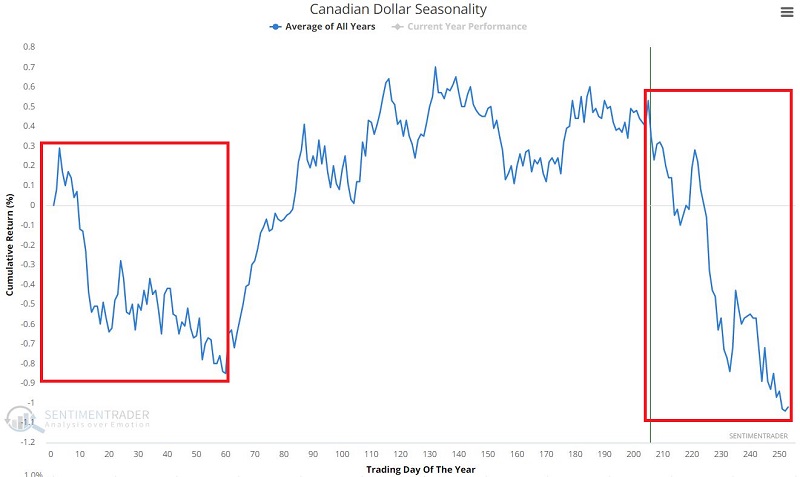

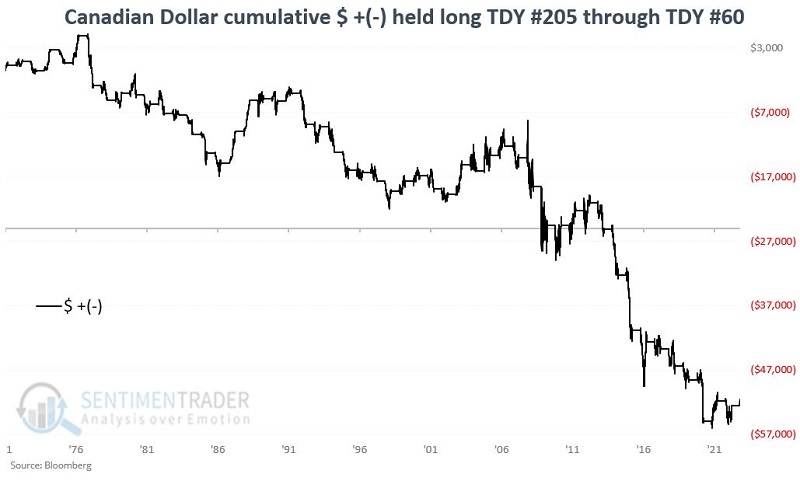

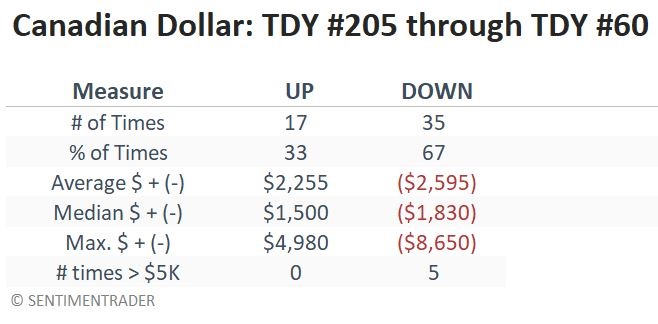

The chart below displays the hypothetical equity curve from holding a long position in Canadian Dollar futures only during this unfavorable period since 1971.

During these seasonal windows, the loonie declined more than twice as often as it rallied. When it declined, it sometimes declined hard, while rallies tended to be relatively muted.

Risk reversal buttresses a short-term negative outlook

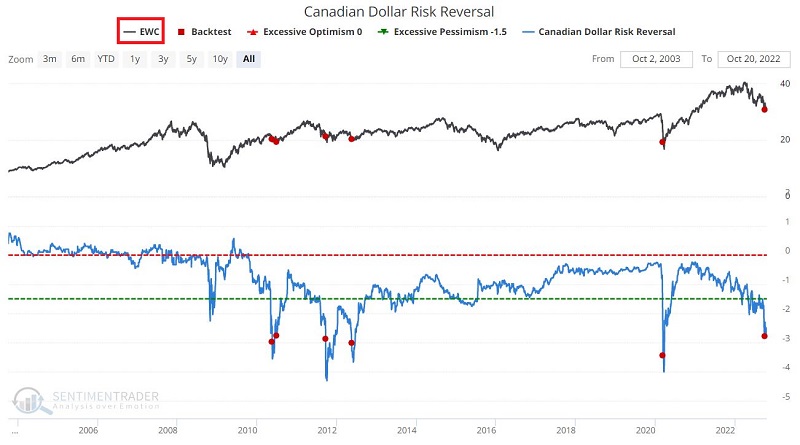

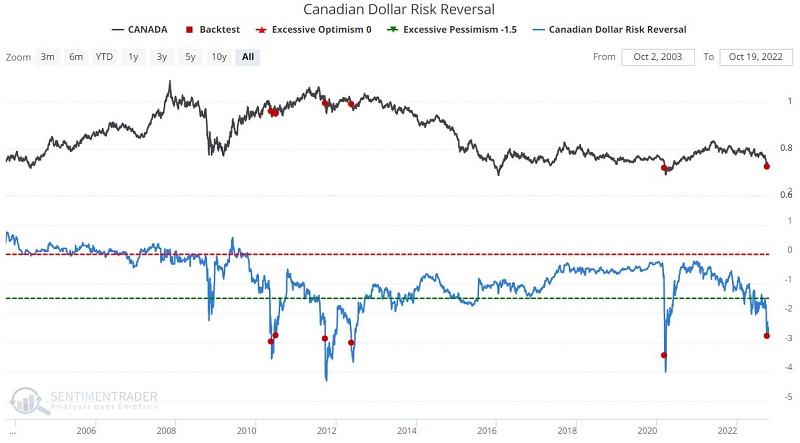

The Canadian Dollar risk reversal indicator shows how much more expensive Canadian Dollar put options are relative to call options. Extreme readings can be noteworthy for both the currency and Canadian stocks (more in a moment).

The chart below displays rare occasions when the Canadian Dollar risk reversal crossed below -2.75. The latest signal occurred on September 30.

Note the weak performance during the first two months following signals and the abrupt about-face in subsequent months. This latest signal argues for a continued decline through the end of November and potentially better times for this currency in 2023.

Much like the euro, the Canadian Dollar has declined sharply of late and appears to be oversold. Nevertheless, the seasonal and risk reversal measure above suggests patience for traders seeking to play the long side of this currency.

A quick detour into Canadian stocks

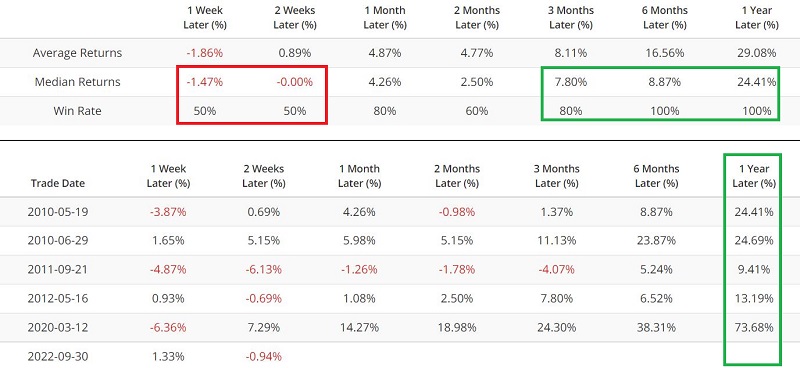

In the test below, we run the same test as above but replace the Canadian Dollar with the iShares MSCI Canada ETF (EWC), which seeks to track the investment results of an index composed of Canadian equities.

The table below displays EWC performance following previous signals. Three-, six- and twelve-month returns have been relatively robust. If history is a guide, the Canadian stock market may witness solid performance in the year ahead - although not necessarily right away.

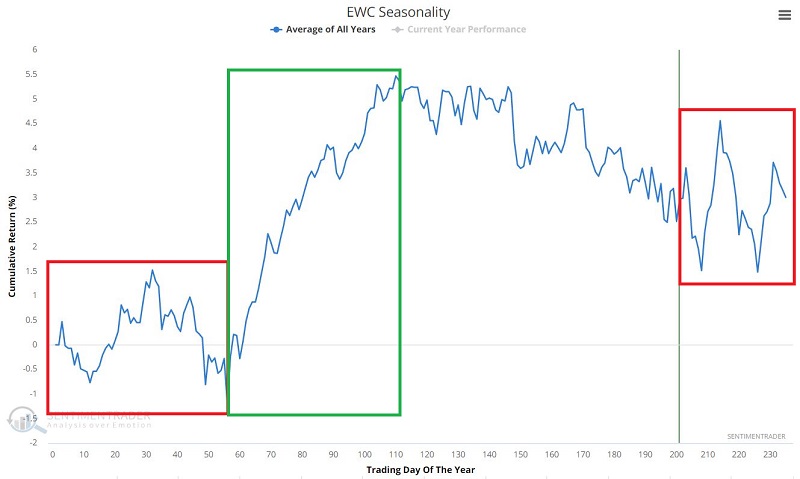

The annual seasonal trend chart for EWC below buttresses this outlook. It suggests continued choppiness for EWC through the late first quarter of 2023, followed by a significant advance into mid-year.

The data for the euro and Canadian Dollar used in the tests below comes from Bloomberg. Two things to note:

- Before the start of foreign currency futures trading, the data is based on Bloomberg's estimated price data. In my opinion, this data is accurate enough to be used as a proxy to extend the backtest, but note that these results are not based on actual trading data

- The data series includes price data on many U.S. market holidays if non-U.S. market trading occurred and/or if electronic trading took place.

What the research tells us…

Both the euro and Canadian Dollar have experienced deep, extended declines and, on the face of it, appear due for a rebound. However, the fact remains that current seasonal trends may act as a headwind. Given the unfavorable seasonal backdrop, the real question for traders is, is now the right time to jump into a bullish contrarian trade in a sharply declining market? On the other hand, investors in Canadian stocks might look for opportunities in early 2023.