Real estate sector is tied more closely to the economy than you may realize

Key points

- The real estate sector is down over 23% in 2022

- Will it rebound in 2023? That likely depends on the economy

- The real estate sector is more closely tied to the overall economy than most investors realize

Measuring real estate sector performance

To measure the performance of the real estate sector in the stock market, we will use the Fama French Index database from 1959 to 1991 and then the S&P 500 Real Estate sector after that. The Real Estate Select Sector SPDR Fund (ticker XLRE) tracks this index.

To gauge the state of the economy, we will use The Conference Board Index of Leading Economic Indicators (LEI). We will rate LEI performance based on two different measures as described below:

A = LEI minus its 12-month exponential moving average (EMA)

B = LEI 6-month simple moving average minus the LEI 6-month simple moving average last month

C = If A > 0 then C = 2 else C = 0

D = If B > 0 then D = 1 else D = 0

In plain English, if the latest LEI reading is above its 12-month EMA, we add two points, and if the latest LEI 6-month simple moving average rose in the last month, we add another point.

Let's next create an indicator that combines the two. We will call the indicator LEIsum. Its value is calculated as follows:

- LEIsum = C + D

Note that LEI values are reported with a 1-month lag and that I only perform the above calculations at the month's end. So, the LEI value for November is reported sometime during December, and I update the indicators above on December 31st.

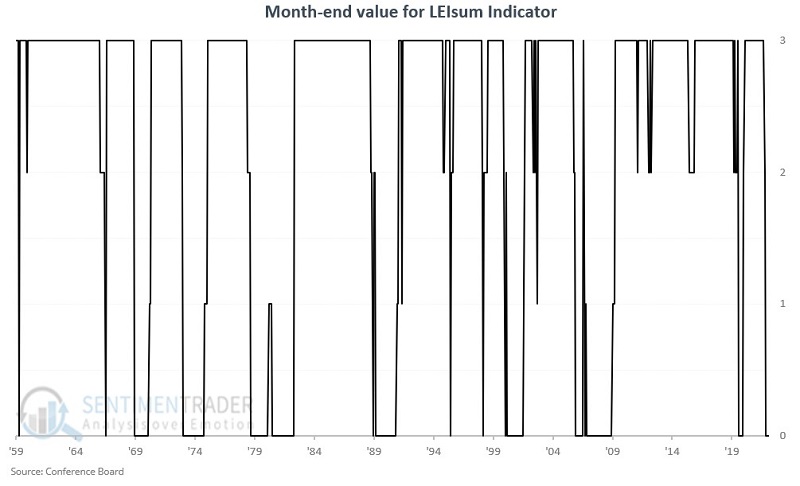

Each month the value for LEIsum can equal 3, 2, 1, or 0, as shown in the chart below - which displays the month-end LEIsum readings since 1959.

The latest results

The November 2022 reading for LEI is 113.50, and the 12-month EMA is 116.17. The 6-month simple moving average for November is 116.45, and the 6-month simple moving average for the prior month was 117.10.

So, on December 31st:

A = 113.50 - 116.17 = (-2.67)

B = 116.45 - 117.10 = (-0.65)

C = since A < 0 then C = 0

D = since B < 0 then D = 0

LEIsum = C + D or 0 + 0 = 0

So as of 2022-12-31, for the purposes of trading XLRE (or any other real estate ETF such as IYR, VNQ, REM, and others), the value for LEIsum = 0.

Does it matter? Peruse the results below and decide for yourself.

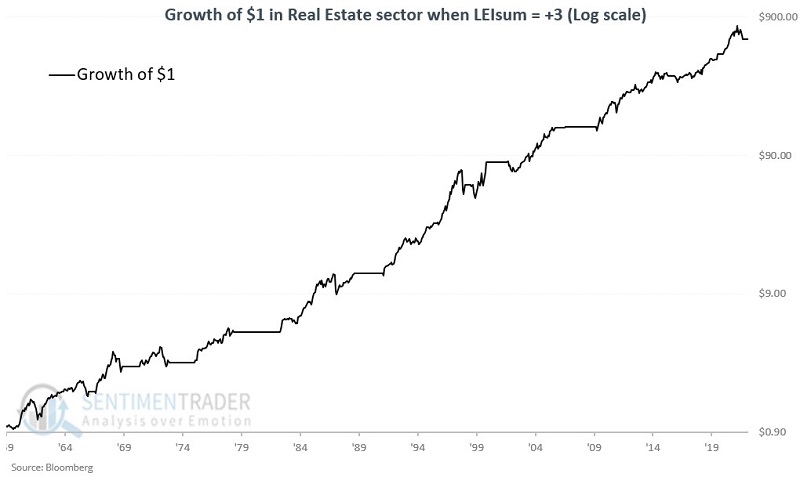

LEIsum readings of +3 are bullish

The chart below displays the cumulative growth of $1 invested in the real estate sector only during those months when LEIsum ended the previous month with a reading of +3. The chart is presented on a logarithmic scale.

The cumulative hypothetical gain from October 1959 through November 2022 was +61,950%.

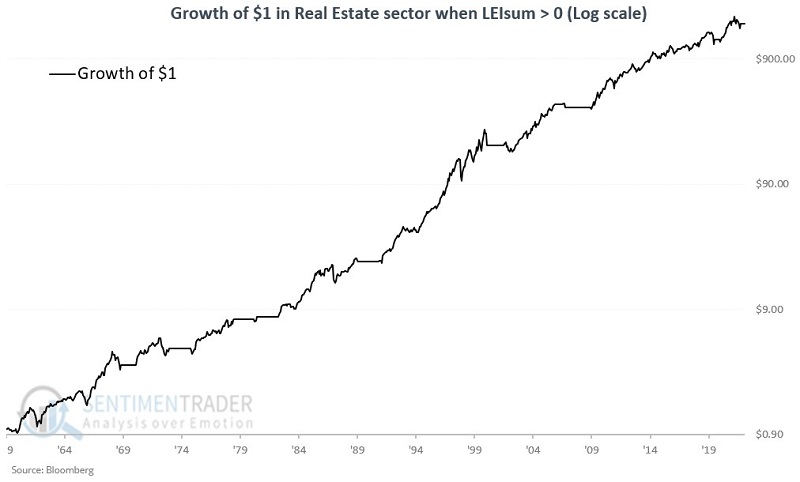

Any LEIsum reading above 0 is favorable

The chart below displays the cumulative growth of $1 invested in the real estate sector only during those months when LEIsum ended the previous month with a reading greater than 0 (i.e., +1, +2, or +3). The chart is presented on a logarithmic scale.

The cumulative hypothetical gain from October 1959 through November 2022 was +171,158%.

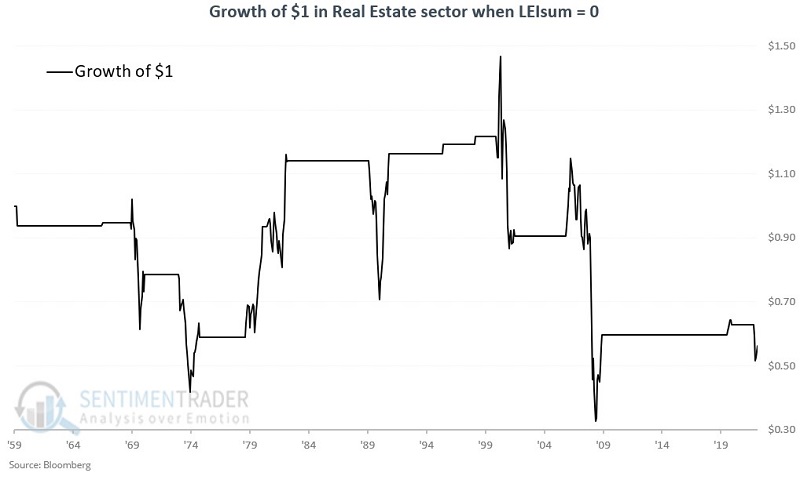

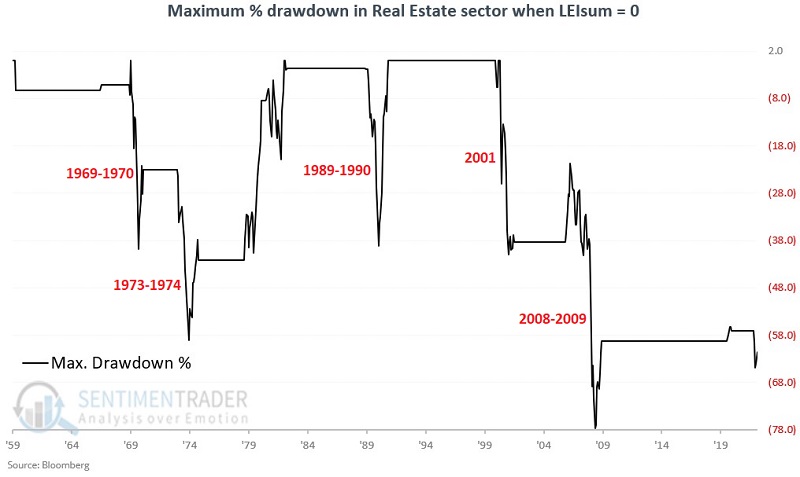

Use extreme caution in real estate when LEIsum = 0

The chart below displays the cumulative growth of $1 invested in the real estate sector only during those months when LEIsum ended the previous month with a reading equal to 0.

Notice any difference between this chart and those above? Essentially every primary bear market in the real estate sector occurred when LEIsum was equal to 0. The hypothetical cumulative return from October 1959 through November 2022 was (-43.7%).

A period from 1979 into 1982 saw real estate show a massive gain even in the face of a foundering economy. While making money is typically objective #1, avoiding devastating losses and preserving capital is paramount. Standing aside real estate when LEIsum stood at 0 would have allowed investors to avoid a drawdown of -40% or more in 1969-70, 1973-1974,1989-1990, 2001, and 2008-2009 and the decline so far since the end of July 2022.

What the research tells us…

The real estate sector does not always rise when the economy is strong, nor does it always go down when the economy is weak. The charts above showed several occasions during the 1980s and 1990s when the real estate sector rallied significantly when LEIsum was equal to 0. Nevertheless, it is also clear that the bulk of all gains in the real estate sector occurred when the economy showed at least some signs of life and that the significant "killer" declines in the sector occurred when the economy was in decline. For what it is worth, LEIsum is presently sitting at a value of 0. This does not preclude the possibility of higher prices in the real estate sector. But it suggests that there might be better opportunities elsewhere.