Rate-Sensitive Divergence With Yields As New Lows Climb

This is an abridged version of our Daily Report.

Rate-sensitive divergence warning

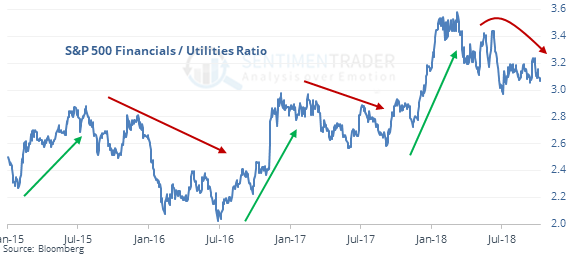

As yields rise, the Financial sector is badly underperforming Utilities, which is atypical.

Historically, there has been a strong positive correlation between rates and the ratio of Financials to Utilities. When a divergence like we’re seeing now has happened before, it was a bad sign for stocks in general.

Not yet so bad that it’s good

So many securities on the NYSE are hitting 52-week lows that it’s nearing an extreme, the most since February. But when stocks haven’t sold off much, a rise in new lows like this isn’t a good contrary sign, and forward returns were mostly weak.

More signs of bond pessimism

Put/call ratios on bonds are spiking. The 5-day average on 10-year Treasury futures is above 2.25, the highest since last December. According to the Backtest Engine, over the past 15 years a ratio above 2.0 has led to a positive return in the TLT fund three months later 73% of the time.

Most-hated country

India is the most-hated fund among the ones we follow. The 10-day average Optimism Index for PIN has dropped below 20.