Rally path given how sectors are reacting

One of the more popular ways to look at the rebound over the past month is how much it looks like other rallies. Does it seem more like a bull market kick-off, or just another bear market rally?

We've looked at it multiple ways since March, and the Wall Street Journal noted it again on Friday.

"In zoological terms, is the 34% rebound since the low of March 23 the start of a new bull market or merely a dead cat bounce we will all forget when the bear returns?"

The idea that we're going to enjoy a v-shaped recovery is being met with increased skepticism as the latest studies suggest a more prolonged misery than many have been expecting. So, let's revisit it in a couple of different ways. First, looking at the highest-correlated rebounds using pure price action, then according to which sectors have led and lagged.

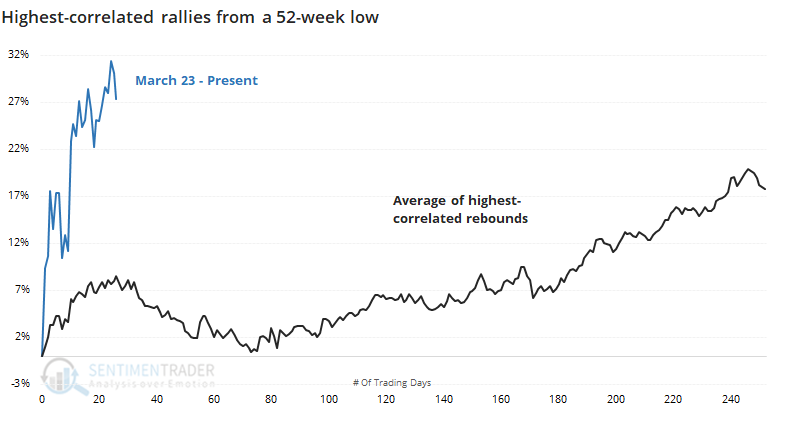

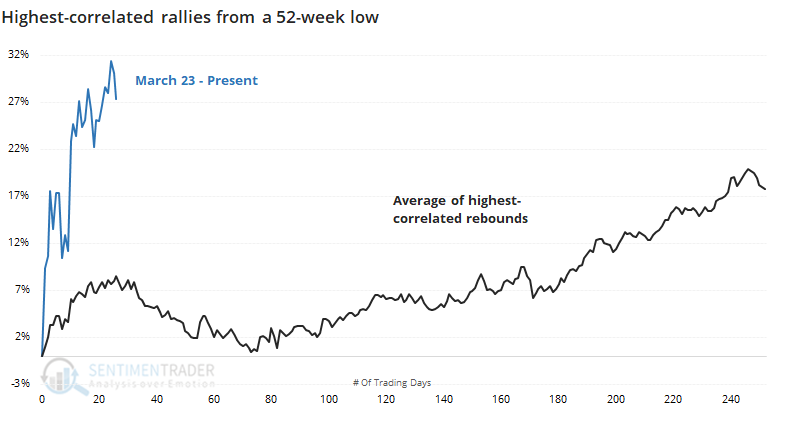

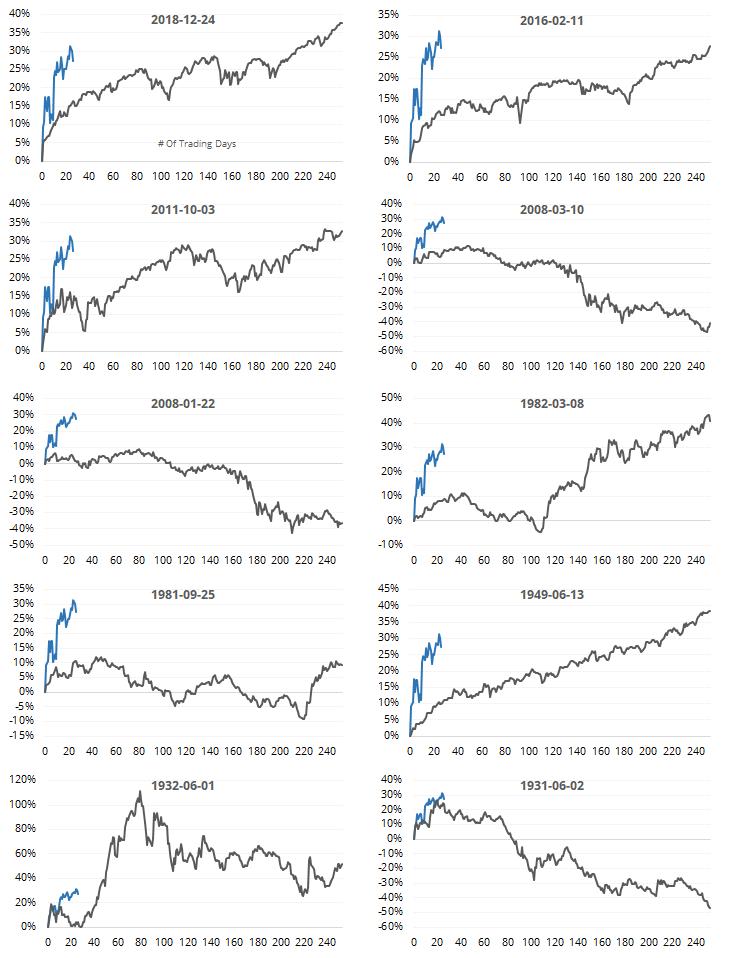

Using pure price action this many days into a rebound following a 52-week low, here is the price path among the 10 highest-correlated bounces.

Most of them ran into some trouble, to put it mildly, right around now.

As the WSJ also noted:

"Furthermore, it has been a strange recovery. After energy stocks, the two best sectors in the S&P from the March low up to Friday were health care and utilities, defensive companies usually expected to prosper in bad times, not in a bounce back. Industrials, classic cyclical stocks that ought to do well when investors expect the economy to prosper, underperformed."

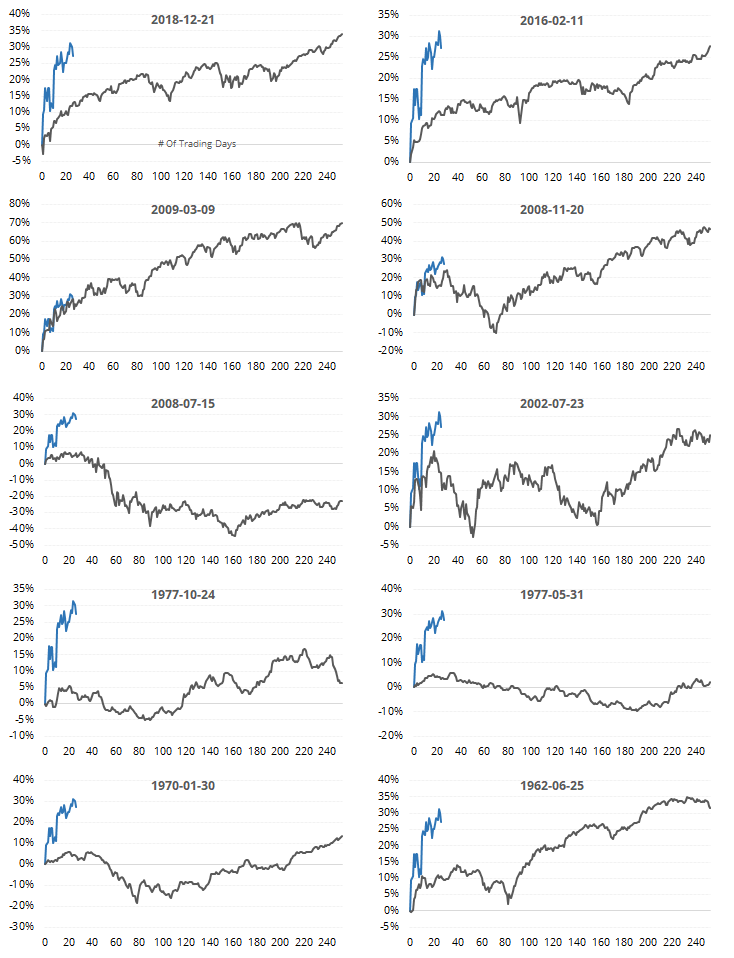

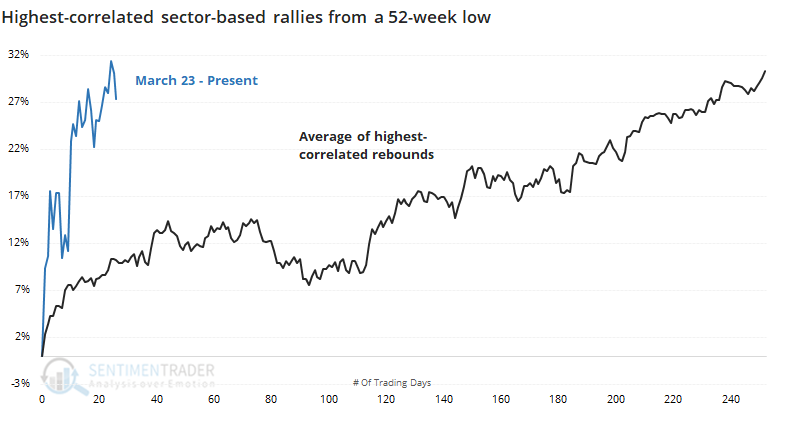

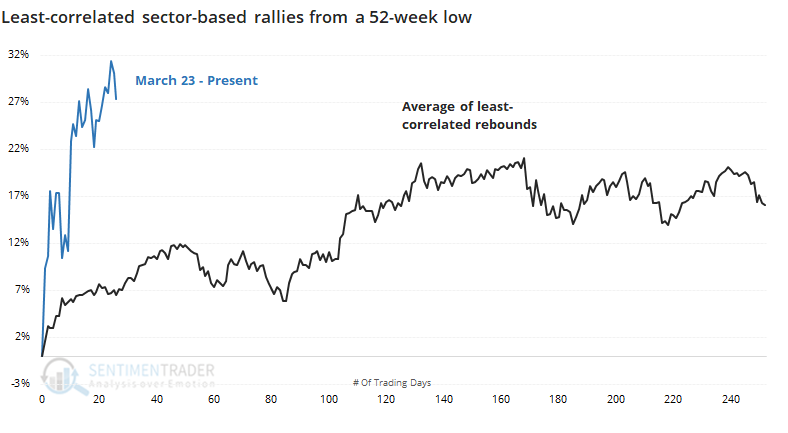

Instead of looking at action in the S&P 500 index itself, let's focus on performance among the 11 major sectors during the rally. Again, we'll look at the price path in the S&P following the rebounds with the sector returns that are most closely correlated to how sectors performed since the March 23 bottom.

Again, the S&P tended to plateau around now, at least for a few months, though the pullbacks weren't as deep. Individually, there was wide variation in their paths going forward.

We often like to look also at counter-examples. If the highest-correlated ones show a certain pattern, and the least-correlated show the opposite pattern going forward, then it adds to the robustness of the study.

After rallies with the highest-correlated sector returns, the future path of the S&P vacillated from about now through approximately day 90, then took off again to the upside.

After rallies with the least-correlated sector returns, the digestion period tended to be shorter, but the ensuing longer-term rallies were weaker.

Between price action itself and the sectors that have been driving the rally, the probability continues to look more like a legitimate bull market beginning rather than just a bear market rally. It's not a slam dunk, though, and if this is the latter, then upside should be extremely limited from here on out. If we continue to see higher highs at some point, then the "bear market rally" idea loses almost any credibility.