Rally Broadens to Push Breadth to New Highs

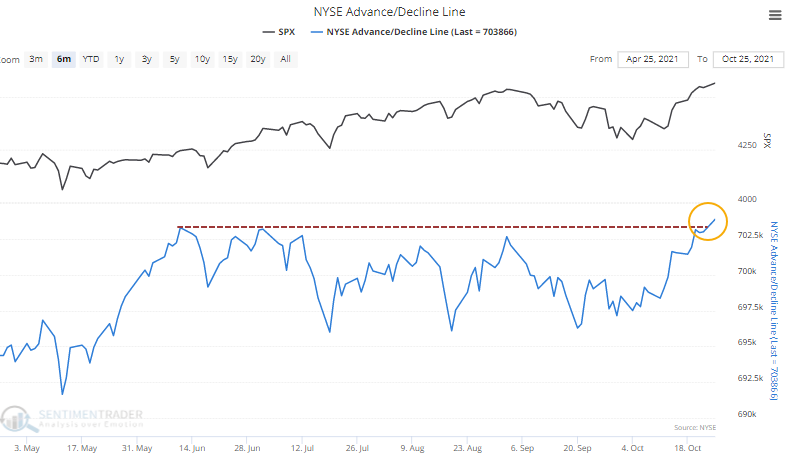

On Monday, we saw that the Advance/Decline Line for S&P 500 stocks broke out to a new high. A line that incorporates the breadth of all securities traded on the NYSE hadn't quite done the same. Now it has.

For the first time in more than 90 days, the NYSE Cumulative Advance/Decline Line is sitting at a record high.

There are all kinds of things traded on the NYSE, with some arguments being that they should be excluded. That's a mistake. Securities with a smaller capitalization or that are especially sensitive to interest rates are suitable to include in breadth measurements.

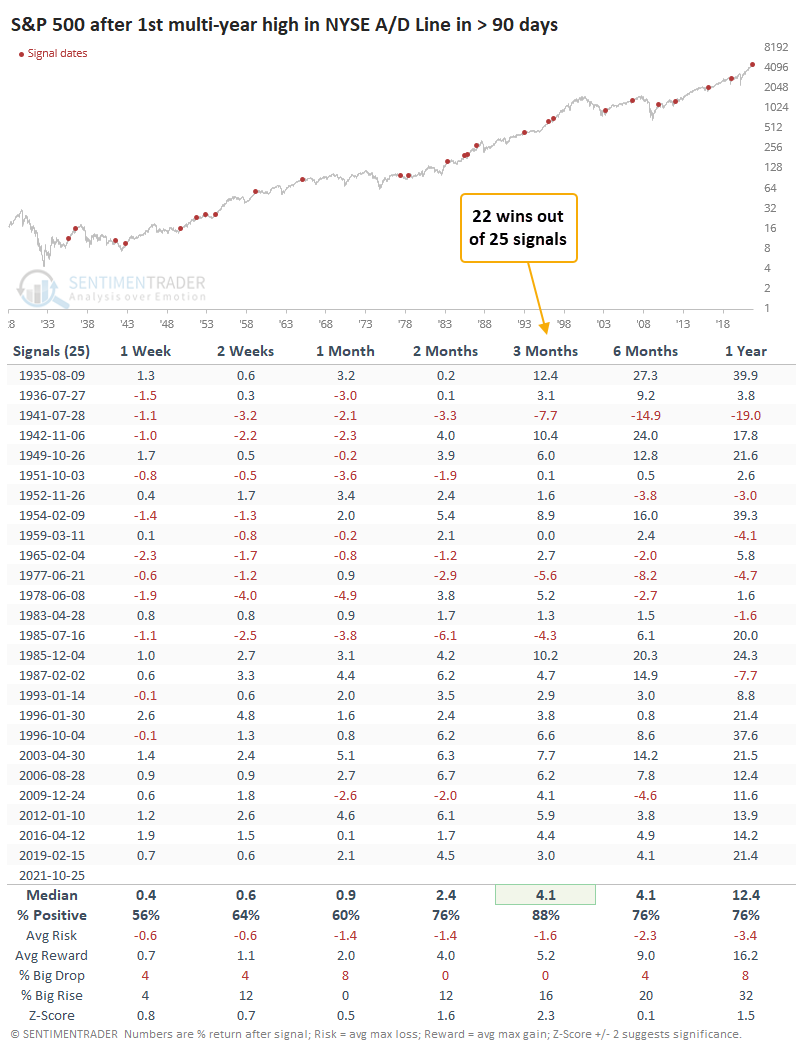

Like we saw with breakouts in the S&P 500 line on Monday, new highs in the NYSE A/D Line have consistently preceded stock gains.

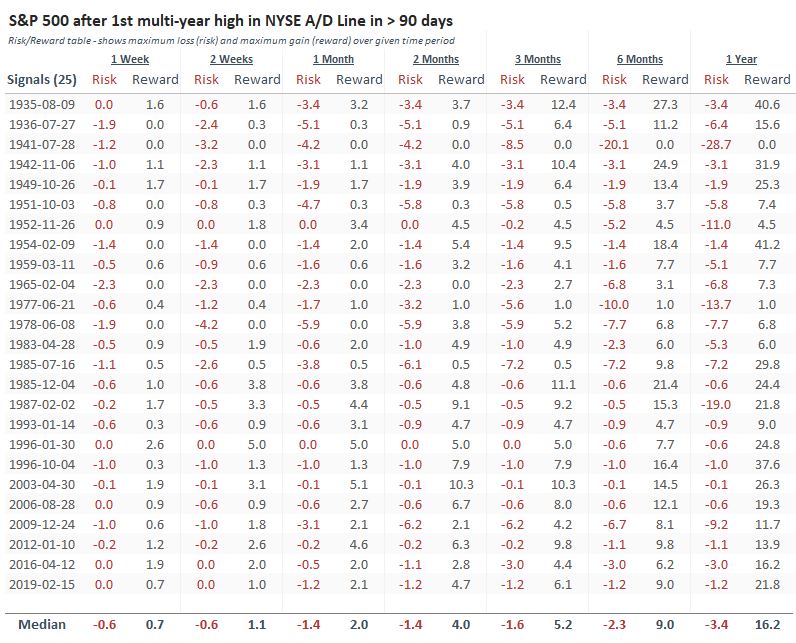

The Risk/Reward Table shows a dizzying amount of numbers, but it's worth demonstrating that over the next three months, there were no losses greater than -8.5% at any point for any signal. On average, drawdowns were limited to only -1.6%. Out of the 25 signals, 19 showed more reward (maximum gain) than risk (maximum decline).

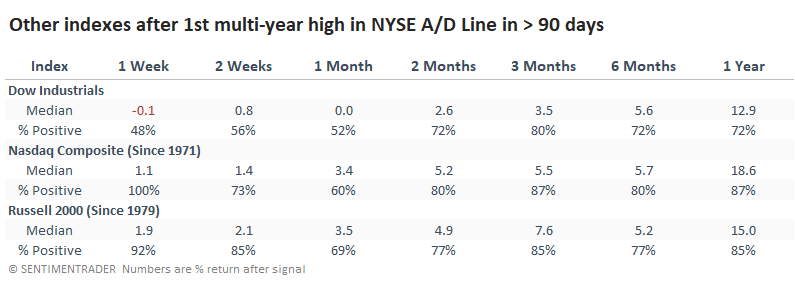

Among the other major equity indexes, the Dow Industrials struggled a bit more in the short-term while the tech-heavy Nasdaq Composite and small-cap Russell 2000 fared much better (but with fewer signals). Over the next week, the Nasdaq and Russell suffered few, if any, losses. Medium- to long-term returns were reasonably consistent between them.

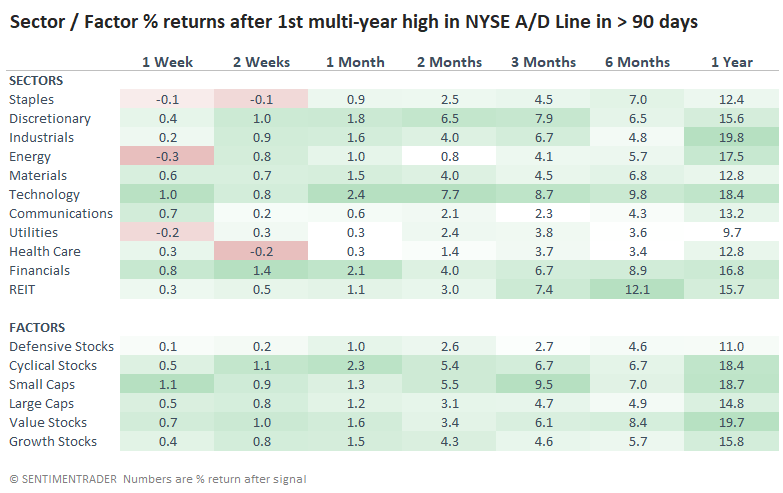

The same can be said for sectors and factors. There was a remarkable amount of consistency, with good returns pretty much all around.

Just because cumulative breadth measures like the Advance/Decline Line are sitting at new highs, it does not mean stocks can't decline. They can; they can even crash. While technicians like to focus on divergences, many 10% or greater declines began when the A/D Line was at new highs.

The biggest difference is that those significant declines usually began after a prolonged "everything" rally in the A/D Line. They rarely happened when the A/D Line was just breaking out to new highs. We can never traffic in absolutes or certainties, only probabilities. Over a very long history, probabilities favor rising stocks, or at least only limited declines, after breakouts in breadth.