Quick Update On Futures Positioning

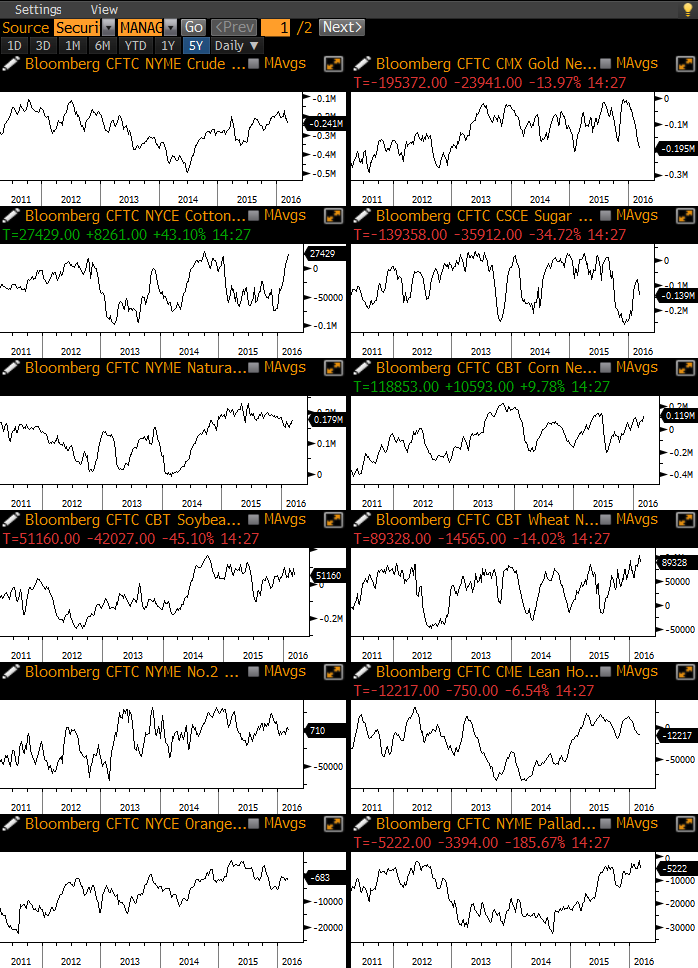

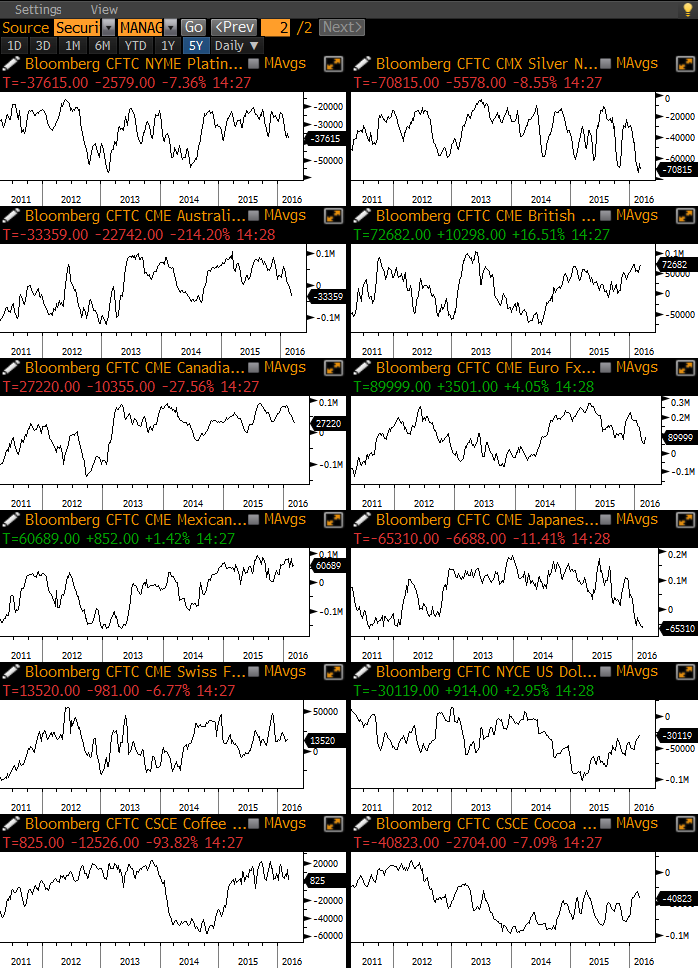

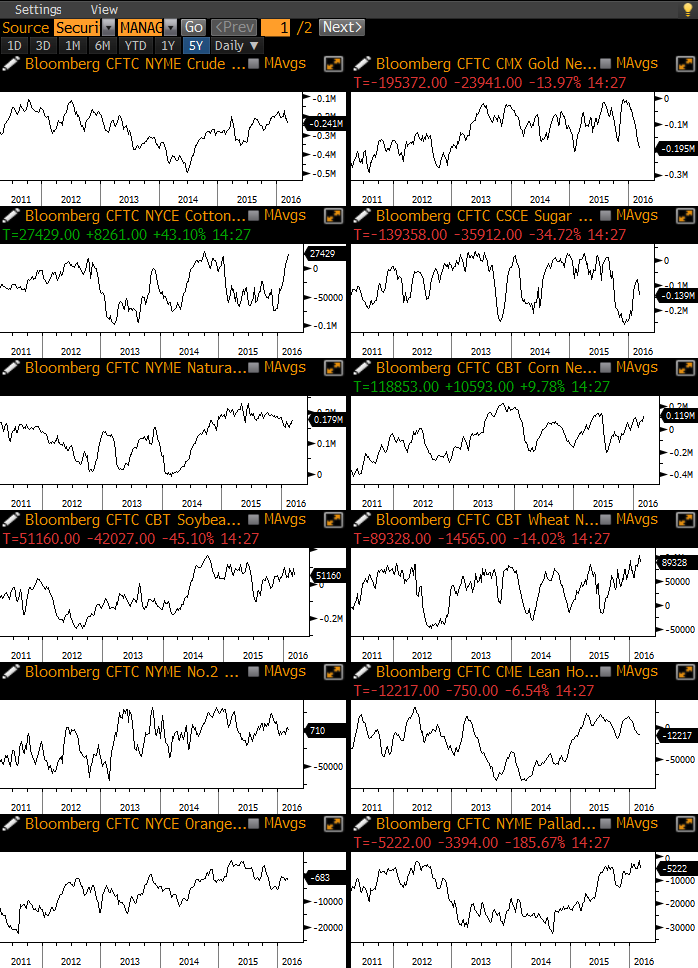

The just-released Commitments of Traders report showed mostly modest changes in most contracts, with the same general theme as the last couple of weeks. Hedgers remain heavily short precious metals, particularly silver, and long grains, particularly wheat.

One change that has been gathering steam is in cotton. This is not a popular contract, but hedgers just exceeded a 27,000 net long position. In the history of that contract, just an extreme has been a good medium- to long-term long signal. At its worst point over the next six months, cotton lost a median 4.7% but at its best point gained a median 11.5%. There was really only one failure to precede a rally, in May/June 2004.

There is a lack of interest in cotton products, but there are three ETFs that have a sole or heavy weighting, BAL CTNN and JJS, all of which have very little volume, but they may at least be interesting to watch over a 3-9 month time period.