Quick Look At Futures Positioning

The latest Commitments of Traders data showed some interesting changes this week, especially in equities.

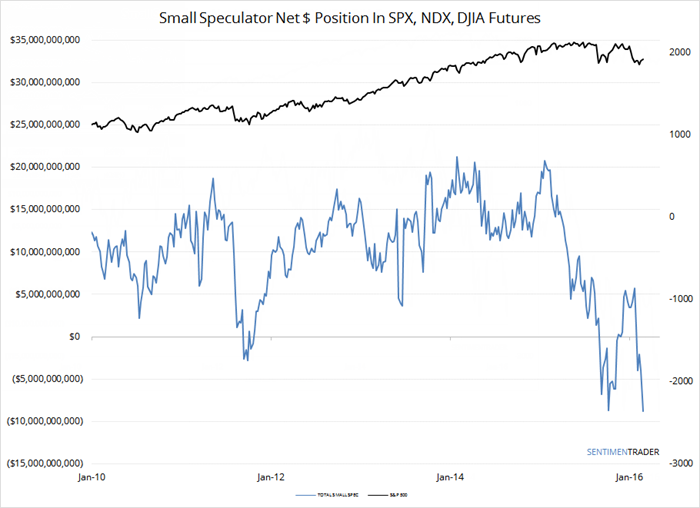

Nonreportable (small) traders in S&P 500, Nasdaq 100 and DJIA futures apparently didn't believe in the rally, as they pushed their net short position to over $8 billion, an all-time record high.

This data has not been perfect in the past, but it is a useful contrary guide. When these traders are pressing so hard in one direction, stocks most often move the other way. Futures trading is a zero-sum game, and the other side of those speculators' positions are the "smart money" commercial hedgers.

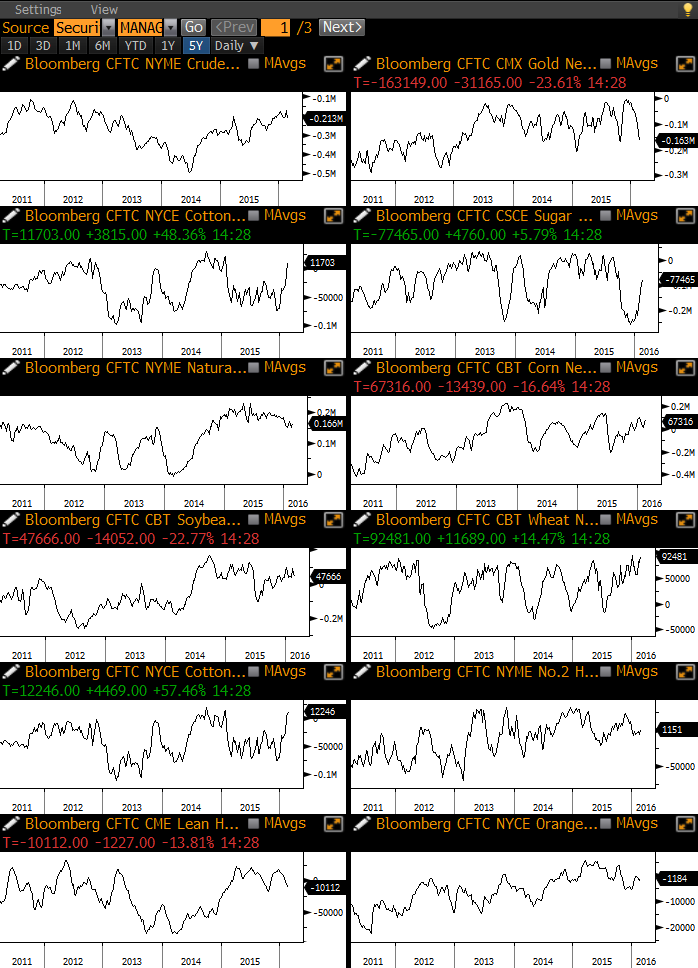

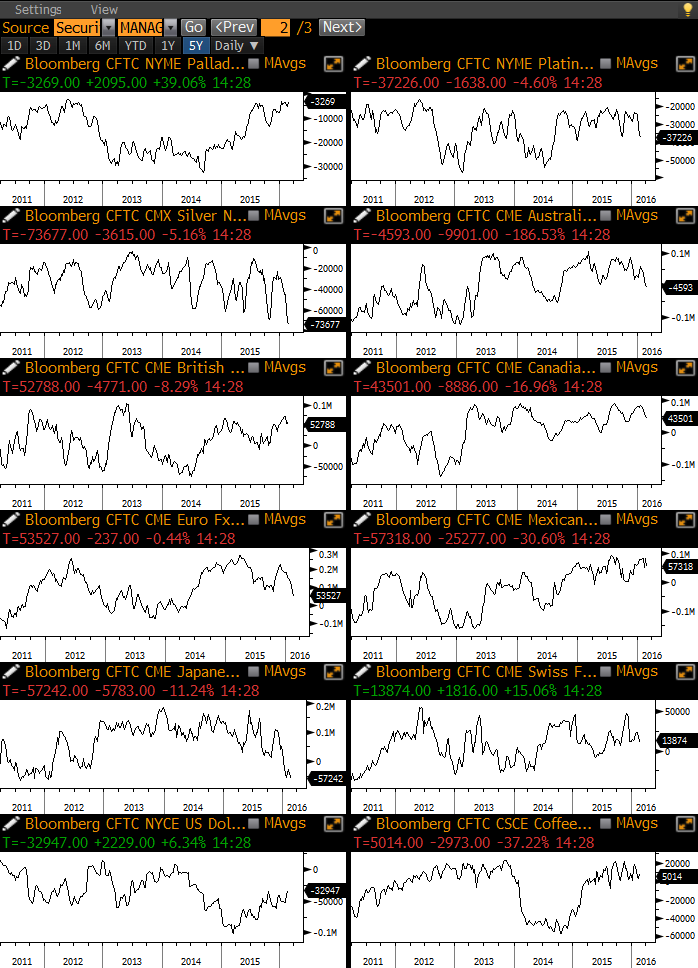

In other markets, those hedgers continued to sell precious metals as gold and silver rallied. As noted last week, their position in silver is particularly extreme and it became more so this week.

At the other end of the spectrum, they increased longs and are holding substantial positions in wheat and cotton.