Quick hit: Germany (EWG) update

Key Points

- In a recent article, I highlighted a bearish play on the German stock market

- Since then, the German market has not moved much. However, energy prices and inflation have soared to historic levels

- In addition, unfavorable seasonality still portends potential trouble in the month directly ahead

Germany

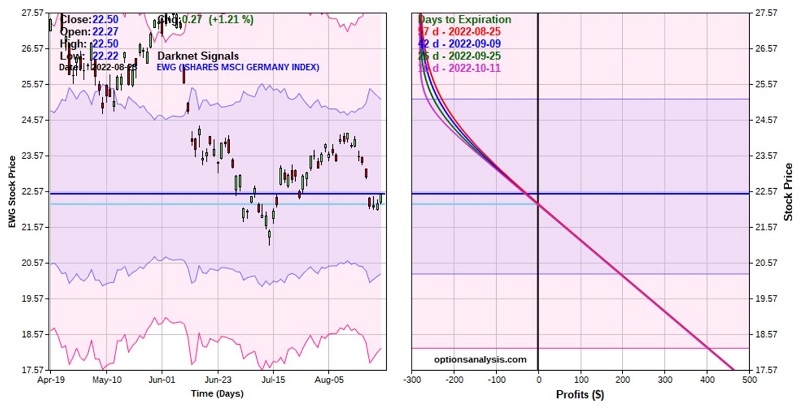

In this article dated 2022-07-26, I highlighted a bearish seasonal trend for ticker EWG (Germany iShares MSCI ETF) and a bearish put option position. Since then, both EWG and the EWG Oct21 2022 25 puts are roughly unchanged. The outlook, however, has not changed.

The chart below shows that Germany's electricity price is 14 times higher than the seasonal average of years past. The reality is that electricity prices and stock prices are not necessarily correlated. However, it is hard to envision a scenario whereby the soaring energy cost does not ripple negatively through the German economy.

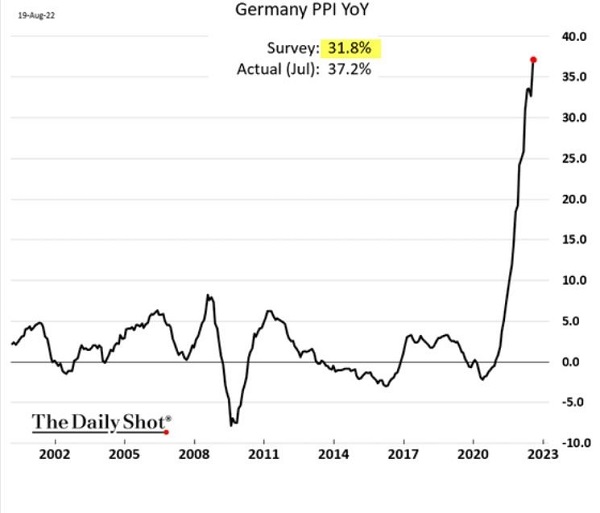

Similarly - and related heavily to soaring energy prices - the German Producer Price Index has soared to a hard-to-comprehend level, as shown in the chart below.

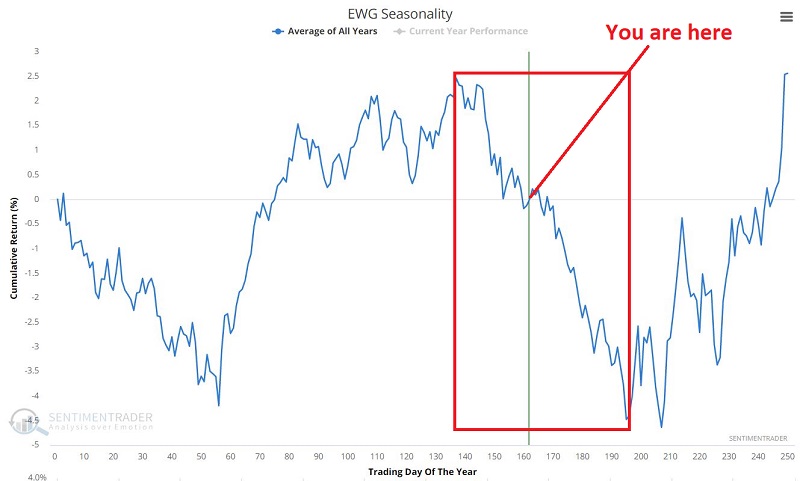

Finally, the annual seasonal trend chart for ticker EWG below also suggests the continuing potential for weakness in the month or so ahead. The unfavorable seasonal period bottoms on 2022-10-11.

Does all of this doom the German stock market to fall between now and October option expiration? Not at all. With the stock market, it is always possible that the bad news is already priced in and that the slightest bit of good news may cause a massive bullish reversal.

Nevertheless, moving from macro analysis to actual trading, the charts above can strengthen the resolve of a trader holding a properly sized put option position to hold on a little longer.

Put option status

The status of the option position detailed in the original article appears below (courtesy of Optionsanalysis).

From here, one of two things will happen. Either the German market will decline sometime between now and 2022-10-11 and present a profit-taking opportunity, or it will rally, and the option position will lose value. Note that at the moment, there is little time premium left in the option price and that the delta is -95.74.

This delta value tells us that holding a long position in the option is roughly equivalent to holding a short position of 96 shares of EWG. The difference is that the option position costs only $280 (per 1-lot) to enter - which also represents the maximum risk regardless of how high EWG might rally. Holding a short position of 96 EWG shares would require a margin deposit and theoretically unlimited risk. In addition, because of this relatively high delta position, if EWG declines in price in the month ahead, the option position will move point-for-point with the price of the ETF shares.

What the research tells us…

From a technical analysis standpoint, one might argue that the -42% decline in EWG from June 2021 into July 2022 may have discounted the bad news in the German economy and that the July bottom is the bottom. And they may be correct. Nevertheless, given the limited risk and relatively low cost of the put option position shown above - combined with the uncertainty of the potential effects of soaring energy prices and inflation - it may also be reasonable to give the option position more time to play out.