Q1 Buy Signal is a Potential Plus for Stocks

One of the many unique indicators popularized by The Stock Traders Almanac is this one:

- If the S&P 500 Index DOES NOT register a daily close during the first quarter of a year that is below the low of the previous December then a favorable sign is flashed for stocks for the remainder of the calendar year

- If the S&P 500 Index DOES register a daily close during the first quarter of a year that is below the low of the previous December then an unfavorable sign is flashed for stocks for the remainder of the calendar year

Does this method of analysis hold any water? Let's let the numbers tell the story.

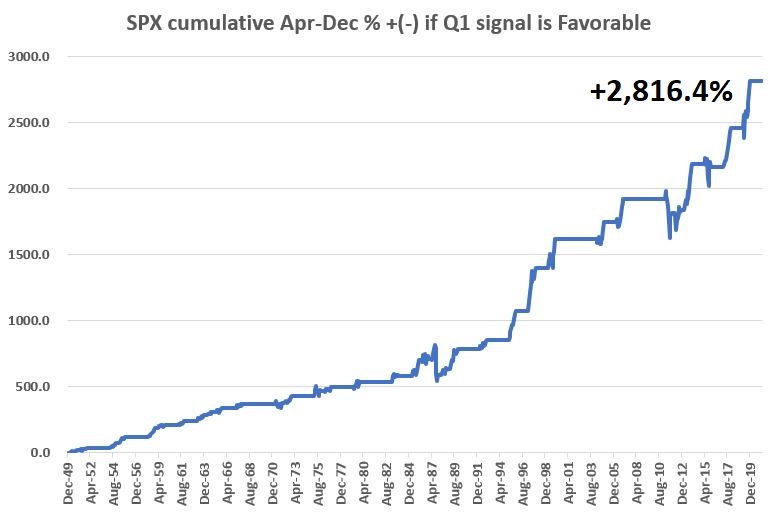

First, let's look at "Favorable" years. If the S&P 500 DOES NOT close below the previous December low during the first quarter of the year we will:

- deem April through December of that year as "Favorable"

- hold the S&P 500 Index during the months of April through December

- analyze the results using month-end closing prices

The chart below displays the cumulative monthly % +(-) using these rules, from 1950 into 2021.

Make no mistake, there were some significant downdrafts along the way (1987, 2011, 2015). Still, the long-term "lower left-to-upper right" nature of returns is fairly compelling.

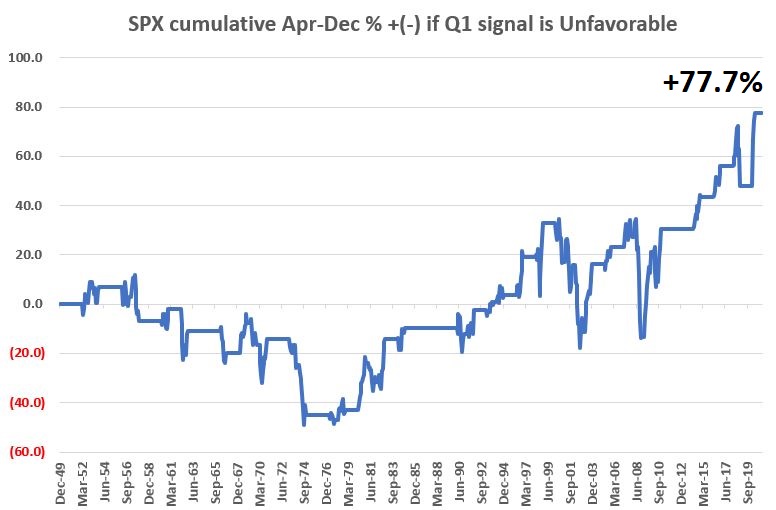

Now let's look at "Unfavorable" years. If the S&P 500 DOES close below the previous December low during the first quarter of the year we will:

- deem April through December of that year as "Unfavorable"

- hold the S&P 500 Index during the months of April through December

- analyze the results using month-end closing prices

The chart below displays the cumulative monthly % +(-) using these rules, from 1950 into 2021.

Clearly, an Unfavorable signal DOES NOT mean the stock market will automatically be bearish for the rest of the year. Still the results during Unfavorable years are much more volatile and exceedingly less consistent than during Favorable years.

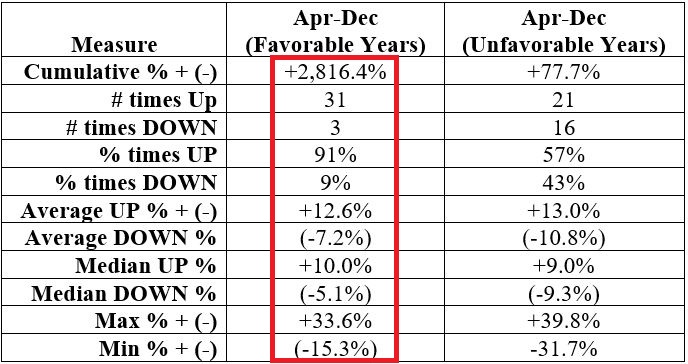

The table below presents a comparative summary of the results.

As we can see in the information above, the odds appear to favor the bullish argument during April through December when the Q1 low does not pierce the low for the previous 4th quarter. As seen in the chart below - for better or worse and with no guarantees (in 1987 the October crash resulted in a -15.3% April through December loss), 2021 falls into the "Favorable" category.

Does this "Favorable" designation mean that it is "smooth sailing" from here on out in 2021? Not at all. It is simply one more piece of evidence that suggests giving the bullish case the benefit of the doubt until proven otherwise.