Putting the "rat" in rating

By the time the ratings agencies react, you know it's bad.

Many times over the past 20 years, we've looked at ratings agencies and their very strong, very consistent tendency to be behind the curve. Their primary interests do not lie with the investors they purport to help. Their underlying incentive is to maintain their revenue streams, which they do by waiting until the last possible moment to downgrade any issuer's debt, so they can stay in their good graces and win future business. Cynical, but true.

This is particularly evident with the largest companies, like those in the S&P 500. Any ratings agency is loathe to downgrade the debt of a major issuer, since they are the ones most likely to generate the best business in the future.

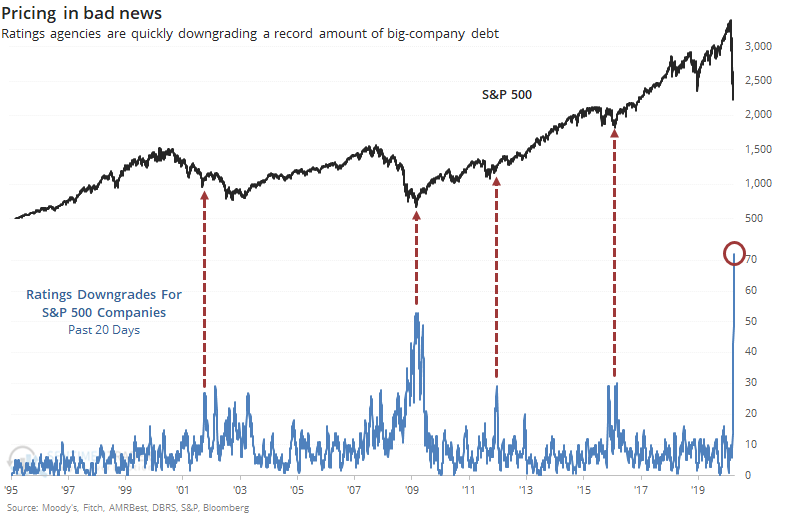

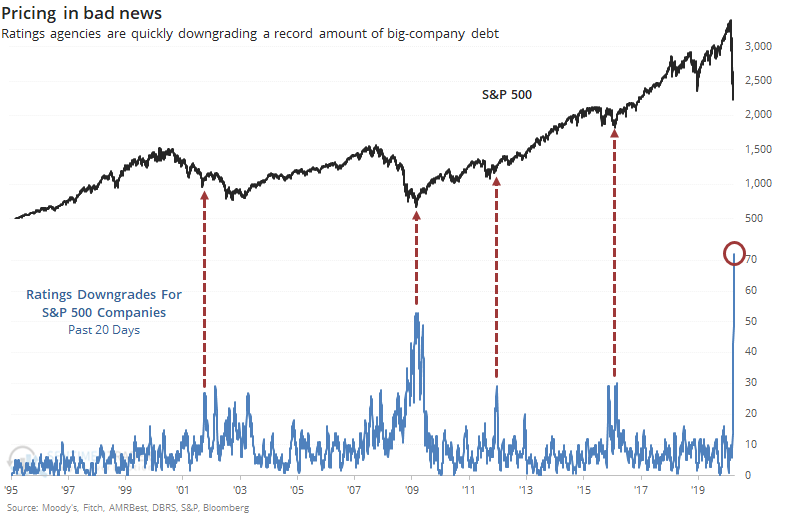

The unprecedented shutdown of American business has changed that. Over the past month, ratings agencies have downgraded a record amount of debt on firms within the S&P 500.

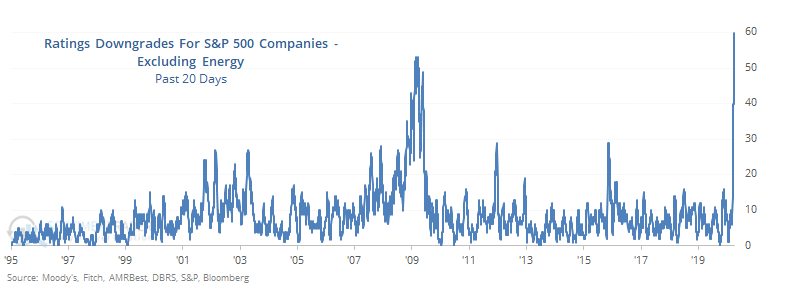

We already saw that a lot of energy companies are being downgraded, so maybe that skews the results. But in just the few few days, agencies have downgraded Harley-Davidson, Marriott, Carnival, Darden Restaurants, Kohls, Macy's...and the list goes on.

If we sum up the downgrades and exclude anything to do with oil or energy, they're still at a record high.

There is no question that the global slump is severe. Maybe the worst in generations depending on how long this lasts, the projections for which seem to change daily.

One thing that doesn't change, though, is that people (and companies) respond to incentives. The incentive for ratings agencies is to prolong the pain of a client downgrade for as long as possible, so by the time a large number of those companies have been downgraded, most of the declines have already run their course. That would be a hopeful sign now.