Puts Are Popular; No Sector Funds Are Beating Cash

This is an abridged version of our Daily Report.

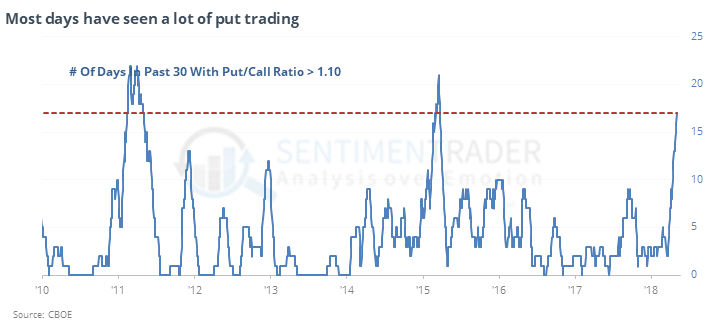

Puts have become popular

Since the market peaked in September, most days have seen at least 10% more put options traded than call options, the largest cluster in three years. Out of a total of 27 days in the sample, the S&P was higher two months later after 26 of them (there were no signals prior to 2007).

An argument could be made that all of this put activity isn’t traders panicking by buying protective put options, but rather trying to collect premium and be a little bit bullish by selling puts to open instead. Even while that’s considered a bearish contrary indicator, that’s not the way it has worked in S&P 500 options.

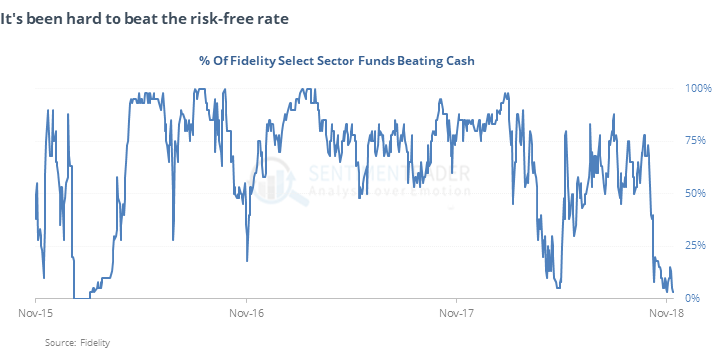

Sector funds struggle to beat risk-free

There isn’t a single Fidelity sector mutual fund that has managed to beat cash over the past few months.

Other times we’ve seen this, stocks generally did well over the next couple of months. That’s also true after the 20-day average of the breadth indicator drops below 10%, which it just did.

Not many up days

Per Deutsche Bank, the S&P has been up only 12 out of 39 days (since the September peak). That has led to a positive one-month forward return 71% of the time since 1928 and 90% of the time in the past 50 years.

NOTE: There will be no Lite report the week of Thanksgiving. Have a safe and joyous holiday!