Prices are surging and Wall Street can't keep up

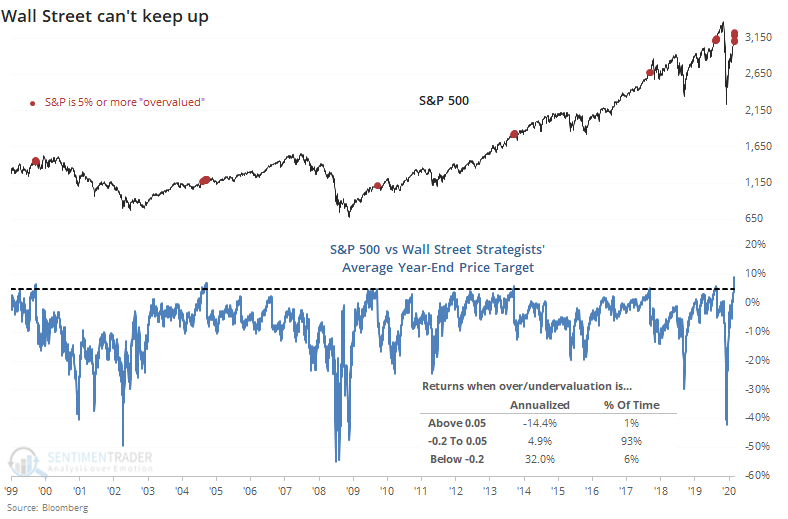

In June 2019, the S&P 500 had rallied enough to already meet Wall Street strategists' year-end target. Even by late 2019, they were not very optimistic about the S&P 500's prospects for 2020. That's usually been a good sign over the medium-term.

We've seen in prior years that when the S&P becomes 20% or more "undervalued" according to strategists, it's been a very good sign. It was again this year though it doubled that discount before rebounding. Now, strategists are not really buying into the rally. In aggregate, they haven't been raising their year-end price target for the S&P 500 nearly fast enough to keep up with the index.

The S&P is now nearly 10% higher than the average strategist year-end target, the highest since at least 1999, as noted by Bloomberg.

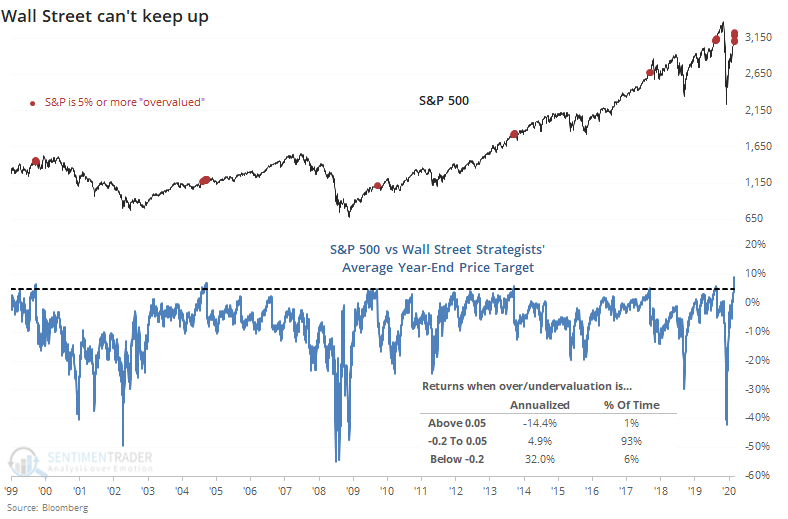

We can see from the chart that the S&P 500's annualized return after becoming at least 5% overvalued relative to strategists' expectations is a terrible -14.4%, versus +32.0% when it's 20% or more undervalued.

When the S&P first runs more than 5% ahead of strategists' estimates, returns over the next six months were questionable.

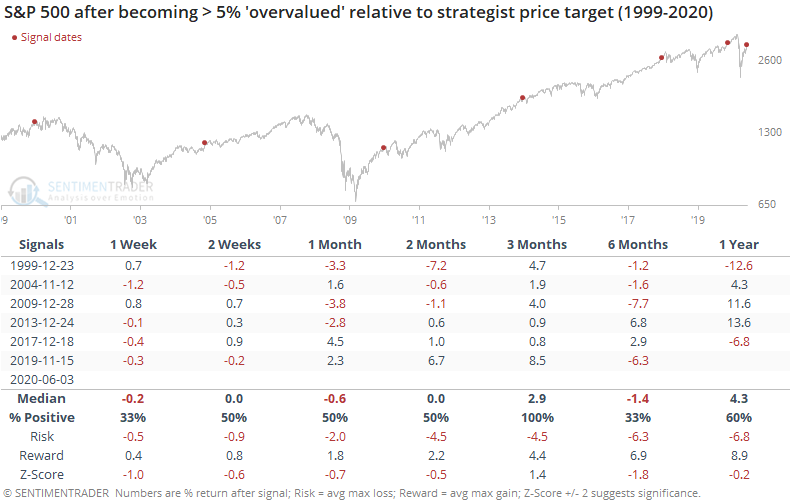

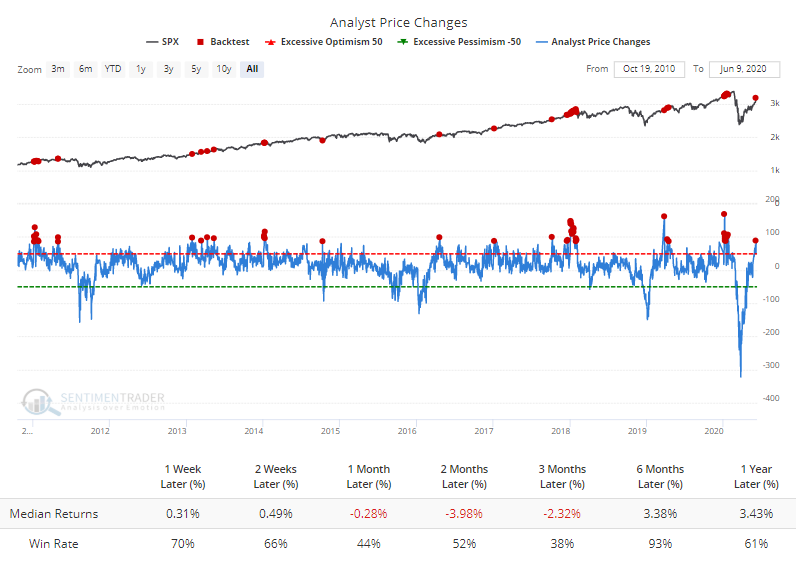

Strategists tend to work from the top down, utilizing macro inputs to gauge the likelihood of higher or lower prices. Analysts tend to work from the bottom up, evaluating earnings prospects for individual companies. After a historic panic in March, they've been busy upgrading the price targets on stocks they follow.

Their optimism has generally not been rewarded.

The Backtest Engine shows that when analysts upgraded their price targets on more than a net 85 stocks within the S&P 500, returns in the index over the next three months were poor and consistently negative.

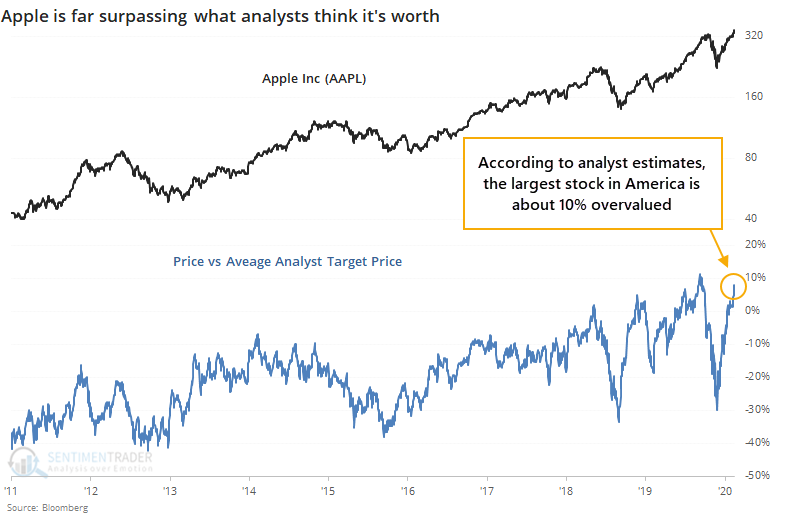

Curiously, they remain tepid on prospects for the largest stock in the U.S. The share price of Apple has run far ahead of where analysts think it should be, indicating that the stock is nearly 10% overvalued.

While this has not been a precise timing signal, when the stock has run this far ahead of analysts, its future returns were mediocre, with short-term gains usually given back during subsequent pullbacks.

There are quite a few conflicting cross-currents right now, with (mostly) shorter-term signs of speculation and rates of change suggesting a period of short- to medium-term digestion at least. This sudden price surge, over and above fundamental expectations, is another shorter-term warning sign. Longer-term, we continue to see massive thrusts and recoveries in stocks, which have led to higher prices 6-12 months later almost without fail.