Pre-FOMC Strength

As traders enter into the pre-FOMC bullish malaise that has set in for years, stocks are drifting higher ahead of the open. It has become de rigueur to simply buy and hold for a day or two ahead of the pronouncement on interest rates from the Federal Reserve, which will happen tomorrow afternoon.

Looking at similar scenarios, though, something sticks out - the gains have never lasted.

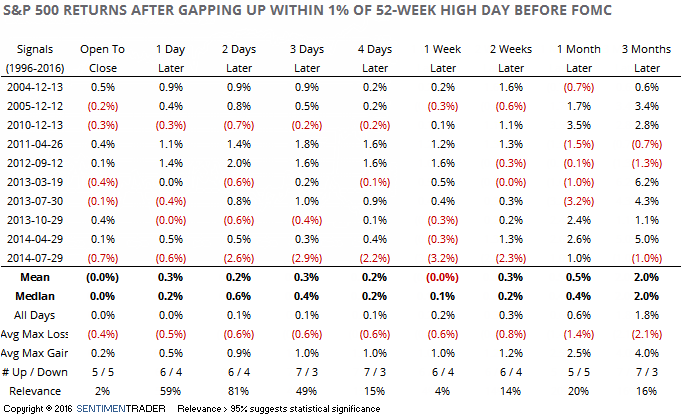

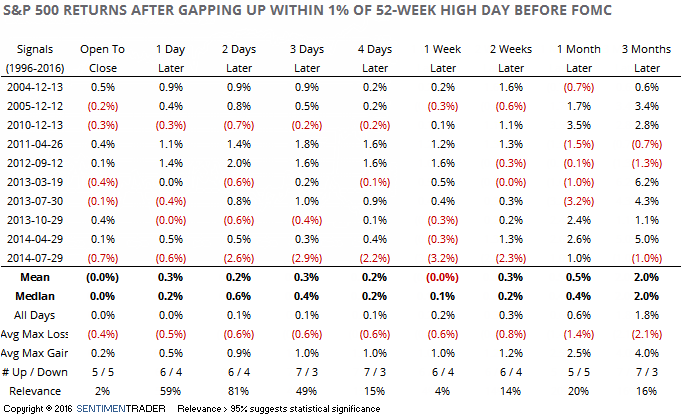

Let's go back over the past 20 years and look at every time the S&P 500 futures were within 1% of a 52-week high and then gapped up the day before a FOMC meeting. We'll buy the futures that morning and hold for various time periods.

The percentage of time the S&P rallied was not bad. Three days later (so two days after the FOMC meeting), the S&P had added to its gains 7 out of 10 times. But notice the pattern in the actual returns in the table - every time the S&P showed gains in the shorter-term, it showed losses in the longer-term (longer-term here being weeks, not months). Even the ones that (gasp!) occurred in December.

There is an almost automatic assumption these days that stocks will rally ahead of the latest FOMC decision, and that has been a pretty good bet, especially on Wednesday mornings. But we should be careful about assuming that strength will last, because it hasn't in the past. Looking for any kind of weakness in recent weeks has been akin to tilting at windmills so maybe this will be another tendency that goes by the wayside but it's another suggestion that chasing short-term strength is an iffy bet.