Post-election movements

Markets made some big moves after the election. There are some clues in these signals, but these clues should be taken with a grain of salt given that markets can be very volatile after major events.

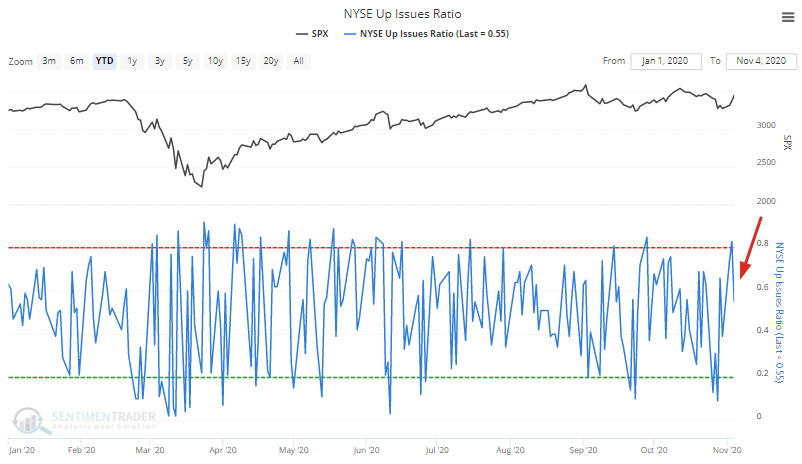

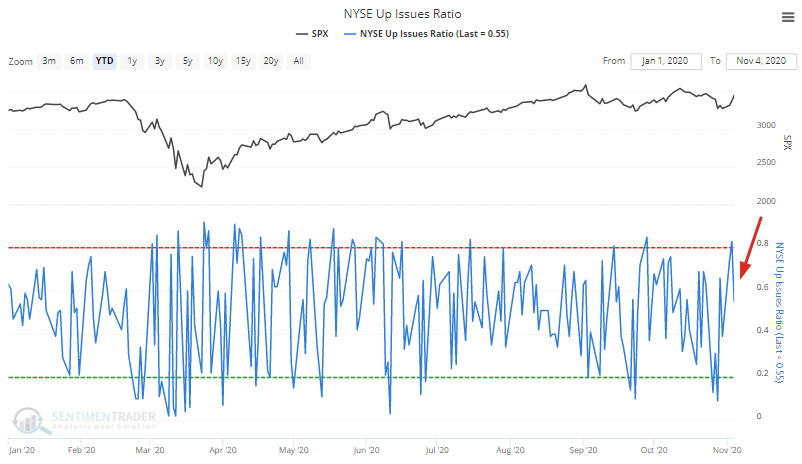

For example, Jason noted that this is the first time in almost 6 decades in which the S&P surged more than 2%, yet less than half of volume flowed into issues that went up. Here's the NYSE Up Issues Ratio:

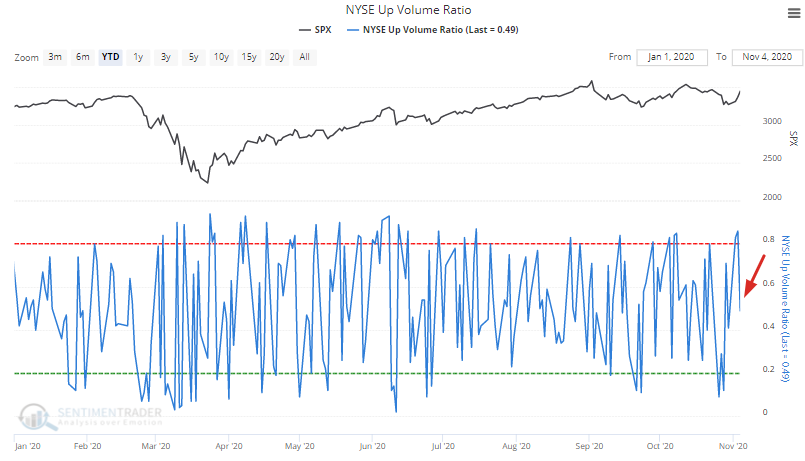

Here's the NYSE Up Volume Ratio:

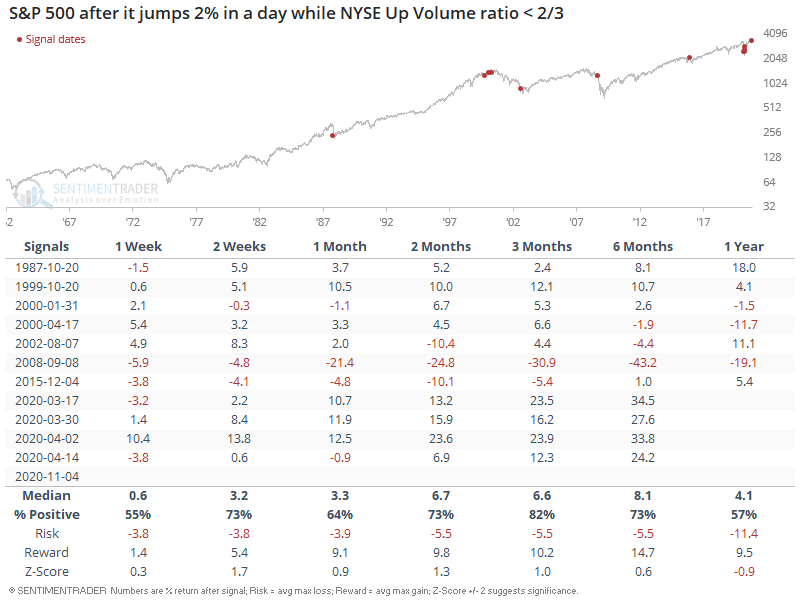

Given how rare this is, we must loosen the parameters to increase the sample size. The following table looks at what happens to the S&P when it jumps more than 2% in a day, while NYSE Up Volume ratio was less than 2/3:

As you can see, this wasn't quite a consistently bearish factor for stocks. But nevertheless, one has to wonder how much this tech-driven rally will last. The general sentiment these days is that "disruption is everywhere. Innovative businesses will survive, and non innovative ones (i.e. not tech) will do worse". While that is true from a corporate revenue perspective, that is not true from a stock price perspective. E.g. Amazon's business grew from 2000-2002. Its stock price still collapsed during those years. Price is what you pay, value is what you get.

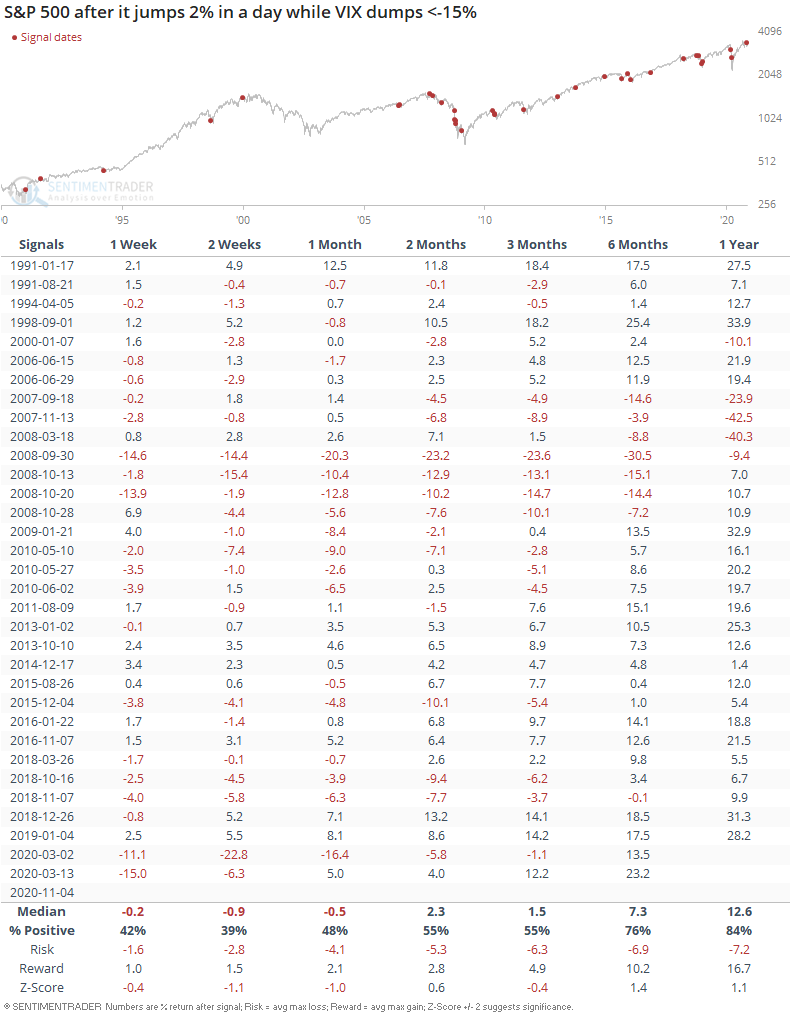

Looking at this from a different way, stocks jumped and VIX dumped:

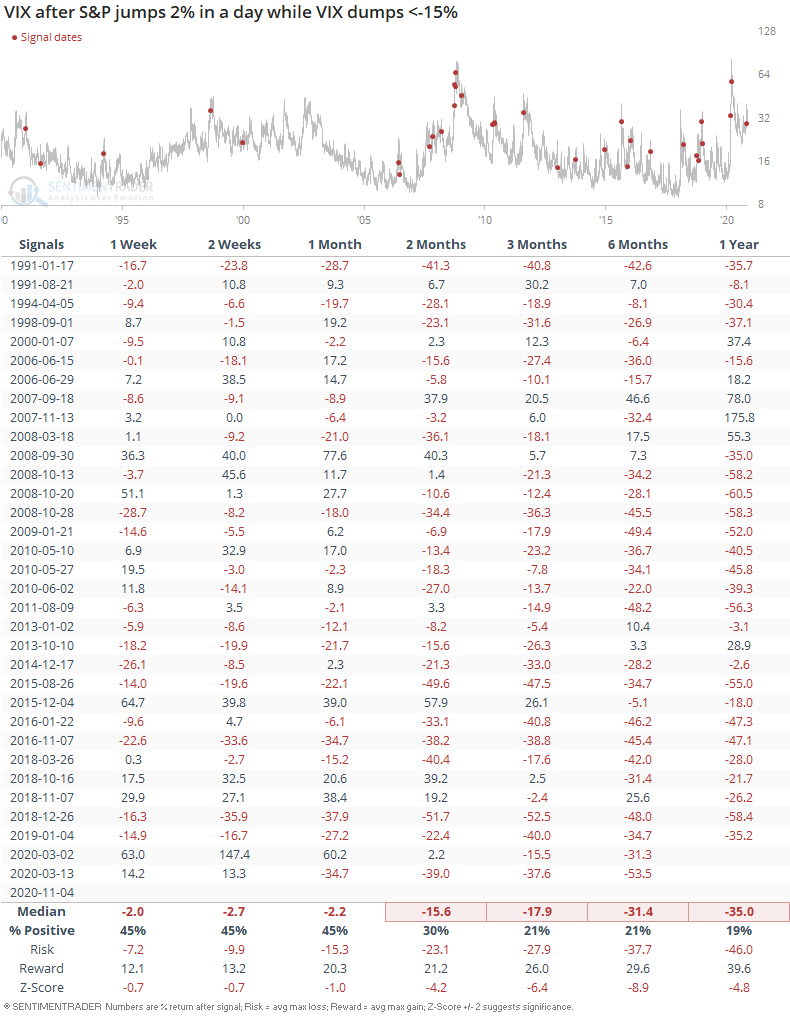

While this wasn't consistently bullish for the S&P, it still mostly led to VIX losses over the next few months:

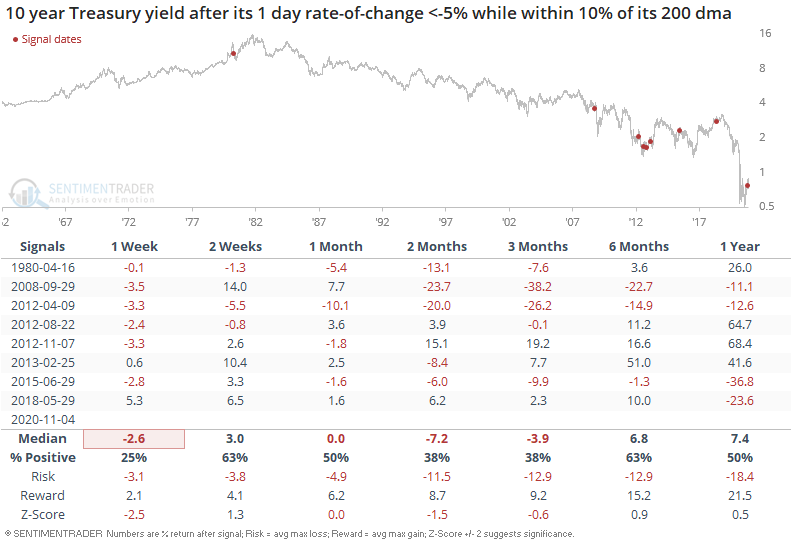

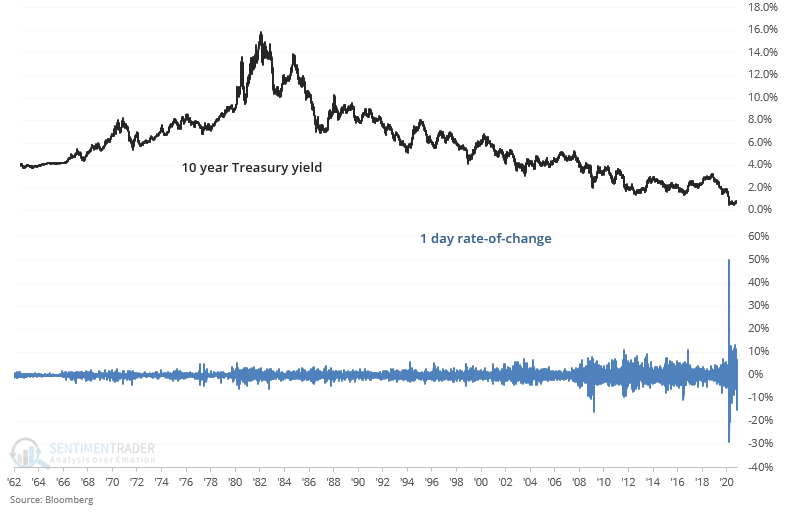

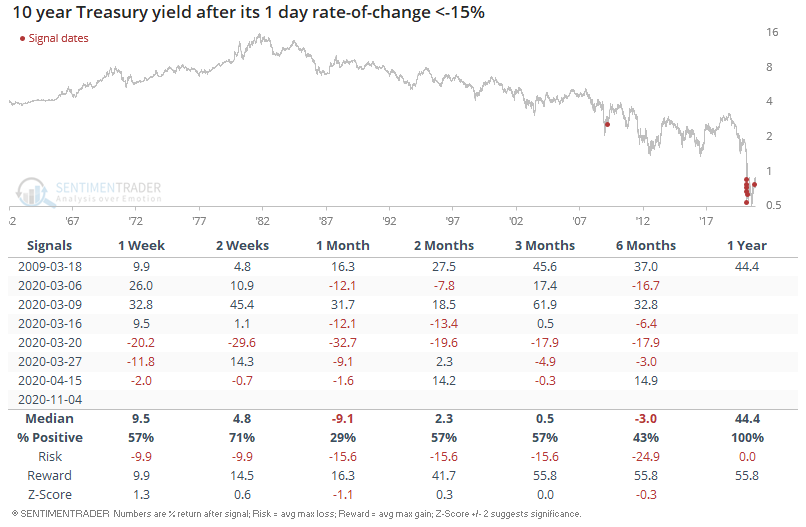

In the bond market, the 10 year Treasury yield slumped:

Such 1 day slumps are rare, making it hard to determine whether this is bullish or bearish for bonds:

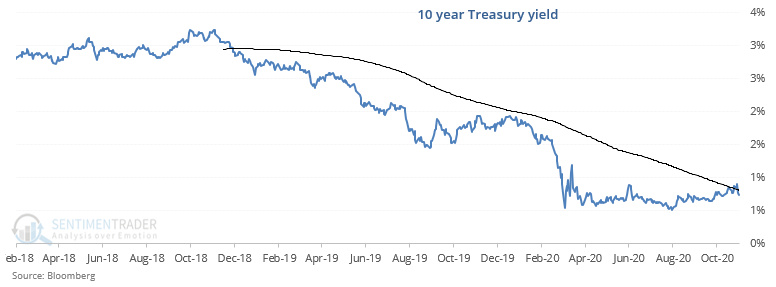

However, one of the more important factors is that the 10 year Treasury yield was rejected at resistance (200 dma):

When this happened in the past, the 10 year Treasury yield usually dropped over the next week (bullish for bonds).