Post-bear market behavior

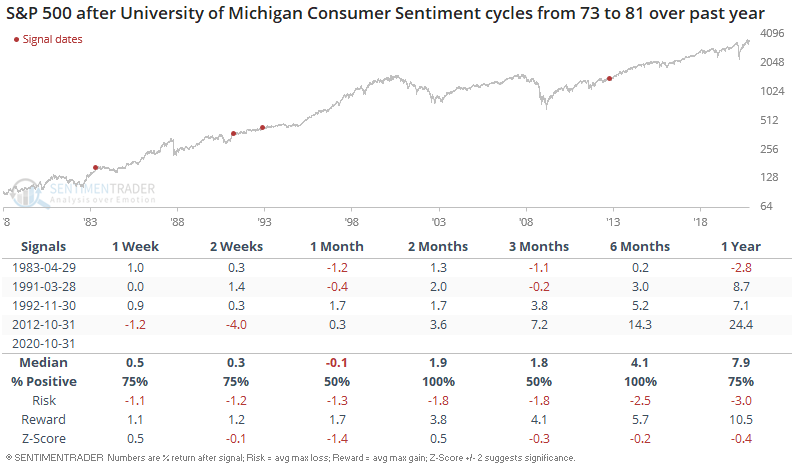

Global equity markets continue to exhibit behavior that is typical of the first year after a major bear market. For example, the % of Australian equities in a long term uptrend (above 200 dma) has cycled from the lowest levels since the GFC to more than 65%:

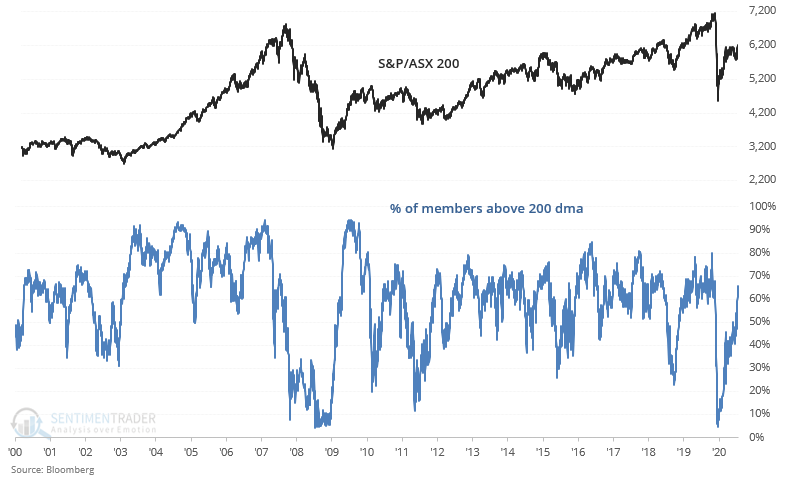

When this happened in the past, it wasn't a clear sign that Australian equities would continue to rally over the next year. Sometimes it did, but sometimes most of the gains were already baked in:

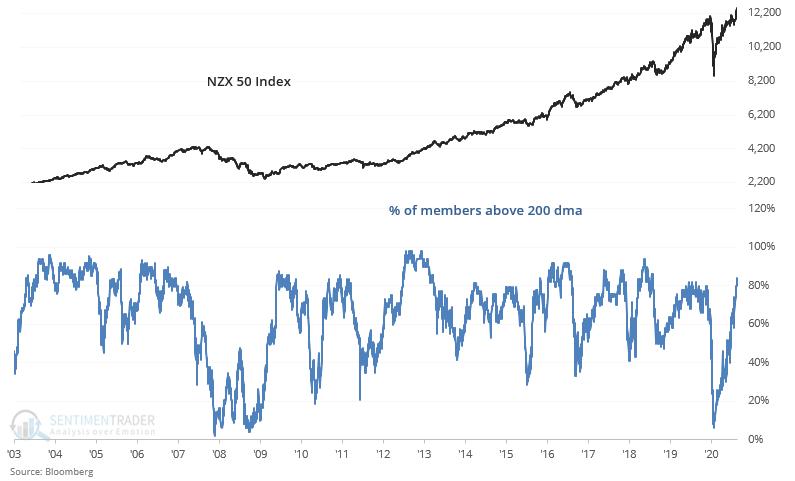

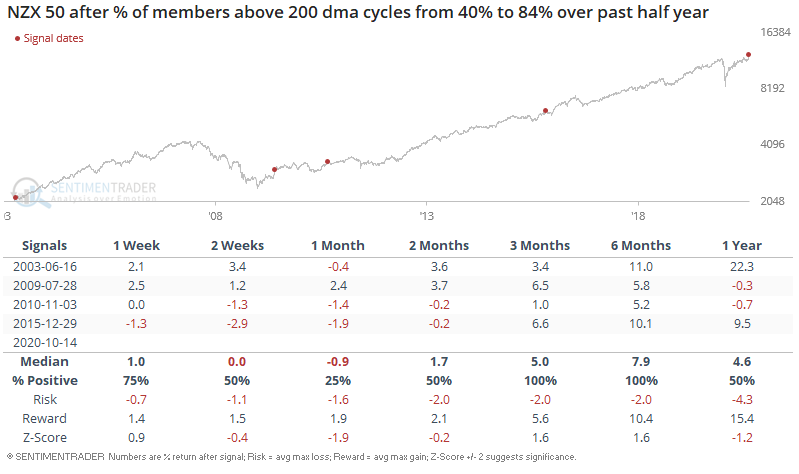

In New Zealand, the % of NZX 50 members in a long term uptrend has surged to 84% as the NZX makes all-time highs:

When this happened in the past, the NZX 50 Index usually pushed higher over the next 6 months:

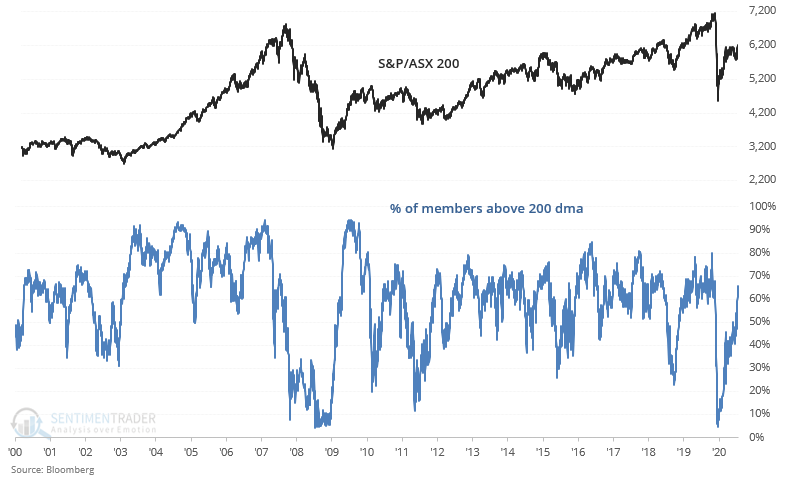

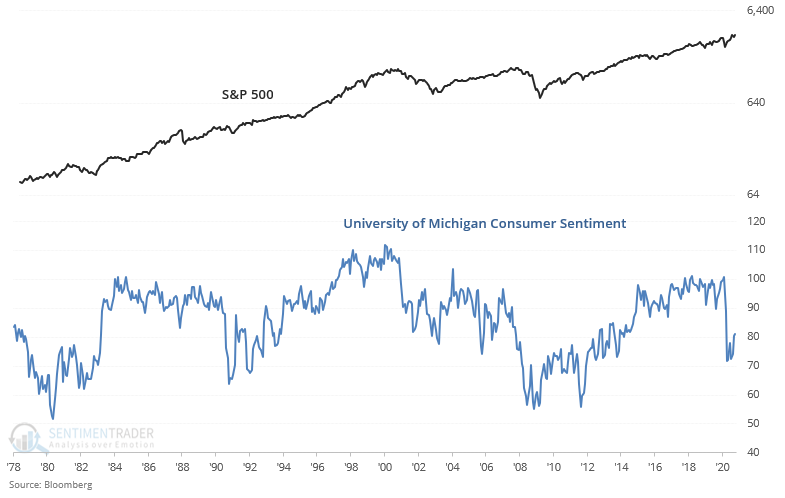

In the U.S., the University of Michigan Consumer Sentiment Index is rising. Perhaps this figure will taper off in the coming months if the U.S. economic recovery slows down:

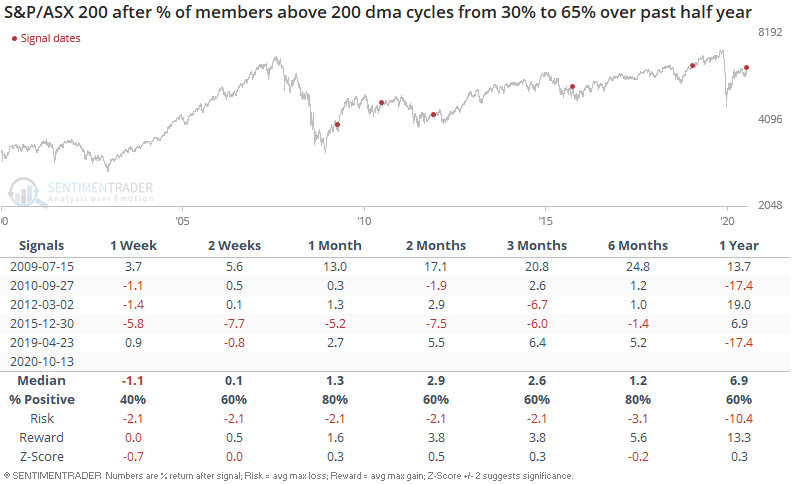

When Consumer Sentiment cycled from 73 to 81 in the past (recovering), the S&P usually rallied over the next year. The exception was in April 1983, when most of the S&P's post-recession gains had already occurred: