Positive Markets On Nonfarm Payroll Miss

Even though the Nonfarm Payroll report (NFP) missed expectations, traders are responding in a positive way, or at least "positive" in the traditional sense. Stocks gapped up, gold up, and bonds down.

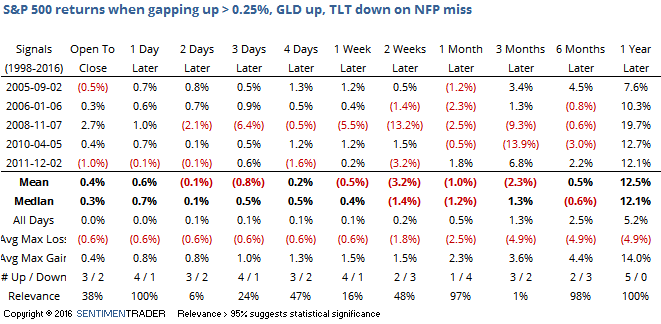

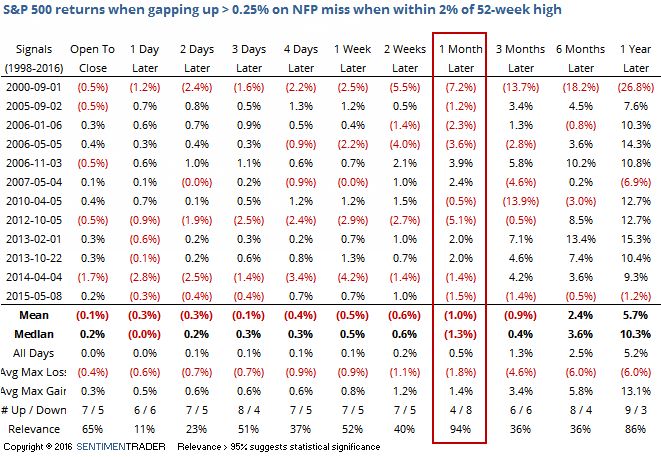

Let's take a look for other times the report missed expectations and yet stocks and gold gapped up and bonds down (returns are as of the opening price on NFP day, i.e. Friday's open):

A small sample size to be sure, but generally there was some short-term follow-through that ultimately failed. A month later one one occurrence was positive, and that's after it had declined more than 3% in the preceding weeks.

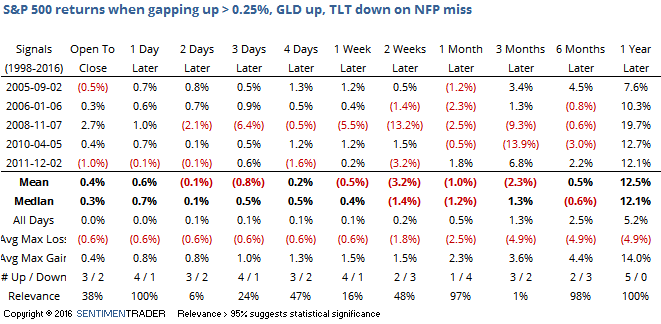

Now let's just take a look for any time the S&P 500 gapped up at least mildly on a day the NFP report missed expectations, and the S&P had been within 2% of a 52-week high:

Here we see some mixed-short-term returns but again, mostly negative a month later. The S&P's average return, % of time positive and risk/reward were all skewed to the downside, though the four winners were all for 2% or more.

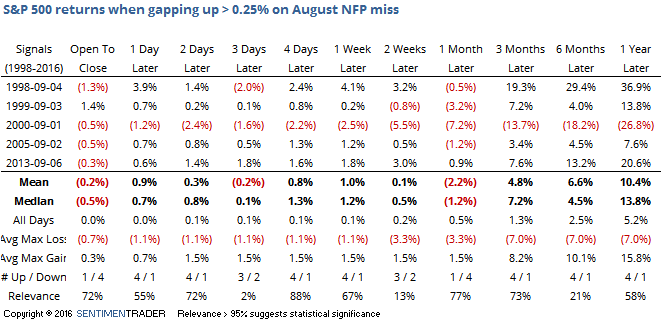

How about seasonality? Here is how the S&P did after gapping up on a NFP miss for August's report, the one that's released in September:

Again, some short-term upside but then weakness over the next month.

It's hard to read a lot into knee-jerk reactions in a holiday-impacted tape and with small sample sizes, but from what we can see from similar reactions, the very short-term looks a bit positive but over the next several weeks there has been much more of a headwind.