Plunge in gold:silver ratio

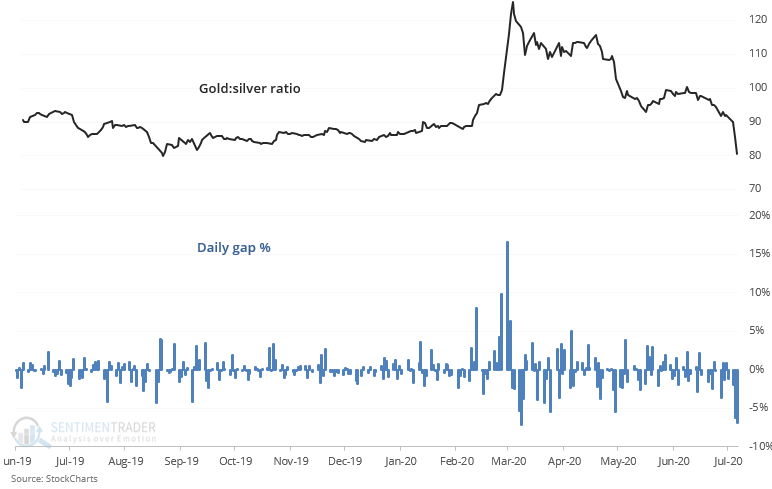

Gold's rally since late-2018 initially did not see any participation from silver (gold rallied up to $1600 while silver bounced sideways). But now that many traders are jumping on the "long precious metals as a hedge against currency debasement" theme, silver is rapidly catching up to gold. The last 2 days saw the gold:silver ratio plunge:

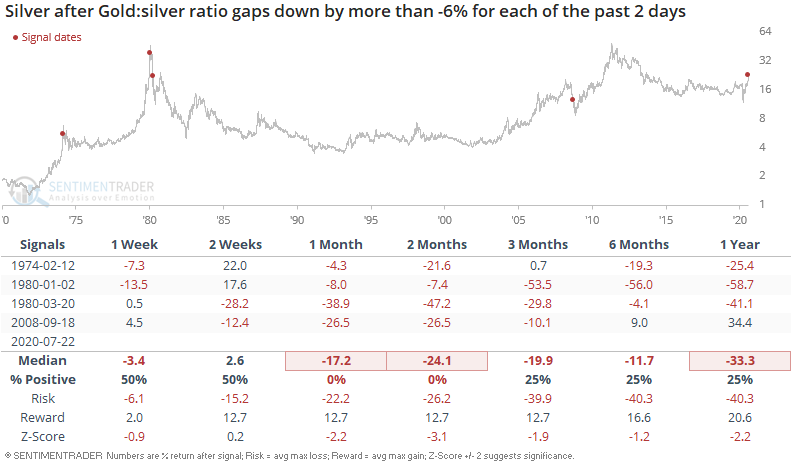

This wasn't a great sign for silver in the past as it typically happened towards the end of a silver rally. When the gold:silver ratio fell by more than -6% on each of the past 2 days, silver had a strong tendency to pullback over the next 1-2 months, even if it surged higher for a few days more:

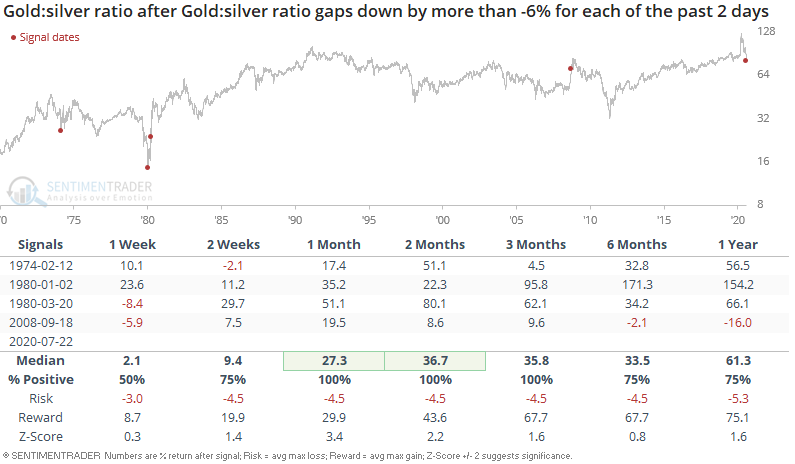

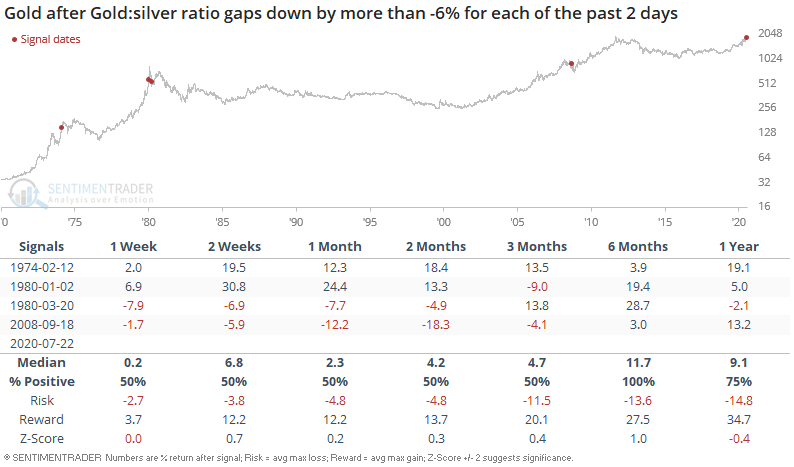

Since a falling gold:silver ratio was mostly due to silver's rally, this was not as consistently bearish for gold:

And usually led to gold outperforming silver over the next 1-2 months: