Persistent Momentum Gets Investors Back In The Mood

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Investors are back in the mood

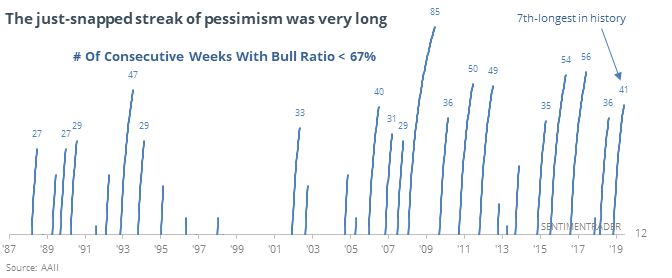

After more than 9 months, the AAII survey of individual investors shows that more than two-thirds of them are finally optimistic. This ends one of the longest streaks in 30 years.

After the ends of other long streaks with subdued sentiment, the S&P 500 most often carried higher over the next week, but then ran into some issues. Over the next 2-3 months, its returns suffered. They were not only below random, but the median was negative, and the risk/reward was poor.

Persistent Momentum

We've looked at a bunch of momentum type studies. Another will pop up this week, with the S&P 500 rallying 10 out of 11 weeks.

Such persistent rallies have usually been followed by weakness over the next 1-2 weeks, especially from 1980-present. And while the 2-3 months forward returns may seem bullish, many of those bullish cases occurred before the 1980s.

We also looked at:

- Junk bond buying binge, with a sentiment composite the highest in several years

- Active investment managers are aggressively positioned

- Gamma exposure is exploding

- Smart Money / Dumb Money Confidence is extremely stretched

- Optimism on oil and gas producers just hit an extreme

- The Conference Board's LEI is dropping

- Volatility in Hong Kong is very low

- What happens when there are few 1% down days in a given year

- In Mexico, more shares are above their 10-day average than any point in 6 years