Pension Tension

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Public pension tension

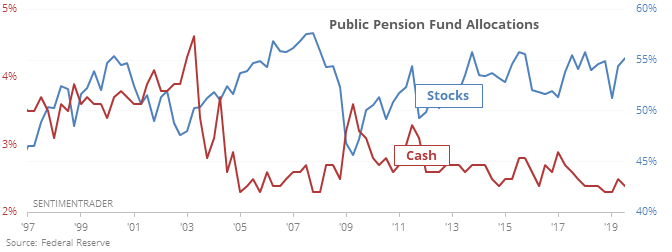

Public pension funds have been adding to their stock allocation, raising it significantly over the past year. They’ve also dropped their allocation to cash so their exposure to a downturn is among the highest in history.

Starting in the early 1950s, there was a clear bias toward bonds, which gradually changed during the 1960s and ‘70s then more rapidly in the ‘80s.

Several times over the past 6 years, it has reached an exposure level equal to the current one. A couple preceded some trouble, but a couple others did not. Perhaps it’s a minor concern, but not much beyond that.

Dow Cheery

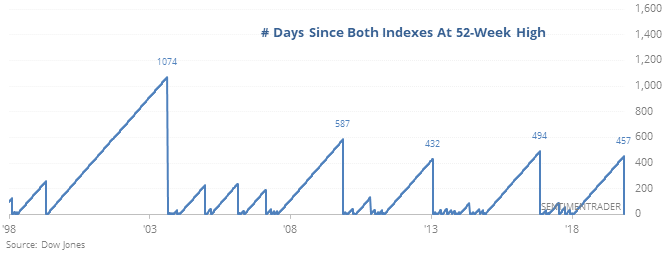

While their relevance has shrunk, the Dow Jones Industrials and Transports were also tickling new highs on Thursday (including intraday data).

This is the first time they ticked at new highs together in more than 450 days. That’s one of the longer streaks since 1920 and among the largest over the past decade.

Both the Industrials and Transports did well after other coincident breakouts. The most notable aspect is the risk/reward, which is skewed heavily to the upside, as the few declines tended to be modest, with none of them leading to bear markets. Momentum is hard to defeat.