Peak claims

Today's release of jobless claims in the U.S. was higher than forecast, but it had to impact on stocks as investors have come to expect horrid economic news.

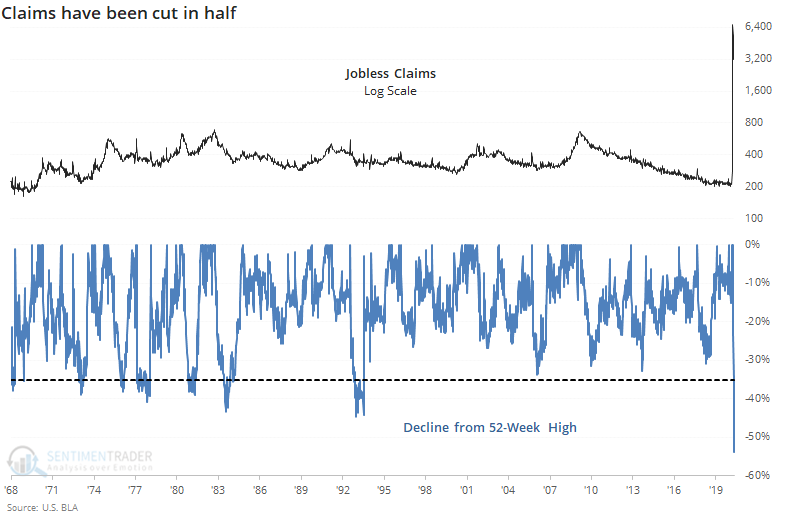

Even though it was worse than expected, claims have still dropped more than 50% from the peak. Because of the unprecedented spike, this is also the most that claims have declined from a 52-week high.

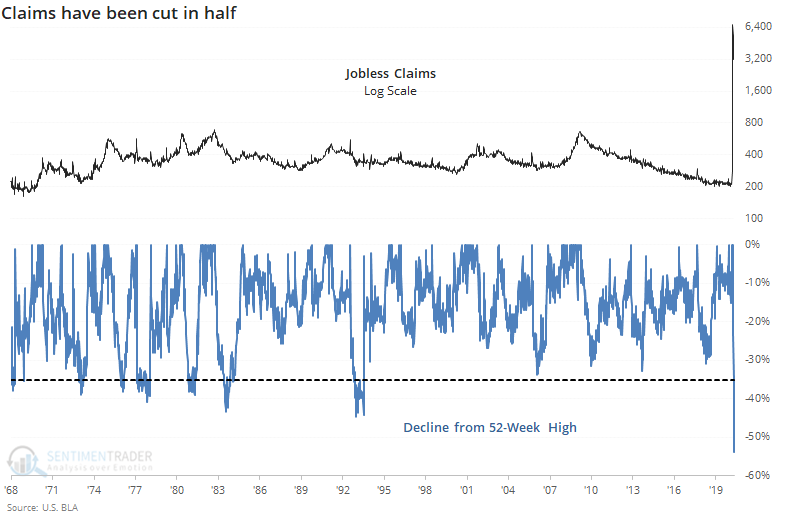

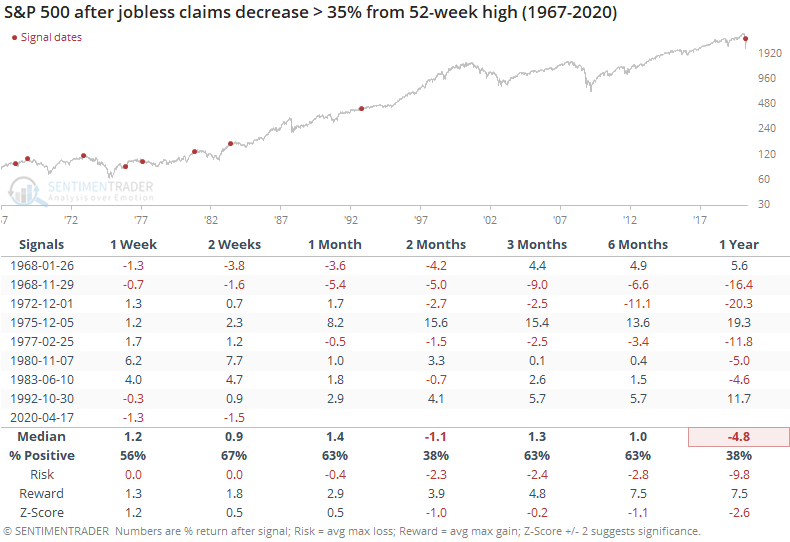

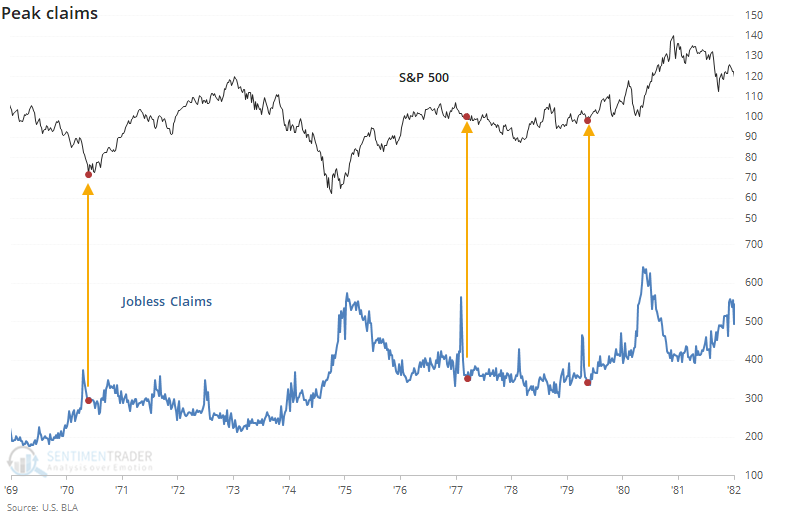

Usually, claims don't drop much more than 35% from their peak over the past year. But in a stark example that the economy does not equal the stock market, some of these occurred as stocks were peaking.

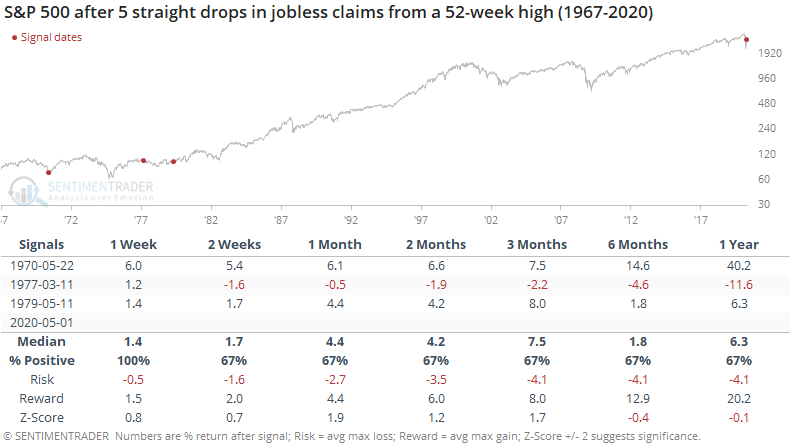

This is also one of the most persistent streaks of declines in jobless claims. After the spike in March, they have declined for 5 consecutive weeks. That's only happened 3 other times when the claims had hit a 52-week high.

After each of those times, claims started to pick up again, or at least slow the rate of decline. Twice, stocks rallied hard, but slid lower in '77.

The spin on this week's numbers will depend on the bias of the outlet. Some will frame it as good news; most will suggest it's a sign of disruption, policy failures, and a long-term depression.

Just looking at history, for what that's worth right now, doesn't strongly support either side. Bulls might have a slightly better argument, based on remotely similar circumstances after stocks had already sold off.