Panic gaps

Stocks are tumbling before the open this morning. While there is almost always an easily identified catalyst when markets gap down like this, especially on a Monday, drawing comparisons to past market behavior based on price reaction alone seems iffy this time around.

Outside of wartime, we've never really seen a situation like this with large swaths of the world essentially shut down.

With that disclaimer, we typically get asked about behavior following large gaps, so below we'll look at how the futures have responded under various conditions.

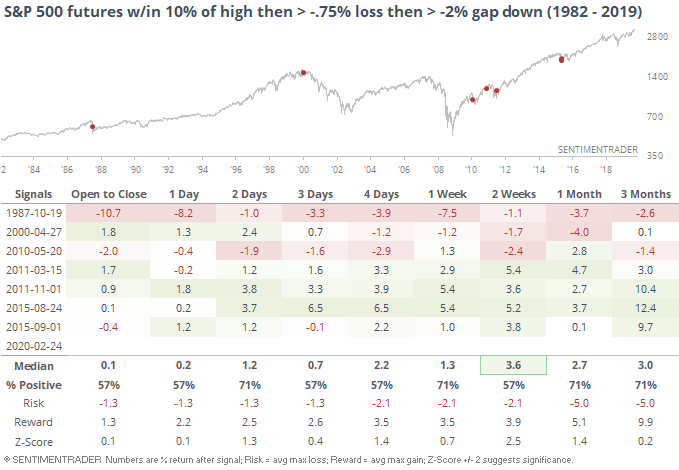

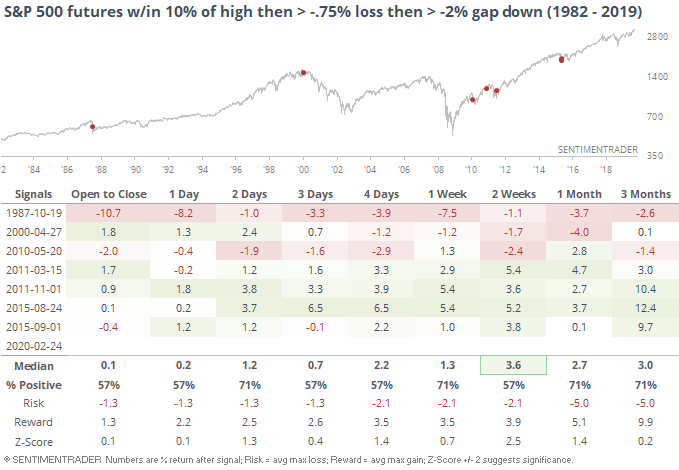

Below, we can see every time the S&P dropped at least 0.75% the prior day, then gapped down at least -2% at the open the next day (i.e. today). Since this was common in 2008, we filter the table to include only those that triggered when the S&P was within 10% of a 52-week high.

Mostly good for a short-term rebound, but there was that pesky day in 1987, which is going to be a common theme in these tables. Outside of Black Monday, buyers stepped in at least temporarily over the next few sessions.

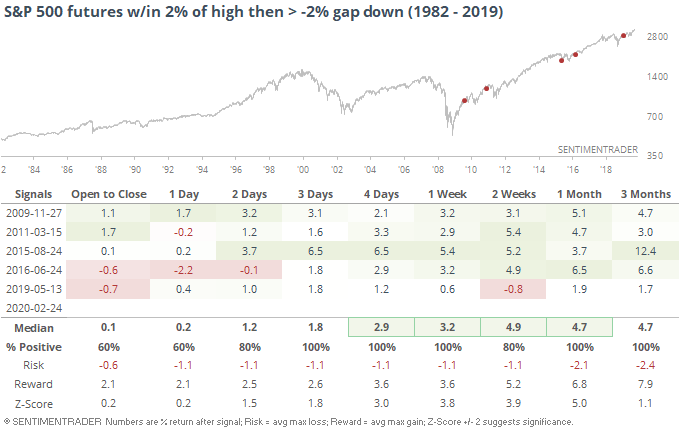

If we ignore the previous day and simply look for large gaps down when stocks were near a 52-week high, there aren't a lot of precedents, and all of them have come since the financial crisis.

Because they all triggered in the past 10 years or so, the returns were excellent. Every one of them saw almost immediate buying interest. The risk/reward was very good over the next week or so. Both the Aug 2015 and Jun 2016 gaps saw further losses of a little more than -2% over the next day, then rebounded strongly. That was the worst of the pain for those who stepped in to buy at the gap down open.

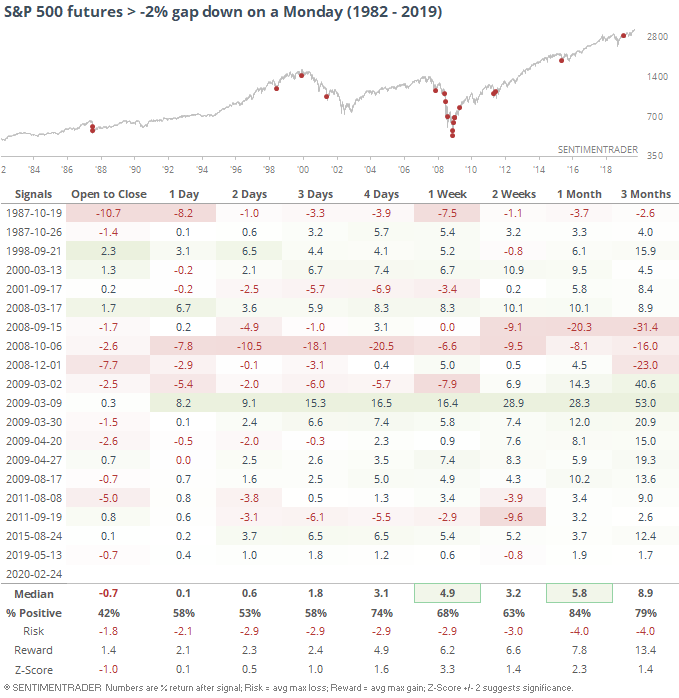

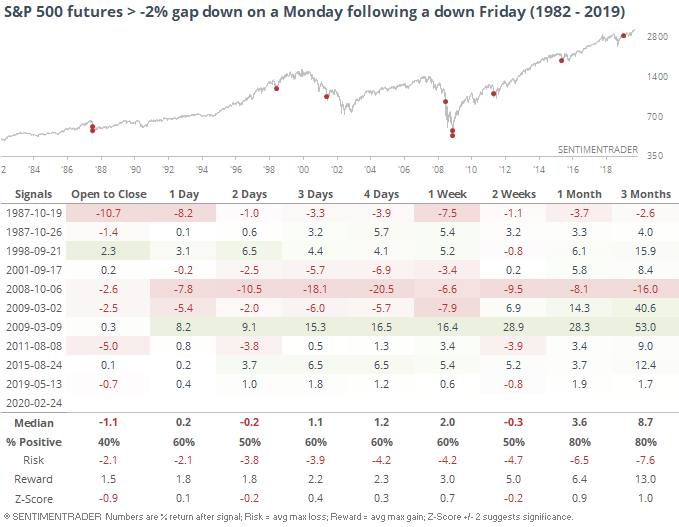

Extreme moves on Monday/Tuesday have a tendency to reverse, so let's look at that. Below is every time there was a -2% or worse gap down on a Monday morning.

Again, 1987 rears its ugly head, as do a lot of dates in 2008. For those who were around during the financial crisis, this is probably familiar because it seemed like every week, we would open our trading screens to see a sea of red after the latest batch of weekend hysteria.

When stocks drop on a Friday then open very negative on Monday, it didn't improve the results at all. In fact, they were worse.

Almost all of these came near major inflection points, but stepping in too early would have caused major issues in 1987 and Oct 2008.

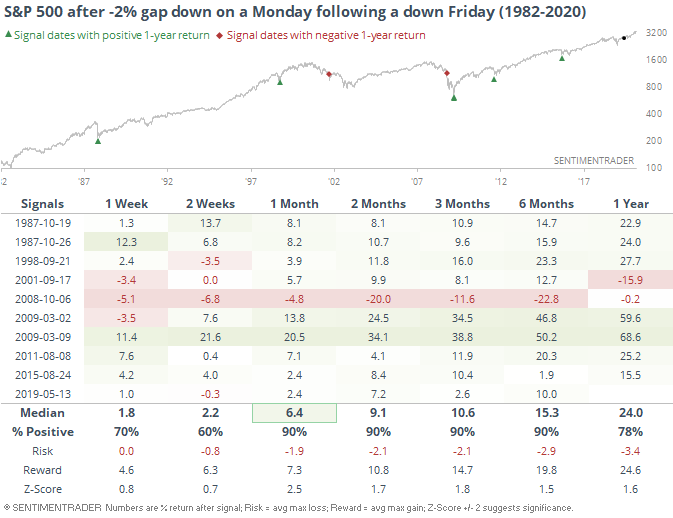

Because most of these saw losses from open to close, when we look at S&P cash index prices as of the close, medium-term returns were excellent.

Given the types of speculative behavior we've looked at over the past 1-2 weeks in particular, it seems awfully early to believe that this kind of negative open on one day will alleviate all of it and all of a sudden the risk/reward turns positive. In the table above, stocks had sold off a lot more - we've never seen selling pressure like this when stocks were so recently at an all-time high. So while the table shows good returns, they don't seem very applicable to our current scenario.

Overall, there is a strong tendency to want to fade a gap down like we're seeing, especially on a Monday. But historically that has led to mixed success, with some account-threatening failures. It's been better to let it sort out for a while first.