Panic And Reverse

This is an abridged version of our Daily Report.

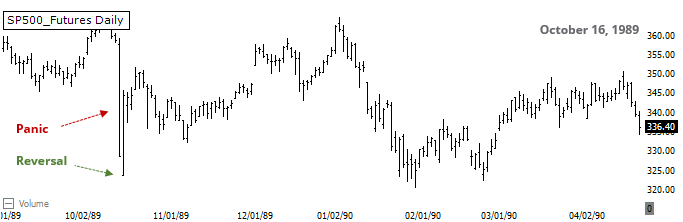

Panic and reverse

Stocks suffered a panic day on Monday, then reversed early losses to close higher. That matches several other instances that led to consistent returns going forward.

There was volatile back-and-forth then another run at the prior highs.

Notable extremes

There was no shortage of extremes on Monday and many of them are redundant. Among the most notable, though, are that every member of the Nasdaq 100 declined but on Tuesday the index managed to reverse hard from a 30-day low. At the same time, more than 2 months of gains were wiped out in just a few sessions.

Heavy selling in high yield

The high-yield (junk) bond market has seen just has lopsided selling as equities. The advance/decline figures have been horrid, with an average of 743 more declining bonds than rising ones over the past three sessions.

Betting on a volatility drop

Our VIX Sentiment model soared above 5 on Tuesday, meaning that there was a whole lot of smart money traders betting that the jump was going to be short-lived. These traders are typically correct.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.