Palladium Rally Not Helping Autos As Warnings Keep Mounting

This is an abridged version of our Daily Report.

Autos sink despite a “should be” good sign

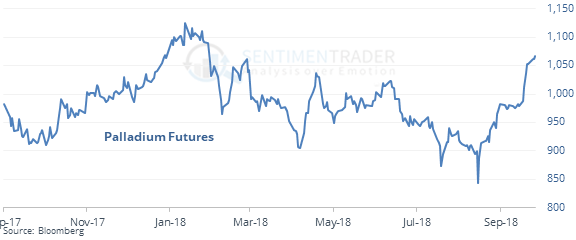

The S&P 500 Auto sector has sunk to a 52-week low despite strong palladium prices, which are at their highest in months.

While that’s usually interpreted as a good sign for the sector, it was not, and mostly led to further weakness. Palladium usually continued to do well.

One more warning about warnings

At the risk of getting monotonous, technical warning signs continue to pile up on the NYSE. They have triggered almost every day for the past 17 sessions, so many that there have been 3 only precedents in 50 years, all leading to declines.

Six straight

Gold is likely to close September with another monthly loss, which would be its sixth consecutive month with a decline.

Remarkable run

The Health Care sector has had a record-breaking run over the past 50 days. It has rallied more than 9% with a daily range less than 0.35%. No period in nearly 30 years can match that.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |