Options Worries As Energy Breadth Surges

This is an abridged version of our Daily Report.

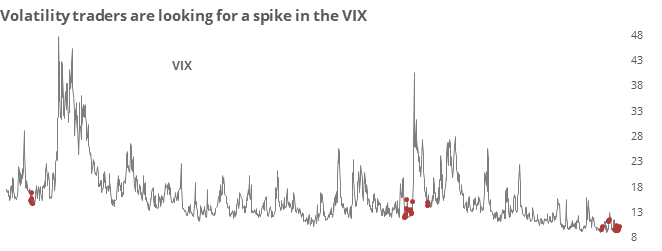

Trouble signs from the options market

Traders in VIX options appear to be betting on a spike, and they’re usually right. The few other times the options market was set up like this, volatility spiked.

Meanwhile, traders in SPY options have been busy bidding up call options, and they’re usually wrong. That’s a worrisome combination that suggest limited upside for stocks.

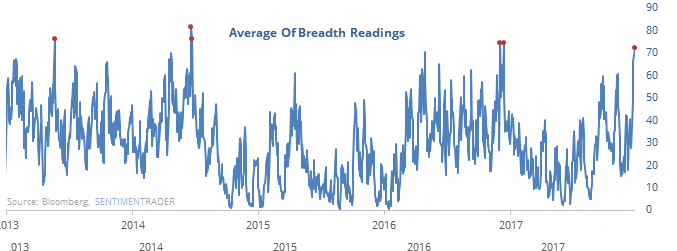

Energy’s about-face

This summer, sentiment on the energy sector was at an extremely pessimistic level. That has changed dramatically, and the sector is currently seeing one of the most positive breadth readings ever as most of the stocks in the S&P 500 Energy Sector are trading above their moving averages and setting multi-month highs.

If buyers continue to push the stocks higher in the coming weeks, then it bodes well for the longer-term based on the precedents of other breadth surges.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.