Options: Understanding What You are Getting Into

This is Part I of an ongoing series highlighting the relative pros and cons of various approaches to trading options.

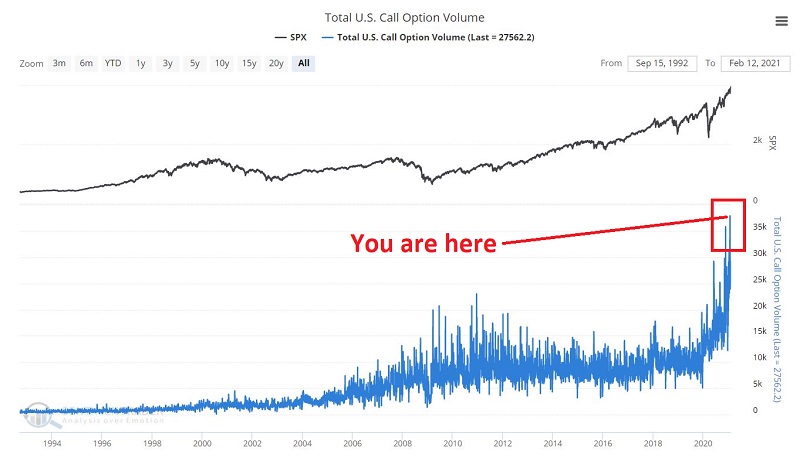

Jason has been covering very thoroughly the rampant amount of speculation going on in the options market of late. The "little guy" appears to be buying call options like crazy - no doubt in hopes of scoring a huge profit on the next "hot stock." And it's all fun and games. At least until the day comes when it's not. And that day ALWAYS comes eventually. I write that last sentence with a very high degree of conviction. At the same time, the one thing we do not know is WHEN or from what level it all comes undone. In other words, the market is very capable of continuing to rally for some time and potentially to a much higher level. So, the purpose of this series is NOT to convince you to abandon buying calls. The purpose is merely to help to make sure you understand what you are getting into.

Long Stock

The chart below displays the expected $ profit or loss for buying 100 shares of ticker SPY at $392.73 a share. The cost to enter this trade is $39,273 ($392.73 x 100 shares) and the position is considered to have 100 deltas (all figures that follow are presented courtesy of www.Optionsanalysis.com)

The chart on the left shows the price action of SPY with the prices along the left-hand side of the graph and the dates along the bottom. The chart on the right shows the expected $ profit or loss for this position based on the price of SPY. As you can see, the expected P/L is a straight line - each $1 increase in the price of SPY generates $100 gain in the value of the position and every $1 decrease in the price of SPY generates a $100 decline in the value of the position. Pretty straightforward.

Long a Call Option

But call buyers face a different reality. Much of that reality hinges on:

- The strike price of the call

- The time left until option expiration

To illustrate this, we will focus on one expiration month - the April 2021 series expiring in 63 calendar days on April 21, 2021. Over time we will look at 3 different call options based on their delta:

- Roughly 25 deltas

- Roughly 50 deltas

- Roughly 75 deltas

This article will focus on the 25-delta call option with 63 calendar days left until expiration.

First a quick-and-dirty explanation of delta: It roughly represents the stock equivalent position of holding the option. In other words, an option with a delta of 25 would be expected to react much like a position holding long 25 shares of stock and an option with a delta of 75 would be expected to react much like a position holding long 75 shares of stock.

So let's consider an out-of-the-money call option with a delta of roughly 25. This involves buying the April21 410 strike price call option @ $3.62. The total cost to enter this position is only $362 and this represents the maximum risk for the trade. The details and risk curves appear below.

There are some important tradeoffs involved in buying the 25 delta call versus buying 100 shares of SPY. The two we will focus on are:

- The good news is that option position costs less than 1% of the cost of buying 100 shares

- The bad news is that SPY must make a certain percentage price move higher prior to expiration in order for the option position to generate a profit

If held until expiration the breakeven price for the 410 call is $413.62 (strike price of $410 + option price of $3.62), which is 5.3% above the current price of SPY shares ($392.73). To put it in the starkest terms possible, if this position is held until option expiration then anything less than a 5.3% gain at that time for SPY shares will result in a loss on the option trade. In reality, a buyer of the 410 call is hoping for a rise in price sooner than later. If you take a closer look at the right-hand chart in the figure above you will note 4 different colored lines (red, blue, green and black).

- The red line represents the expected P/L based on 63 days left until expiration (i.e., as of the current day)

- The blue line represents the expected P/L based on 42 days left until expiration

- The green line represents the expected P/L based on 21 left until expiration

- The black line represents the expected P/L based on the date of option expiration

As you can see the expected profit is less at any given price for SPY the more time goes by. What you are witnessing is the effect of "time decay." Every option will lose all of its time premium by expiration. So ideally if you buy this call option the sooner SPY moves to the upside the greater your profit potential.

One More "Greek" Note: Theta

The dollar amount that an option position is expected to gain or lose based solely on the passage of time is reflected by the Greek known as "Theta". A negative Theta means the position will lose money due to time decay and a positive Theta means the position will gain money due to time decay.

- As of the day of entry the Theta for this call option was -$6.01

- This means that the position will lose roughly $6 today due solely to the passage of time

- It should be noted that Theta can and will change over time and that time decay accelerates in the 30 days just prior to option expiration

One Last Point: Overlaying the Trades

To get a true sense of the difference between the two positions highlighted above, the chart below "overlays" the risk curves for both trades.

The differences are fairly stark.

- If SPY rises $1 the stock trader gains $100 and if SPY declines $1 the stocker trade loses $100

- If SPY makes a significant up move in price the option trader stands to generate a very high percentage rate-of-return

- If SPY gets above the option breakeven price of $413.62 the option position will gain point-for-point with the stock position (despite costing only about 1% as much)

- HOWEVER, if SPY fails to rally the option trader stands to lose 100% of what he or she paid for the call option if SPY fails to rise sufficiently in price

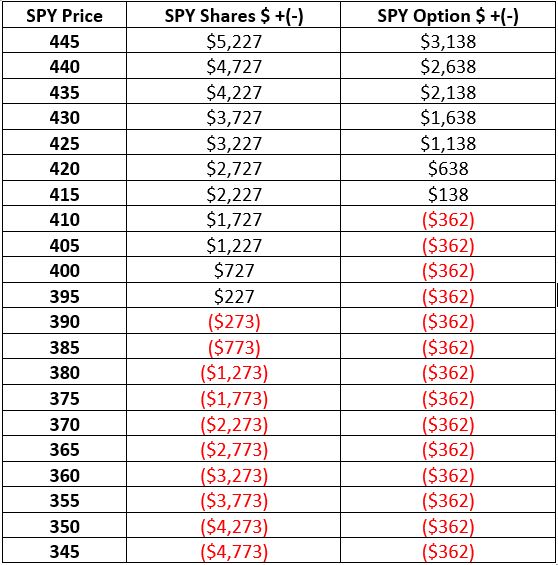

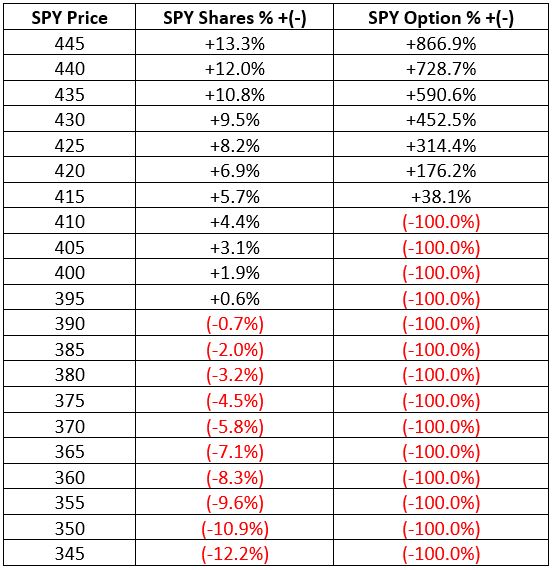

To complete the comparison, the first table below displays the expected $ profit/loss for both positions based on the price of SPY at the time of option expiration. The second table displays the expected % profit/loss for both positions based on the price SPY at the time of option expiration.

In essence, buying 100 shares of SPY is an "investment" - because the shares can be held for as long or as short a period of time as the buyer desires. On the other hand, buying a 25-delta call is a "speculation" - the buyer is playing for a minimum price move within a limited time window with the understanding that anything less can result in a 100% loss of capital invested.

I look at the chart below and can't help but to wonder how many people are aware of the above.