Options: Understanding What You are Getting Into (Part 3)

This is Part III of an ongoing series highlighting the relative pros and cons of various approaches to trading options.

Buying a call option on a given security is essentially a replacement for buying shares of that underlying security. When buying a call option, the hope is simply that prior to the date on which the option expires the underlying security will rise in price enough to generate a profit for the call option position, all at a fraction of the cost of buying the underlying shares.

To what degree a given call option position emulates the movement of the underlying can be approximated using the "delta" value for the option position. However, delta values can and will change over time, thus each position evolves in its own unique way.

There are advantages and disadvantages to any position, therefore the key - and the underlying purpose of this series of articles - is to help traders to recognize exactly what they are getting into when they enter into a particular position. In this piece we will compare 3 separate strategies which all start out as "equivalent" positions, i.e., they each start out with roughly the same delta value. What separates them is how the position will react as time goes by and as price and volatility move.

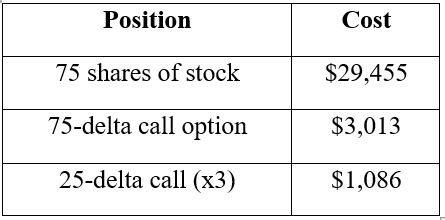

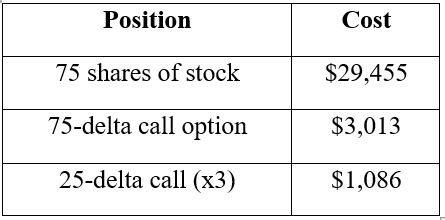

The 3 positions we will compare (starting on 2/12/21) are:

- Long 75 shares of SPY @ $392.73 a share

- Long one Apr16 368 call option (75-delta) on SPY @ $30.13

- Long three Apr16 410 call options (25-delta) on SPY @ $3.62

Cost to enter:

Clearly the 25-delta call option is the lowest cost to enter trade. But does that make it the best trade? Not necessarily. The answer to that question depends on what a trader's primary objectives are. To get a better sense of the relative pros and cons we will compare each position to one another.

All figures below are courtesy of courtesy of www.OptionsAnalysis.com.

Comparison #1: 75 shares of stock versus 75-delta call

As you can see in the chart above these two positions are similar - to a point. But here are the key differences:

- The 75-delta call option costs only 10.2% as much as the stock shares trade to enter

- The 75-delta call option expires on April 16; the stock shares trade can be held indefinitely

- Above roughly $413 a share the 75-delta call option will actually earn a higher dollar profit

- Below roughly $368 a share the 75-delta call option can lose no more than -$3,013

- Below roughly $355 a share the loss on the 75-share position will exceed the loss on the 75-delta call option AND the 75-share position will continue to lose $75 for every point SPY declines

- Between roughly $355 and $413 the 75-delta call option will make less or lose more than the 75-share position

- Despite the fact that the 75-delta call option costs only 10% as much to enter, it CAN lose more money than the 75-share position IF SPY is between $355 and $398.13 at option expiration.

The bottom line: At the time these trades are initiated, the 75-delta call option offers potential point-for-point movement with underlying shares. However, as time goes by, time decay begins to eat away at the value of the call option.

Consider this: if SPY shares are unchanged (i.e., still at $392.73) at the time of option expiration:

- The 75-share position will show no gain or loss

- The 75-delta call option will close at $24.73 (stock close of $392.73 minus strike price of $368), for a loss of -$540

Comparison #2: 75 shares of stock versus 25-delta call (x 3-lot)

As you can see in the chart above, although these two positions start with a delta of 75, they will ultimately evolve in very different ways. Here are the key differences:

- The 25-delta (x3) call option costs only 3.7% as much as the stock shares trade to enter

- The 25-delta (x3) call option expires on April 16; the stock shares trade can be held indefinitely

- The 25-delta (x3) call option enjoys much greater dollar profit potential if SPY rallies strongly

- At expiration, above roughly $420 a share the 25-delta call option will earn a higher dollar profit

- At expiration, at any price below $410, the 25-delta call option will lose all of its value, but not more than -$1,086

- Below roughly $378.50 a share the 75-share position continues to lose $75 for every point SPY declines in price, and the loss will exceed that of the 25-delta (x3) call option

- At expiration, between roughly $378.50 and $420 a share, the 25-delta (x3) call option will make less or lose more than the 75-share position

- Despite the fact that the 25-delta call option costs only 3.7% as much to enter, it CAN lose more money than the 75-share position IF SPY is between roughly $378.50 and roughly $420 at option expiration.

The bottom line: Buying the 25-delta call option is a speculation designed to maximize gain. If anything other than a significant advance in the price of SPY transpires prior to option expiration, the option will likely lose money AND CAN lose more than the 75-share position due to time decay.

Comparison #3: 75-delta call versus 25-delta call (x 3-lot)

As you can see in the chart above, although these two positions both involve holding long call options AND both start with a delta of 75, they will ultimately evolve in very different ways. Here are the key differences:

- The 25-delta (x3) call option costs only 36% as much as the 75-delta call option to enter

- Both positions cease to exist after April 16th

- The 25-delta (x3) call option enjoys much greater dollar profit potential IF (and ONLY if) SPY rallies strongly

- At expiration, above roughly $422 a share the 25-delta (x3) call option will earn a higher dollar profit

- At expiration, at any price below $410, the 25-delta (x3) call option will lose all of its value, but not more than -$1,086

- At expiration, at any price below $368, the 75-delta call option will lose all of its value, but not more than -$3,013

- Below roughly $388 down to $368, the 75-delta call option continues to lose money as SPY declines in price, and the loss will exceed that of the 25-delta (x3) call option

- At expiration, between roughly $388 and $421 a share, the 25-delta (x3) call option will make less or lose more than the 75-delta call option

- Despite the fact that the 25-delta (x3) call option costs only 3.7% as much to enter, it CAN lose more money than the 75-delta call option IF SPY is between roughly $388 and roughly $420 at option expiration.

The bottom line: Buying the 25-delta (x3) call option is a speculation designed to maximize gain. If anything other than a significant advance in the price of SPY transpires prior to option expiration, the option will likely lose money AND CAN lose more than the 75-delta call option due to time decay. The 75-delta call option is designed to track more closely with the long 75-share position at a fraction of the cost of actually buying 75 shares.

Some closing thoughts:

- There is no such thing as "the best trade" among the three detailed. It is a question of what the trader's primary objectives, the particular risks they are willing to take and the size of their trading account

- The 75-share position allows a trader to hold a long position indefinitely and (obviously) offers point-for-point movement with the underlying security

- The 25-delta (x3) call option:

- Allows a speculator to maximize their profit potential at a fraction of the cost of the other two trades

- HOWEVER, it also has a significantly higher likelihood of experiencing a 100% loss

- The 75-delta call option allows a trader to:

- More closely emulate a long 75-share position - without the dollar cost and dollars at risk associated with the 75-share position

- AND without the huge time decay risk associated with the 25-delta (x3) call option