Options: Understanding What You are Getting Into (Part 2)

This is Part II of an ongoing series highlighting the relative pros and cons of various approaches to trading options.

In Part I of this series, I highlighted the difference between buying 100 shares of SPY and buying a call option on SPY with a delta of 25. In this short piece we will do more of an apples-to-apples comparison to highlight the reward/risk differences between buying an out-of-the-money call option and buying shares of the underlying security.

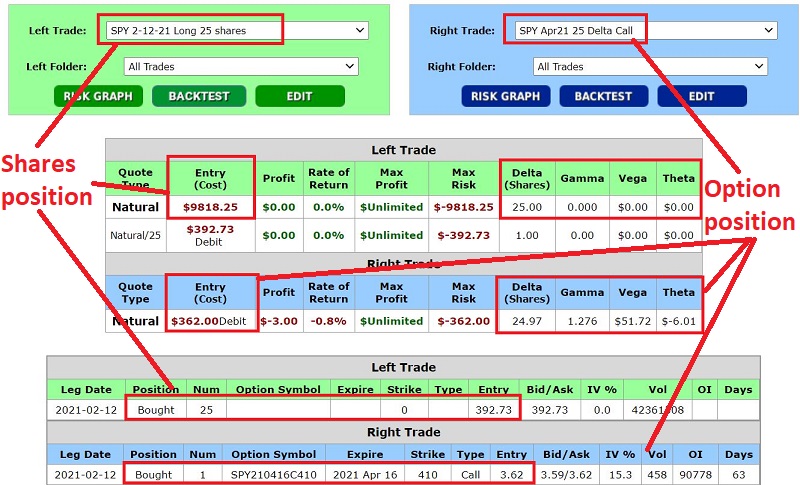

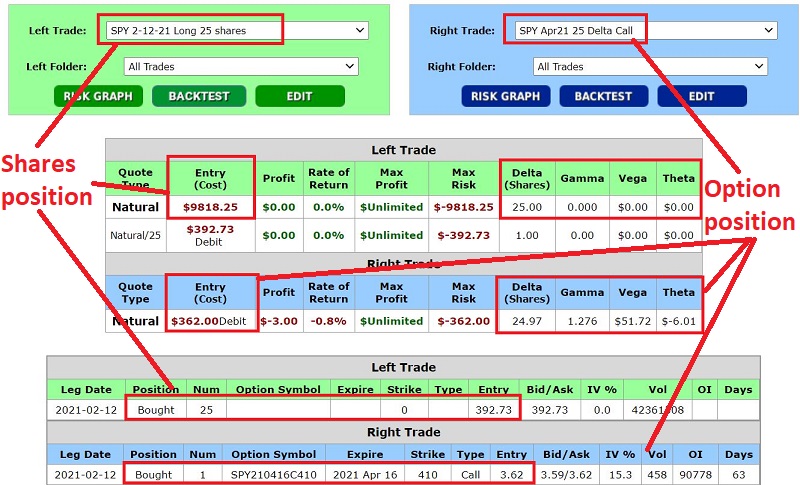

In this piece instead of comparing a 25-delta call option to 100 shares of stock we will compare the following two positions:

- Long one SPY 25-delta call option

- Long 25 shares of SPY

Both of these positions start with a delta of 25.

- To buy 25 shares of SPY at $392.73 a share costs $9,818.25

- To buy one SPY Apr16 410 call option at $3.62 costs $362

The particulars of the two positions appear below.

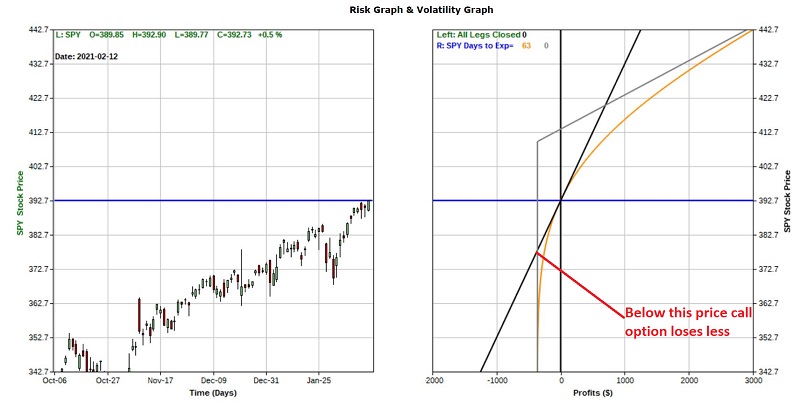

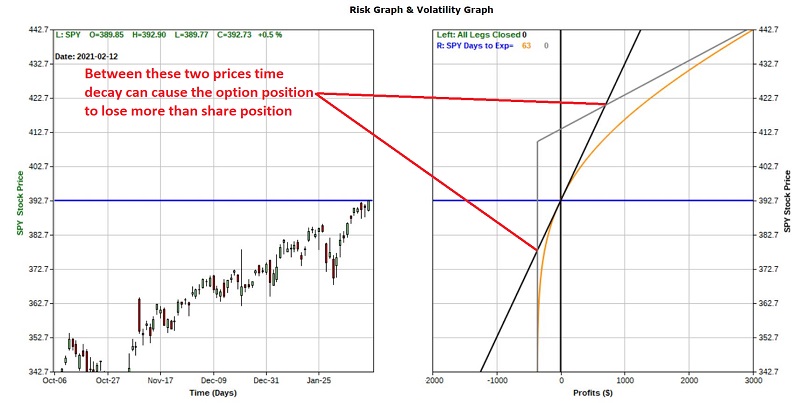

The charts below display the risk curves for the two-position overlaid atop one another.

- The risk curve for the stock position is the black straight line

- The risk curves for the option position are the orange curved line and the grey line that resembles a hockey stick

The tradeoffs are fairly easy to grasp:

- The option position costs far less to enter ($362 for one call option versus $9,818 for 25 shares of an ETF)

- Above a certain price the call option has greater profit potential

- Below a certain price the call option has less downside risk

- Between those two prices the call option has a greater potential for loss (this is due to time decay as the time value built into the price of the option drops to zero by option expiration)

The question on most people's mind is "which position is better?" The answer to that question is in the eye of the beholder. Among the primary considerations when attempting to answer that question might be:

How confident are you that SPY will make the necessary price move prior to option expiration?

If you are highly confident that a significant price advance is imminent then the call option affords you the potential to maximize your profitability.

How long do you want to have exposure to SPY?

If your answer is "longer than 63 days" or even "possibly longer than 63 days" then this particular long call position may not make sense as it will cease to exist in 63 days.

In succinct terms:

- the shares position is a bet on higher prices at some point in time

- the option position is a bet on higher prices sooner than later

Assessing your own objectives and expectations is the key to choosing the proper position.