Options traders spend billions betting that this rally won't end

6 weeks of speculation

Since early January, options traders have been aggressively betting on a continued ramp higher in stocks. It’s mostly paid off, and they keep pressing. Each week that goes by without a pullback, traders become more aggressive, and by some measures, they’ve never been more exposed.

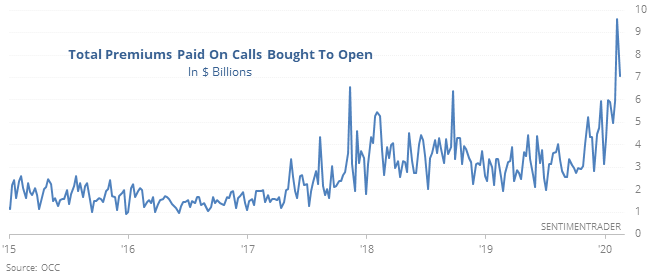

They’ve been spending heavily on that opinion. With the surge in call buying, their total outlay has exceeded more than $7 billion in premiums paid each of the last two weeks. That’s far beyond anything we’ve seen in the past 20 years. Over the past 5 years, it's almost double the previous record.

In a market that’s enjoyed a couple months of “nothing matters,” it’s hard to imagine that this kind of speculative activity won’t be punished. The exact timing is never certain, but in markets, when it gets this rewarding to be this carefree, a punishment almost always follows.

Tech rally

Without a shadow of a doubt, the stock market's rally has been driven by tech. The NASDAQ Composite, NASDAQ 100, and S&P 500 tech sector have surged since October, prompting bears to compare today vs. historical melt-ups that were followed by crashes (e.g. "today is just like 1999").

But the problem with overlapping 2 charts on top of each other is that you tend to see what you want to see.

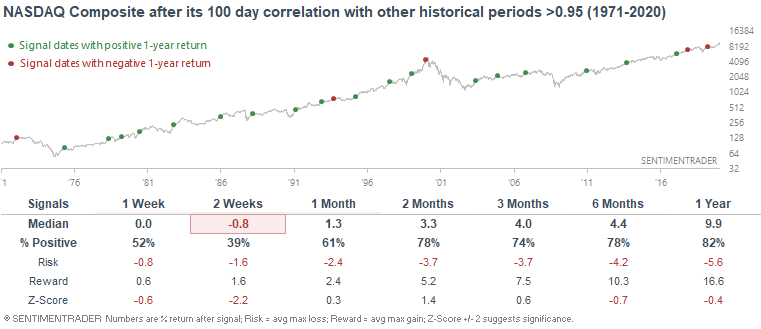

If you're bearish, you're always going to "spot" the similarities between today vs. 1999. So in the interest of bias-free analysis, let's compare the NASDAQ Composite's rally over the past 100 days against other historical 100 day periods, and look at cases in which the correlation exceeded 0.95.

The 1999-2000 period was an extreme case. Looking at all the historical cases which were similar to today, the NASDAQ Composite's returns over the next 2 weeks were poor, but there were more signals that led to gains than losses, especially dramatic ones.

The S&P 500's returns over the next 2 weeks were poor as well, and its average return across almost all time frames was below a random return.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Other looks at the breathtaking speculation among options traders

- What happens when low volatility stocks take over from high beta ones

- YTD, everything is rallying - what happens to the dollar and gold

- Utilities are overbought on a weekly time frame

- The dollar has had a heck of a run over the past 11 days