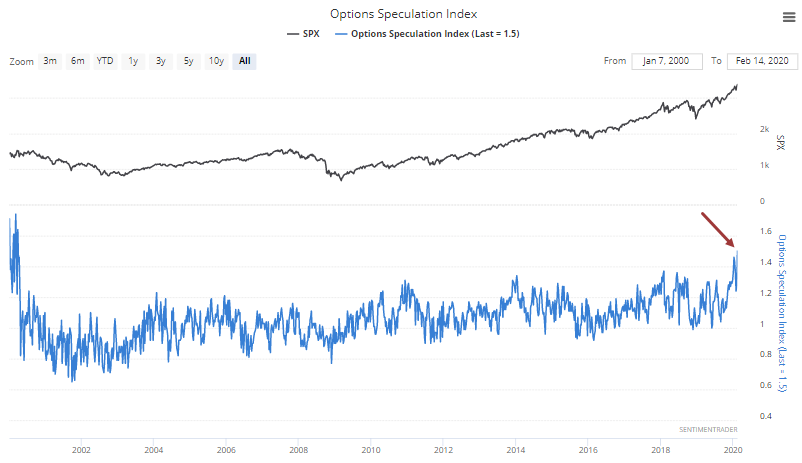

Options traders set new speculative record

We've seen some crazy signs of speculative activity pop up over the past month or so. Retail investor activity has skyrocketed to record highs, stocks are gapping up at the open like few times in history, and some large stocks are witnessing parabolic price gains.

But nothing can compare to options traders.

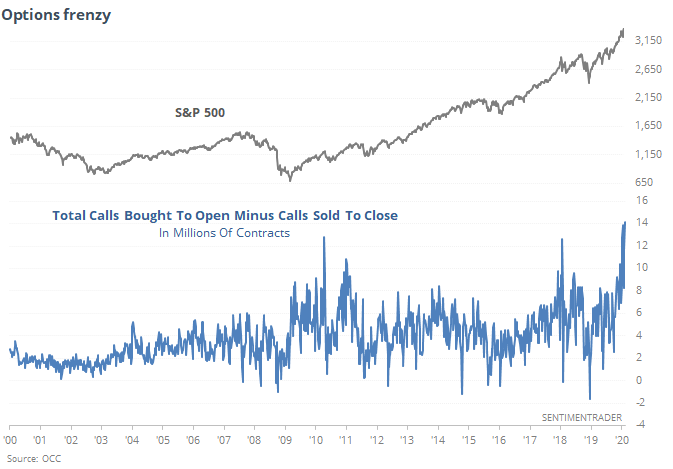

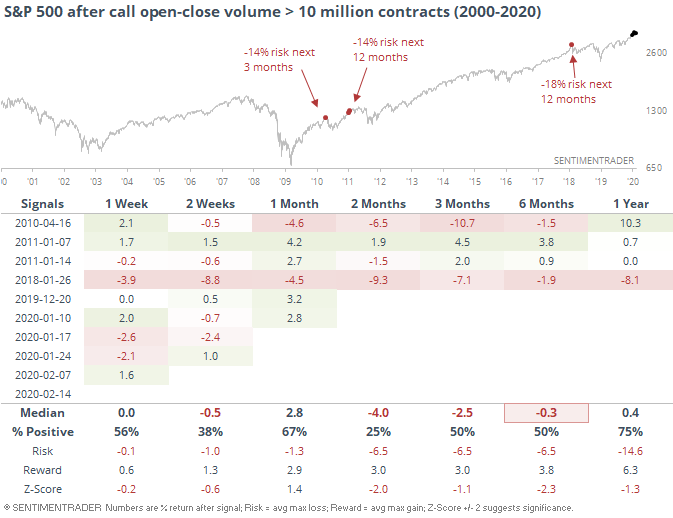

This past week, they outdid themselves. For the week ending February 14, traders bought to open nearly 24 million call options. That's the most in history. And they didn't want to miss out on any gains by closing their existing positions, so call selling (to close) has dropped off nearly 30% from where it was a couple of weeks ago.

That means that the difference between calls bought to open minus calls sold to close is at a record high.

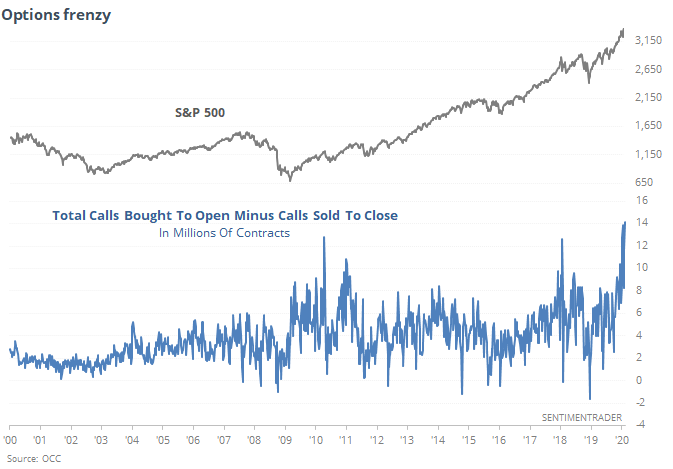

When it has exceeded 10 million contracts over the past 20 years, stocks struggled. It took awhile in 2011, but whatever shorter-term gains the speculators enjoyed were more than wiped away (assuming they held or rolled over their positions).

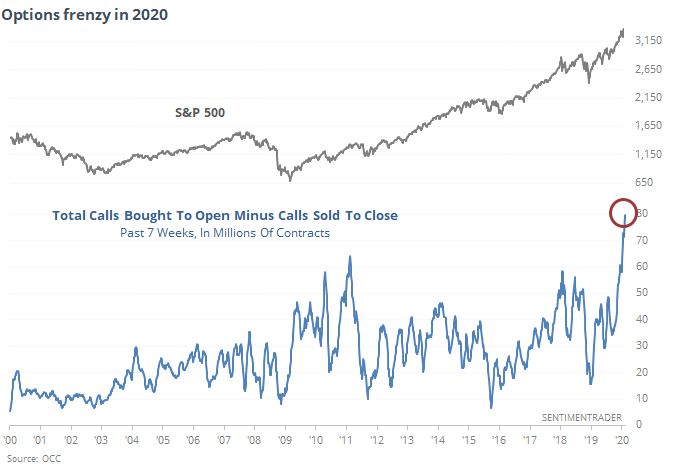

We can see that quite a few of these weeks have come just in 2020. When we sum the past 7 weeks of this activity, we can see how it has gone parabolic this year, with a difference of over 80 million contracts.

No other 7-week stretch has come even close to this level of speculative action. The only one that comes close ended in mid-February 2011, preceding a more than 6% loss in the S&P 500 over the next couple of months, which only got worse in the months after that.

If we normalize this activity based on total options or stock volume, or relative to other strategies, the message stays the same. We're seeing a level of leveraged speculation right now that has either never been seen before in the past 20 years, or only has the early 2000s as a precedent.

This is not a comforting message for bulls.