Options traders really are pessimistic

Key points:

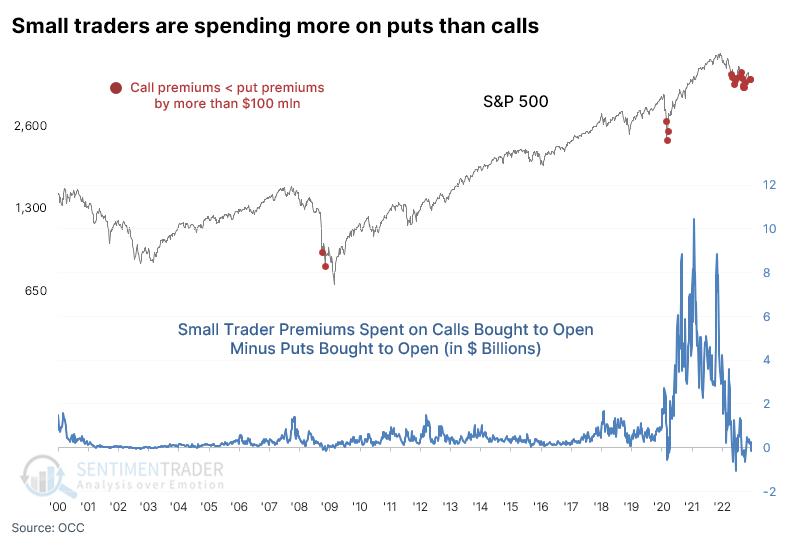

- Last week, small options traders spent more on protective put contracts than speculative calls

- It's rare to see more premiums spent on puts than calls, especially by $100 million or more

- Similar activity didn't necessarily end bear markets immediately, but long-term returns were excellent

The smallest and most leveraged traders are full of fear

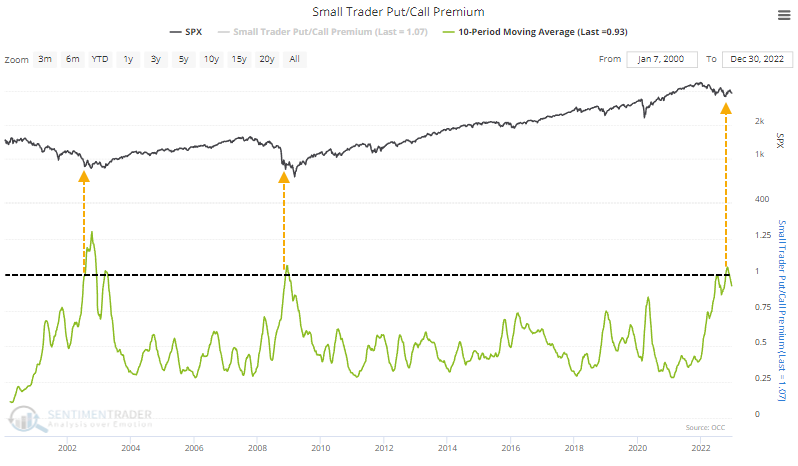

A lot of consternation has occurred in recent weeks about spikes in the put/call ratio. Are traders really more bearish than at any time in history? Are interest rate arbitrage transactions causing all the data to be worthless? Does any of it matter anyway?

The Chicago Board Options Exchange (CBOE) outlined some likely explanations for this activity that don't have much to do with sentiment. It argues against reading too much into the daily jumps in the ratio. As noted by the CBOE:

A last alternative would be to focus on smaller executions, using the size brackets included in the Open-Close datasets. This "Small Trade P/C" avoids the distortion of the large-scale early-exercise activity and may support a better picture of small-trader sentiment across time and product.

In December, we looked at the activity among the largest options market customers, which continued until the end of the month. Taking the CBOE's recommendations to heart, however, maybe it's best to place less weight on those traders and more on the smallest ones.

It's unlikely that small options traders, those buying and selling ten or fewer contracts at a time, are employing complex arbitrage or expiration strategies. Mostly, the focus is on straightforward speculative or hedging strategies like buying calls and puts to open, selling covered calls, or selling cash-secured puts. This isn't idle speculation - I managed the margin and options department of a top-5 online brokerage for several years and had comprehensive insight into how our customers traded.

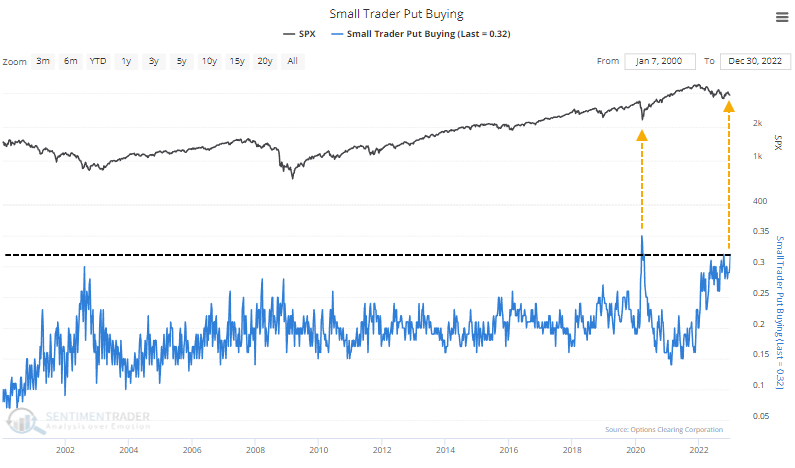

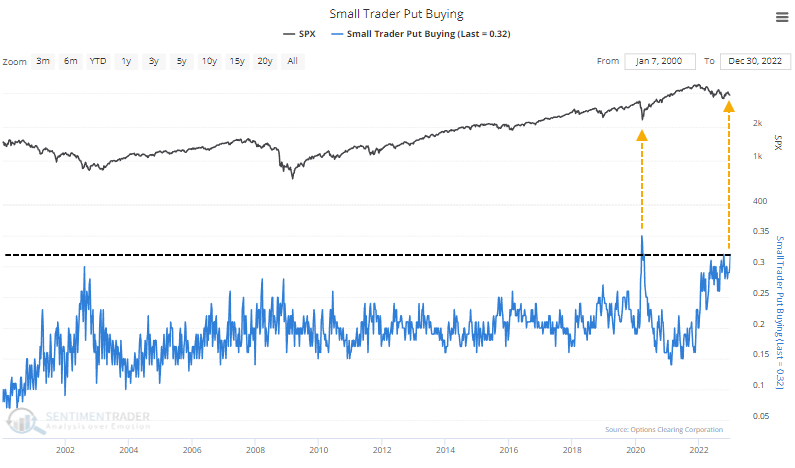

Last week, small options traders spent 32% of their total volume buying put contracts to open. That's tied for the 3rd-most of any week since the year 2000.

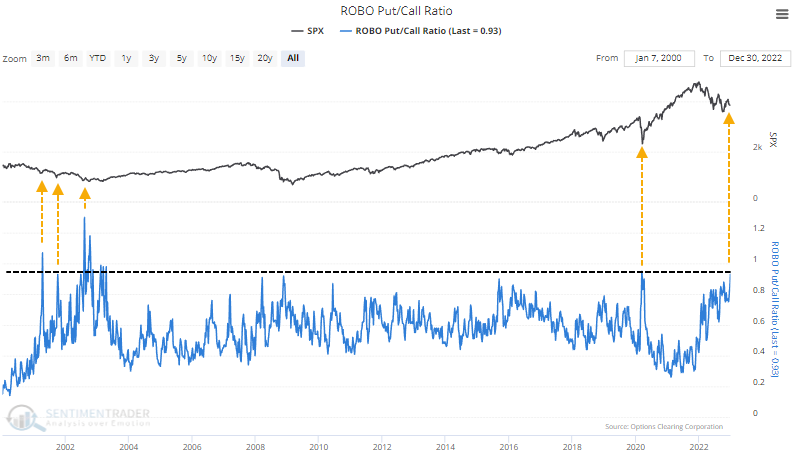

They pulled back on call buying to the greatest extent since May 2019, so the ROBO Put/Call Ratio spiked to 93%. Over the past 20 years, only the week ending March 13, 2020, exceeded this. Before that, there were more significant spikes in the ratio near the market lows in April 2001, October 2001, and during the protracted bottoming process in the summer of 2002 through the spring of 2003.

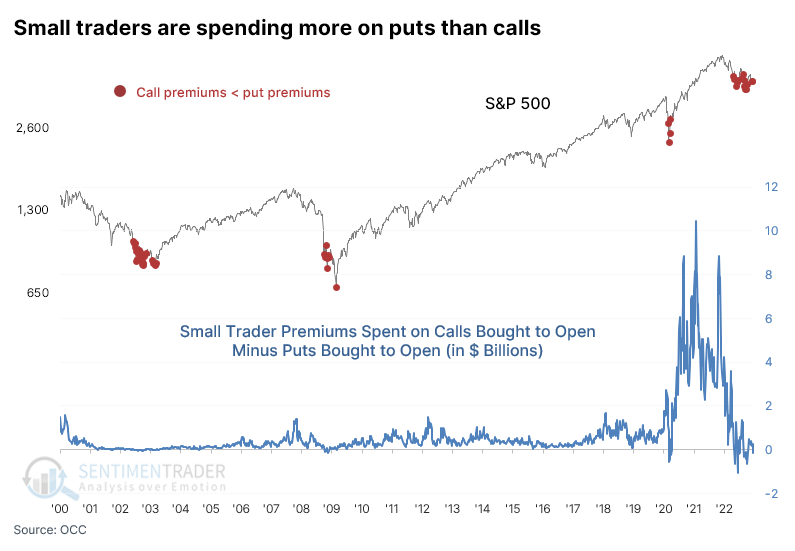

As we saw with large traders, small traders have been paying up for the privilege of buying all those put options. The premiums spent on buying puts exceeded premiums on calls by more than 7%.

Over the past 23 years, it's been rare to see the smallest of traders spend less on speculative call options than protective put options.

Last week, they spent $1.56 billion on calls versus $1.66 billion on puts. That difference of more than $100 million favoring puts is very rare. Prior to the depths of despair during the past six months, it only happened during the meltdowns in the fall of 2008 and spring of 2020.

Over the past ten weeks, the average premiums spent on puts versus calls have decreased slightly, but it's coming from a level matched only by the (lengthy) bottoming processes in 2002 and 2008.

What the research tells us...

Following the speculative options mania two years ago, it makes sense that traders would run to the other side of the boat and drive extremes in the opposite direction. We have certainly seen that, and it's not due to complex arbitrage strategies. It is pure and simple fear. Whether it's enough to offset the extremes from a couple of years ago is the big question, and historically, extremes like this have not necessarily meant a precise end to a bear market. But the fearful activity has persisted off and on for months, and while we only have a couple of precedents, they suggest positive long-term returns from such behavior.