Options Traders Pour Into Calls As Breadth Lags

This is an abridged version of our Daily Report.

Forget stock, call options have more oomph

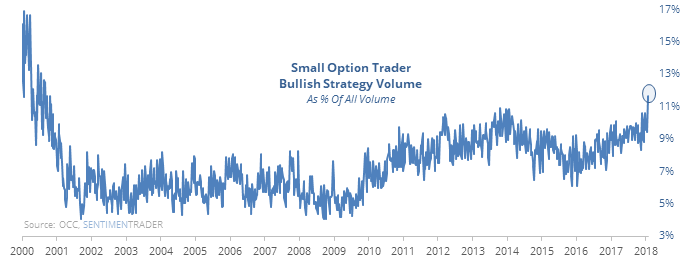

Retail traders have returned in a big way. We saw on Friday the surge in brokerage transactions, and that has bled over into the options market. The smallest of options traders put on a skyrocketing number of bullish positions last week, opening a record number of call purchases and put sales.

They haven’t engaged in activity like this since October 2000.

Getting tired under the surface

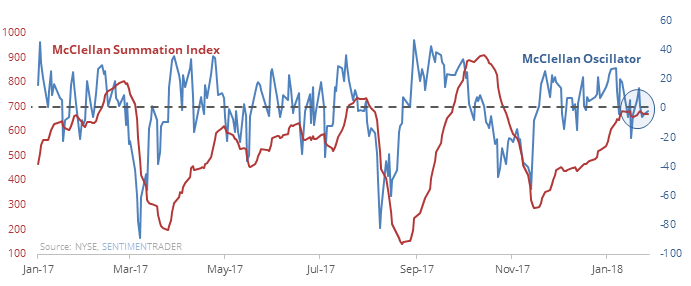

Stocks have jumped over the past month, yet measures of the momentum of underlying breadth are lagging. The McClellan Oscillator and Summation Index are well below where they “should” be given such a rise in the indexes.

While ineffective in 2017, divergences like this have led to a poor risk/reward over the next 2 months.

A streak snapped

The S&P 500 finally suffered a loss greater than 0.6%, its first in nearly 100 days (a record). The ends of other long streaks led to shorter-term rebounds, medium-term losses.

Fear rising?

The VIX “fear gauge” closed at its highest level in more than 100 days a day after the S&P set a 52-week high.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.