Options traders keep setting new speculative records

In mid-February, we saw that options traders were speculating heavily, a disturbing wrinkle in the positive momentum that markets were enjoying at the time. The pandemic slapped that speculation out of them. For a while.

They returned in force, and by early June surpassed any previous speculative record. The rocky market (outside of tech stocks) over the past month alleviated some of that, but this past week they returned.

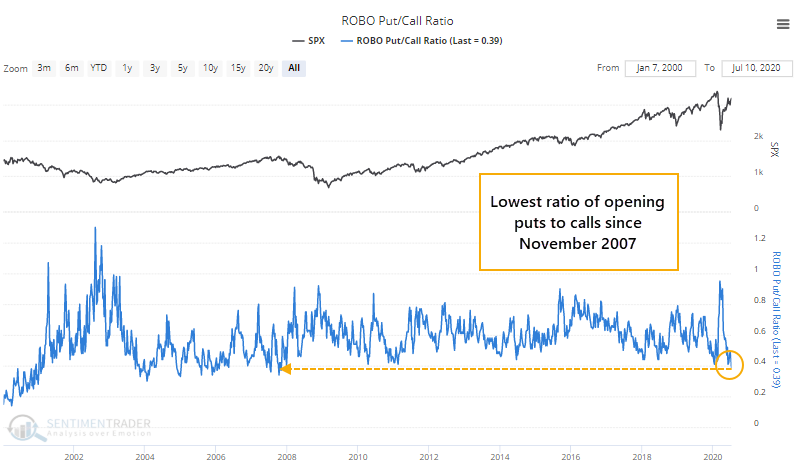

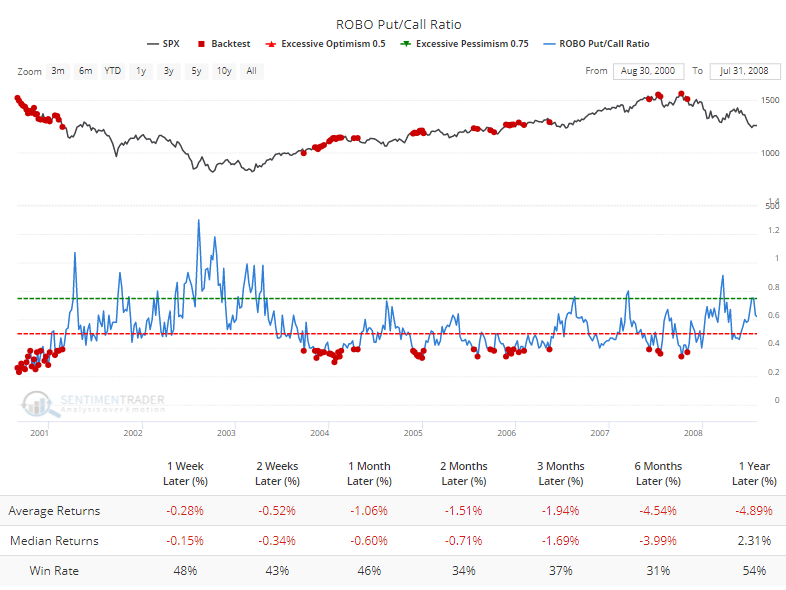

It was enough to push the ROBO Put/Call Ratio to the lowest level since November 2007. This ratio calculates the total number of put options that small traders bought to open versus the number of speculative call options they bought to open. The lower the ratio, the less hedging (and more speculating) that they're doing.

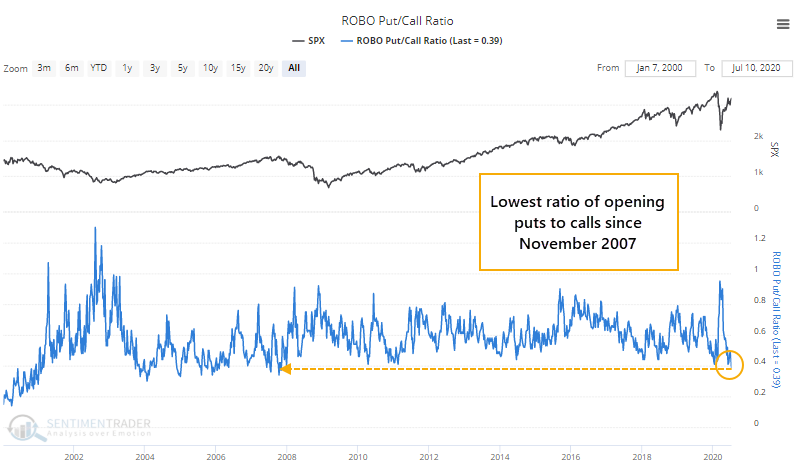

Since 2000, the only weeks when the ratio was lower were in 2000 and several from 2004 - 2007. The Backtest Engine shows that future returns were ugly.

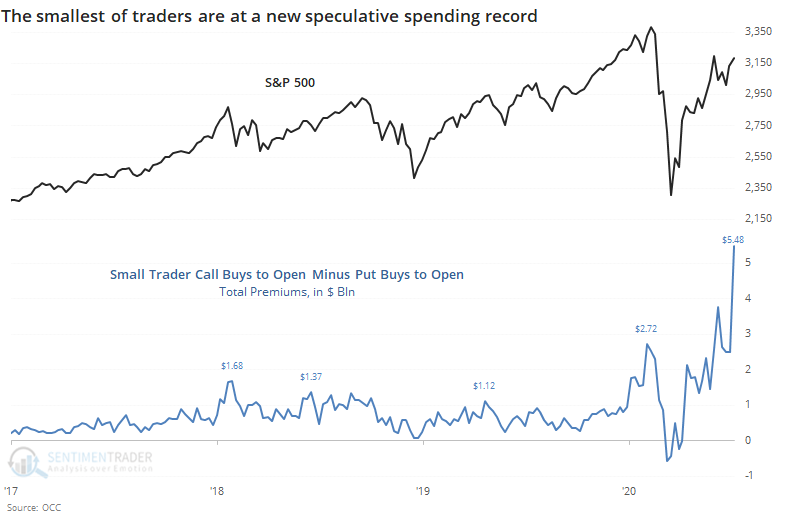

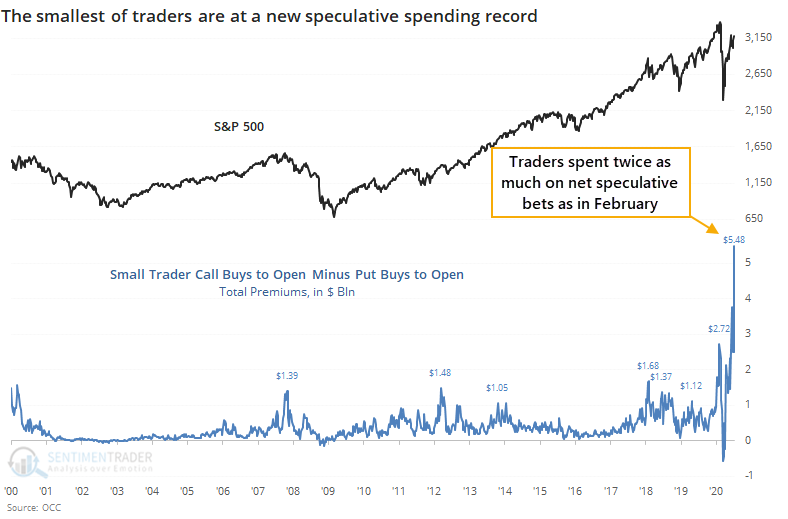

Even more stunning is the absolute dollar amount that small traders are spending on these speculative trades.

If we look at total premiums spent on opening call transactions minus opening puts, for a net speculative dollar commitment, then we can see that last week's total of $5.5 billion has far surpassed the prior record from early June and is more than twice as much as the peak in February.

Prior to this year, these traders had never spent more than $1.7 billion on net speculative trades.

When we zoom out and look at the past 20 years, then the current frenzy is brought into stark relief.

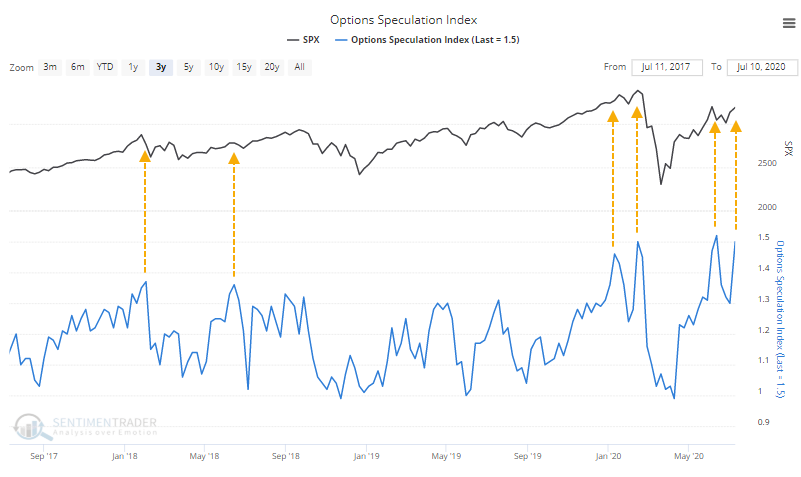

Among all traders, the Options Speculation Index gives us a very good view of the distribution of speculative versus hedging activity on all U.S. exchanges. Once again, it's above 50%, meaning that they opened 50% more bullish contracts than bearish ones.

We put a lot of weight on options data because it ticks all the boxes:

- It reflects real money, not surveys

- There is little to no delay in the data

- We know (pretty much) who is doing (pretty much) what

- They are leveraged, expiring contracts, which increases emotional responses

Given these factors, this new speculative record is once again a primary concern for the short- to medium-term. It doesn't say much about the long-term, only that risk is high in the interim.