Options Traders Go All In As Investors Flood Into TIPS

This is an abridged version of our Daily Report.

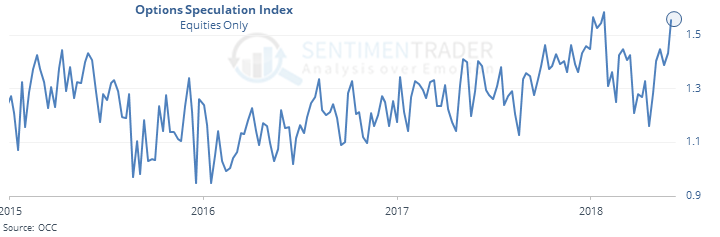

Options traders go all in

Options traders have rushed into bullish strategies at the expense of more conservative ones. Total call volume last week mushroomed to 32 million contracts, the highest since late January, while put volume was about average.

Much of that was small traders buying call options to open, not a good sign for stocks.

TIPS seeing some love

Investors are rushing into TIPS funds that protect against a rise in inflation. Previous spikes in assets led to inconsistent returns in the funds, making it hard to read into this.

Intraday give-up

Ahead of major news events this week, investors didn’t seem to intent on making big bets either way. The S&P 500 fund, SPY, open and closed in the bottom 25% of its intraday range, even while hitting a multi-week high intraday. That has happened 22 other times in its history.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |