Options traders are pricing in fear, while others bet against it

Thanks to heightened concerns about the looming presidential election, uncertainty about upcoming earnings reports, and negative developments in the fight against coronavirus, options traders have continued to price in wide swings in stocks.

The VIX "fear gauge" has been persistently stuck above 25. And at the peak of intraday concern, the VIX has jumped more than 10% on two out of the past three sessions. It's easier to see big jumps in the VIX when it's at a low level. It's much rarer to see it when the VIX is already high, especially when stocks aren't even in a correction at the time.

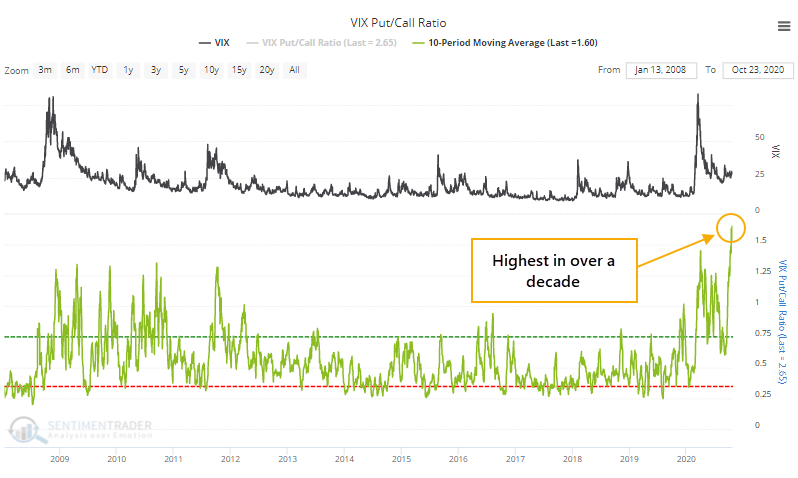

Over the past couple of weeks, more and more traders seem to be betting that it's too high. The 10-day average of the VIX Put/Call Ratio has climbed above 1.5, the highest in more than 13 years.

While we don't know whether the underlying trades are betting on increasing or decreasing volatility, the assumption is that the heavy put volume reflects bets that the VIX will decline. And usually, that's what's happened.

Trading activity in puts versus calls is one of the inputs of our VIX Sentiment model, which just rose above 4. Any time when VIX Sentiment was above 3.5, the Backtest Engine shows that stocks usually reacted by rising in the months ahead as volatility almost universally declined.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- What happens when the VIX spikes 10% multiple days during a benign market environment

- Forward returns after very high (and very low) readings in the VIX Sentiment model

- Wednesday's selling pressure pushed stocks - domestic and overseas - outside of their volatility bands

| Stat Box Wednesday's losses were quick and heavy, both in the U.S. and overseas. Among members of the German DAX index, more than 75% of stocks fell below their lower Bollinger Bands. That's more than 2 standard deviations below their 20-day averages. That's only happened 6 distinct times in nearly 20 years, leading to further shorter-term losses 5 times, but gains over the next 3 months every time but once. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

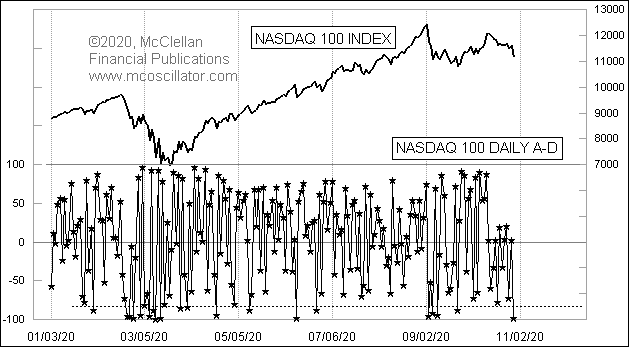

1. Sentiment was so bad on Wednesday that only a single stock in the Nasdaq 100 managed to gain - Tom McClellan

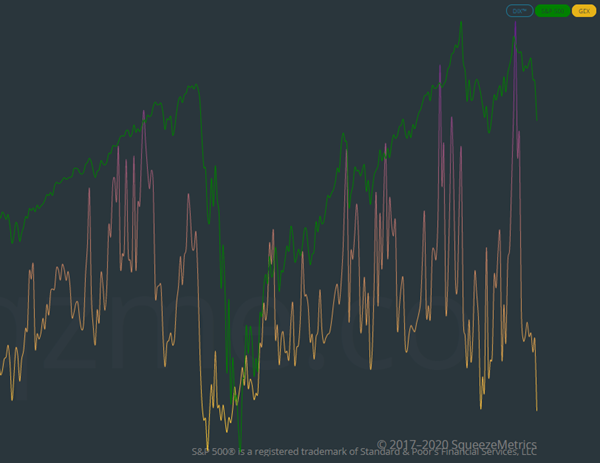

2. Based on options activity, any further 1% decline should be met with underlying buying pressure - SqueezeMetrics

2. Based on options activity, any further 1% decline should be met with underlying buying pressure - SqueezeMetrics

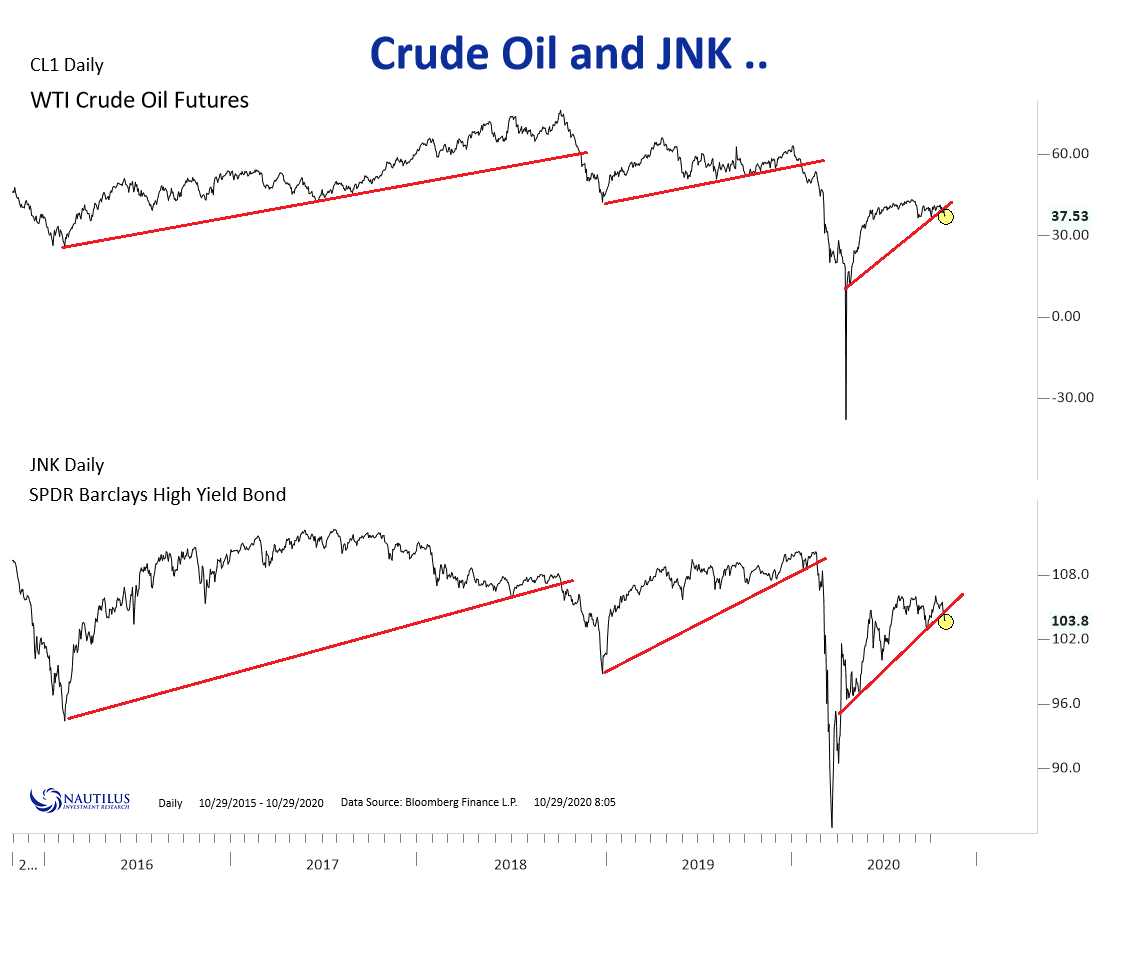

3. The breakdown in oil might be a bad sign for the junk-bond market - Nautilus Research