Options data shows concern is just a memory

One of the many measures of panic that triggered in March was the overwhelming preference for traders to reach for put options, hedging against the possibility of further losses.

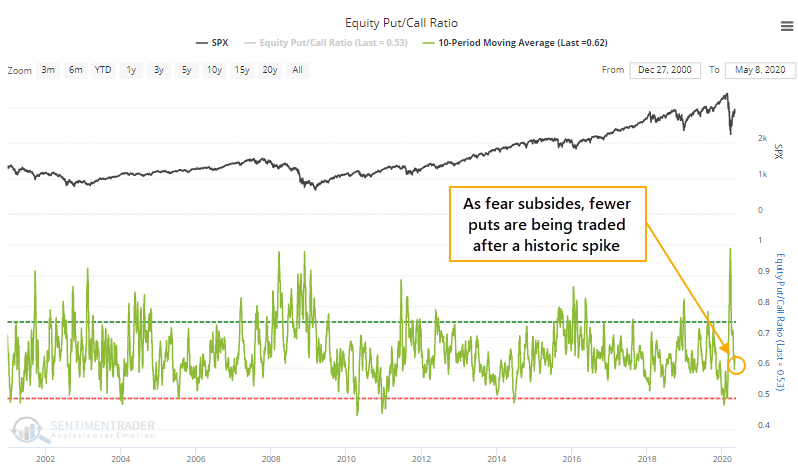

At its peak in March, the 10-day average of the Equity-only Put/Call Ratio neared 1.0, meaning more volume in protective put options than speculative calls. That's one of the highest readings in the history of the data. It has since calmed down and moved well into neutral territory.

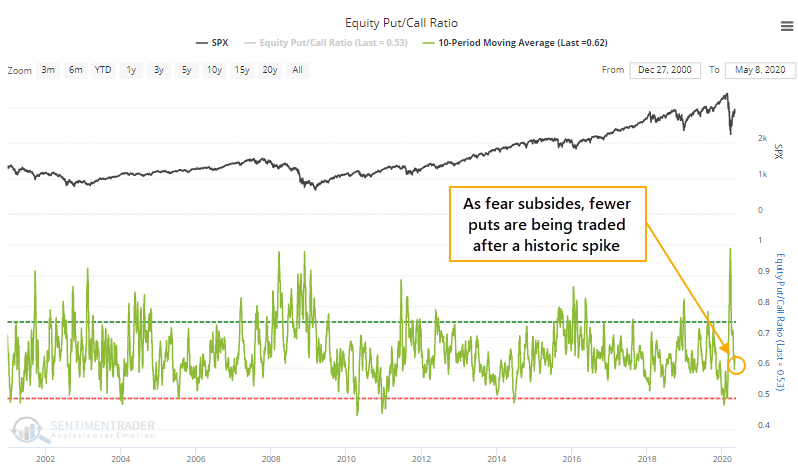

We've seen time and time again that during bear markets, neutral sentiment is about all that's required before sellers do their thing again. That's what happened in 2008, the only other time the 10-day ratio reached as high as it did this year. Both times, when the put/call ratio dropped to its current level, that was about it for the rally attempts.

What's also notable about the current behavior of options traders is that they're shifting sentiment quickly. It has taken barely a month for the 10-day average of the put/call ratio to drop this much.

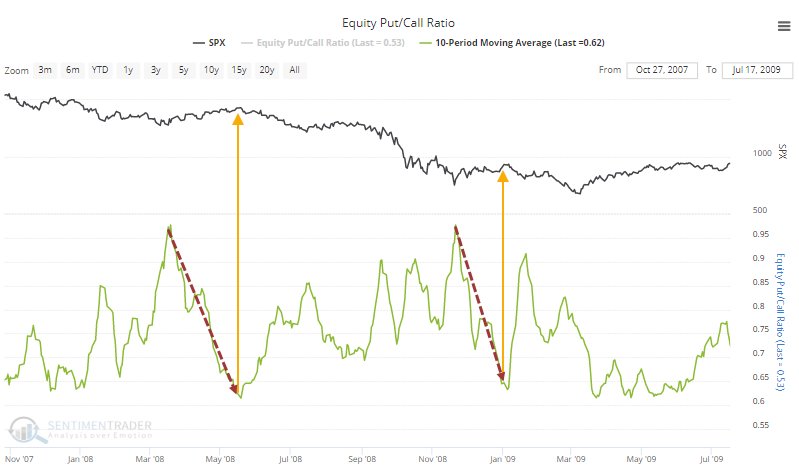

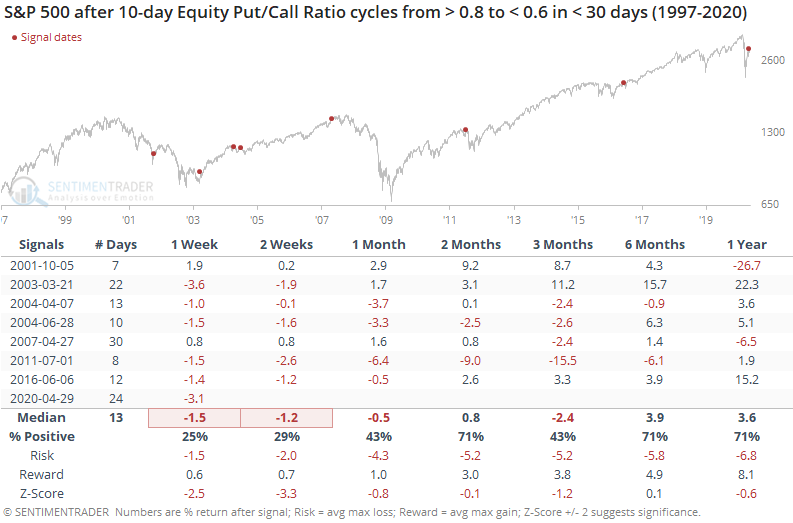

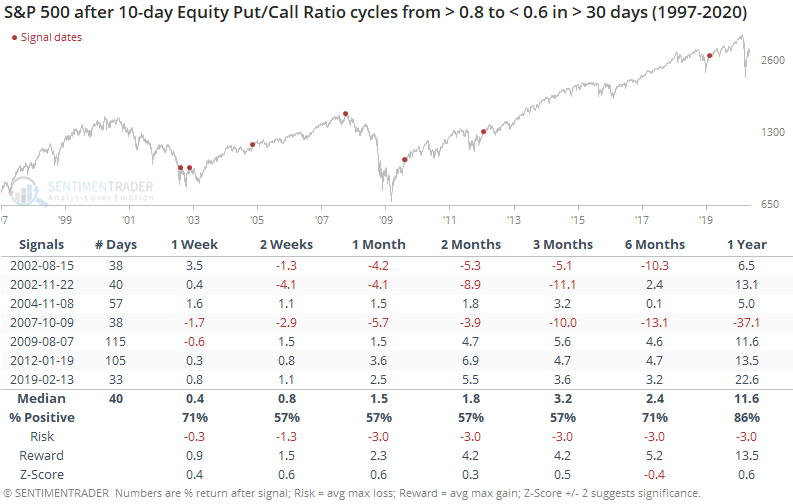

Even if we're in a bull market, which is when these quick shifts in sentiment tend to occur, future returns were iffy.

Other than March 2003, when stocks dropped quickly then recovered just as fast and showed sustained gains, most of the others saw weakness, or small or unsustained gains, in the months ahead.

Contrast that to times when it took longer for traders to ease back on their bearish sentiment.

In these cases, returns were more likely to be positive over the short- to medium-term, and with a better risk/reward skew. There were still a couple of large losses, from the bottoming action in 2002 and the market peak in 2007, but overall it was a more positive bias than those times when the put/call ratio cycled quickly.

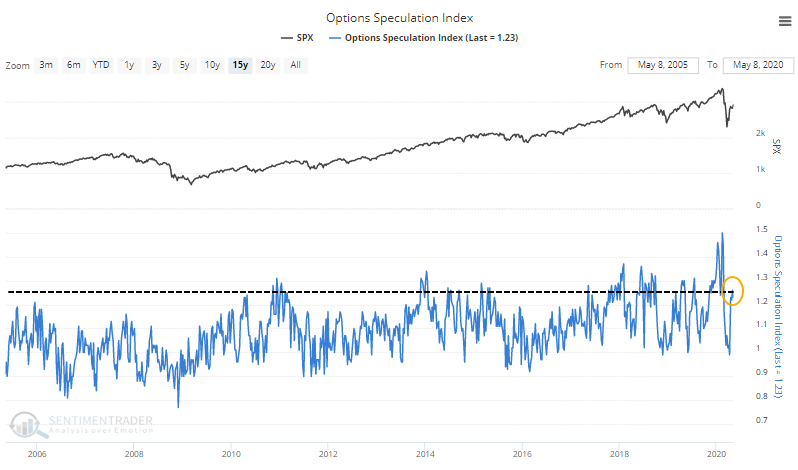

The ratio isn't yet showing an optimistic extreme. The troubling thing is that it has come down so quickly, though, especially since we're still mired in a downtrending market. It's a minor warning for the short- to medium-term, especially since overall speculation in options remains in the upper end of its range.

This is the highest the Options Speculation Index has ever been with the S&P 500 trading below its 50-week moving average, and while there has been a general trend higher in the data over the years, it's still higher than bulls would like to see.