Options Bulls Return As Investors Get Whipsawed

Options bulls return

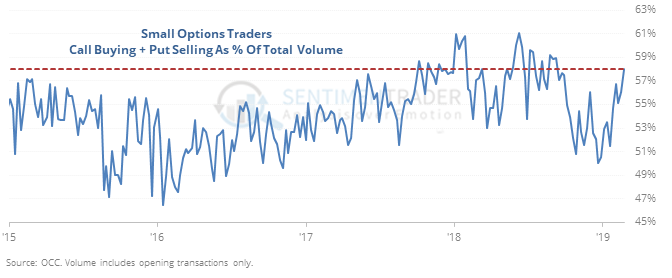

The smallest of options traders spent nearly 60% of their volume last week on bullish strategies, either buying call options or selling puts to open. That’s among the most aggressive bullishness using real money since the financial crisis.

There were some weeks that showed decent returns, especially at the start of the bull runs in early 2014 and last 2017. But overall, it was not helpful for investors to focus on bullish strategies along with these small options traders.

Whipsawed

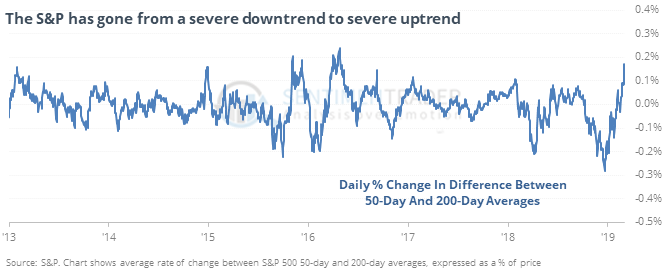

The S&P 500’s medium-term trend has whipsawed around its long-term trend. The 50-day average went from a severe bout of daily losses relative to the 200-day, to a bout of severe daily gains, as noted by respected technician Helene Meisler.

Other times it cycled back and forth like this, it led to either very good or very bad returns, depending on the market environment.

Short-term whipsaw

Not only have investors been whipsawed, but traders have too. The S&P 500 fund, SPY, went from a 3-month high to 5-day low in the same day. Other times that happened, it rose the next day only 27% of the time and next two days 36% of the time. But by 33 days later, it was higher 82% of the time since 1993.

Put surge

The Put/Call Ratio on 30-year bonds surged above 5, as there were more than 200,000 puts traded compared to only 36,000 calls. That hasn’t been a very good contrary indicator for funds like TLT. A week later, it rallied after only 3 of the 9 signals per the Backtest Engine.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.