Options Bulls Reign As New Lows Rise Even Amid Good Price Momentum

This is an abridged version of our Daily Report.

Calling all bulls

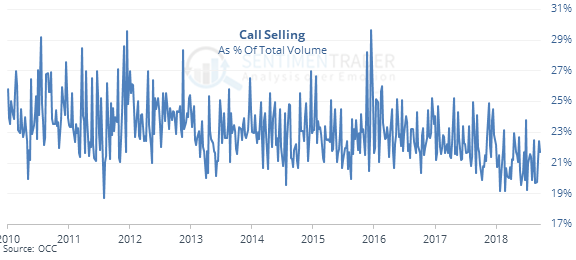

Options traders are showing a historic preference for speculating on the upside. In recent weeks and months, they’ve spent most of their options volume on buying speculative calls.

At the same time, they don’t want to risk a large rally by selling calls, leading to the largest call buy/sell ratio since 2000.

That sinking feeling

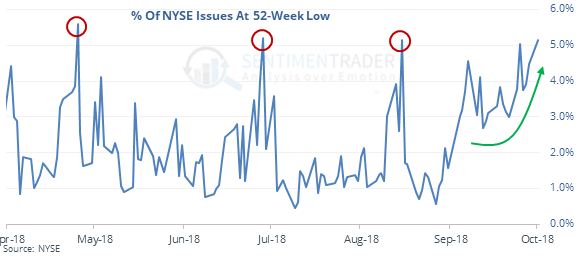

Major indexes continue to hover near their all-time highs. At the same time, a large number of securities on the NYSE have sunk to their lowest in a year. This is one of the few times in 50 years that indexes were so close to their highs while more than 5% of the NYSE was at a 52-week low.

At least there’s price

Price momentum has been strong lately, and conditions are extremely calm. When a quarter ends with such calm conditions, that has been a good sign. Even better, the typically weak third quarter was excellent, and heading into Q4, that has been an excellent sign.

Bio-wreck

The IBB biotech fund had a negative outside day at a 52-week high on Monday. It traded higher than Friday’s high and lower than Friday’s low, while closing lower than Friday’s close. That has happened 21 other times in the fund’s history.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |