Optimism is Low in Both Stock and Bond Markets

Over the past couple of weeks, volatility has spiked, and optimism has plunged. That's true for stocks, and it's true for bonds. It puts investors in an unusual and uncomfortable place.

The two asset classes are supposed to (mostly) offset each other's worst qualities while not being too much of a drag during the good times. That's the whole concept behind the 60/40 portfolio balancing behemoth.

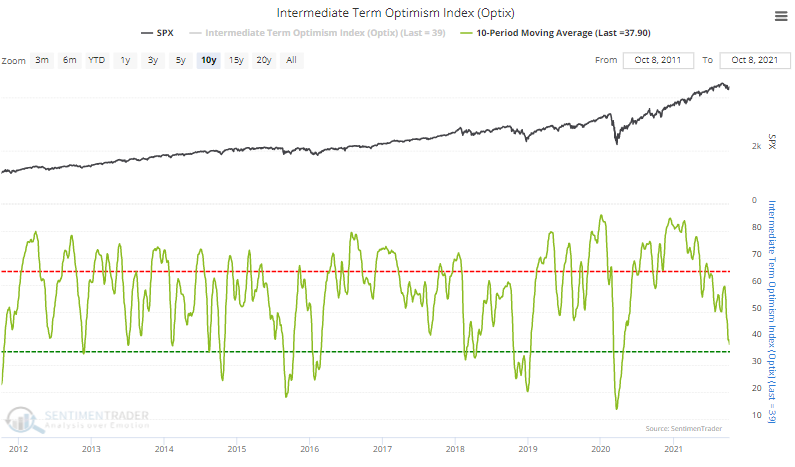

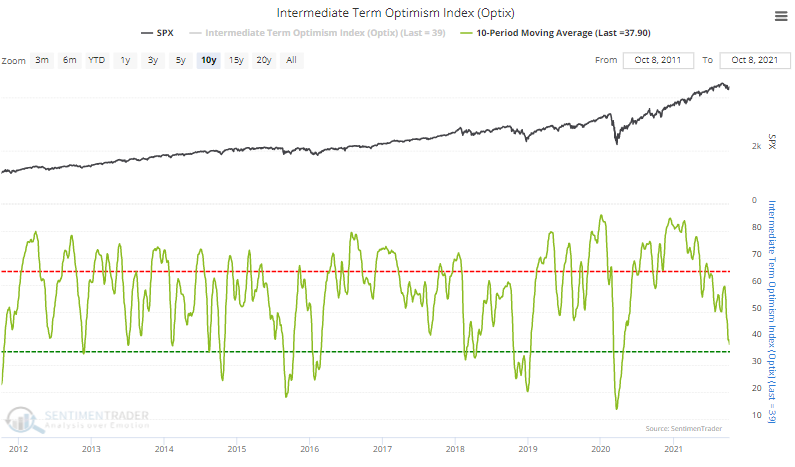

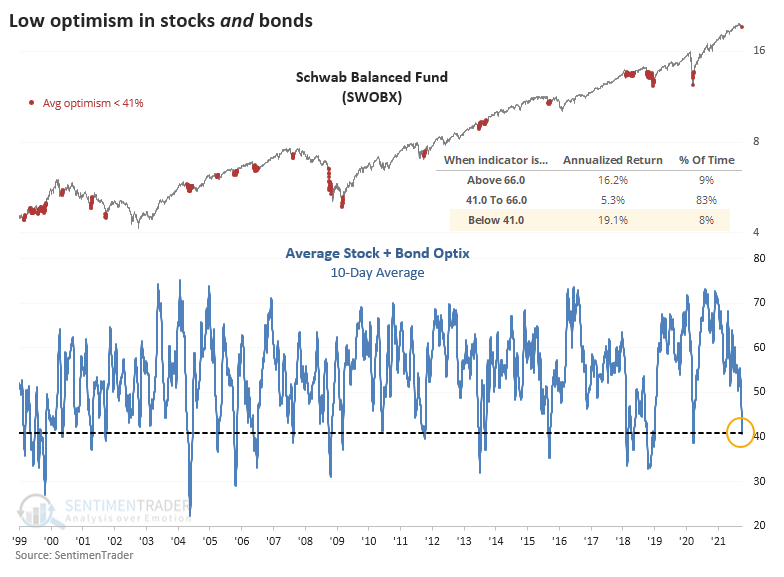

In recent days, sentiment has soured for stocks, and the 10-day average of the Medium-term Optimism Index is nearing a pessimistic extreme.

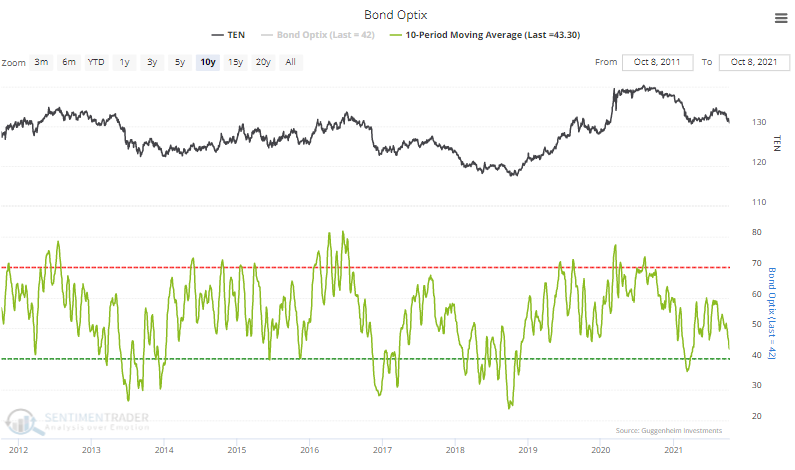

Curiously, investors have not sought the safety of the bond market. The 10-day average Bond Optimism Index has likewise dropped.

The 10-day average of both stock and bond Optimism Indexes are in the bottom 6% of all readings over the past decade.

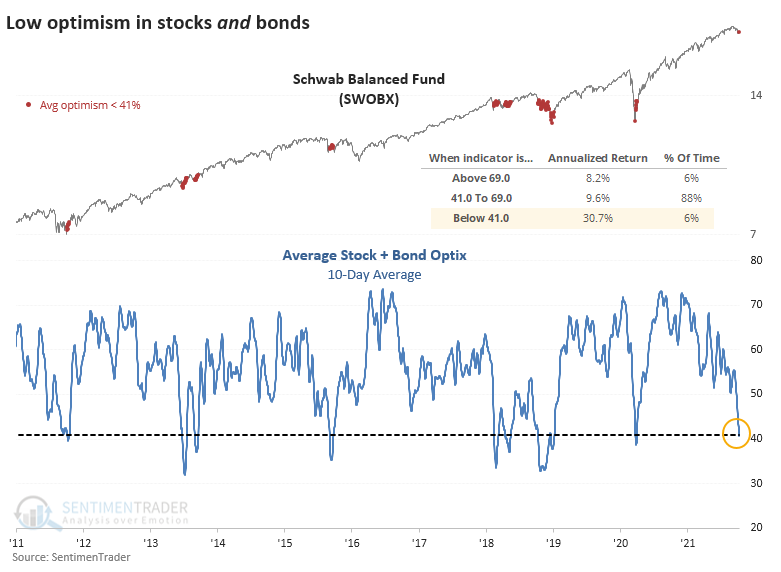

The average combined stock and bond optimism is now approaching 40% for one of the few times in the past 20 years. Typically, the markets balance each other, with investors moving to bonds when they're fearful of stocks and vice-versa. This is only the 2nd time in the past two years when optimism on both markets was so low - the pandemic panic being the other one.

Over the past decade, the annualized return in a balanced equity and bond fund when combined optimism was this low was a hefty +30.7%.

Zooming out to 1999, returns dipped, thanks to being too early during the financial crisis, but were still impressive overall.

There is a lot of talk about whether the bond market will serve as a buffer against stock volatility in the years ahead. Both markets are objectively overvalued, and if they decline together, then it's going to hurt a whole generation of investors raised on the gospel of a 60/40 balanced portfolio.

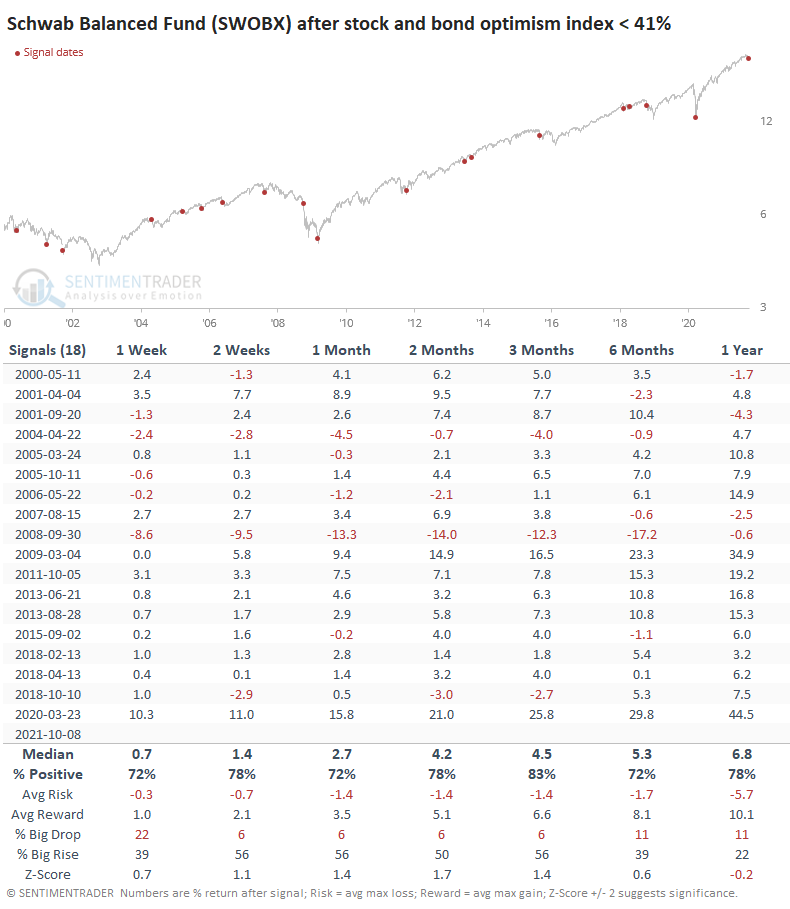

Schwab's good, low-fee fund that generally adheres to the 60/40 stock/bond allocation shows that such fears were mostly unfounded. Out of the 18 prior signals, only one preceded a large and sustained decline (global financial crisis). Only 3 signals saw a loss of more than -5% at any point over the next three months, while 10 of them saw a maximum gain of more than +5%.

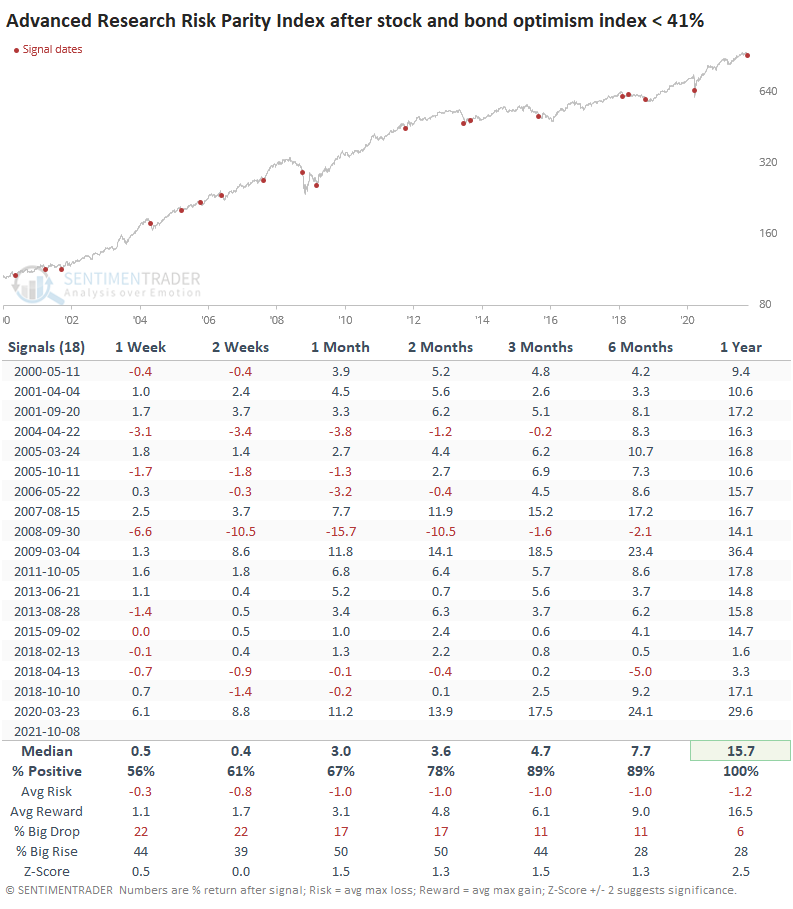

There is also a concern that action like this will trigger systemic issues due to risk parity funds. These obscure funds, which typically use heavy leverage to place bets on stock and bond markets based on their historical volatility, pop up once in a while as a boogeyman.

Their reaction after other periods of stock and bond pessimism made them even less risky than a balanced fund available to everyday investors. In the months after these signals, a risk parity index showed consistent gains, with extremely low risk relative to reward.

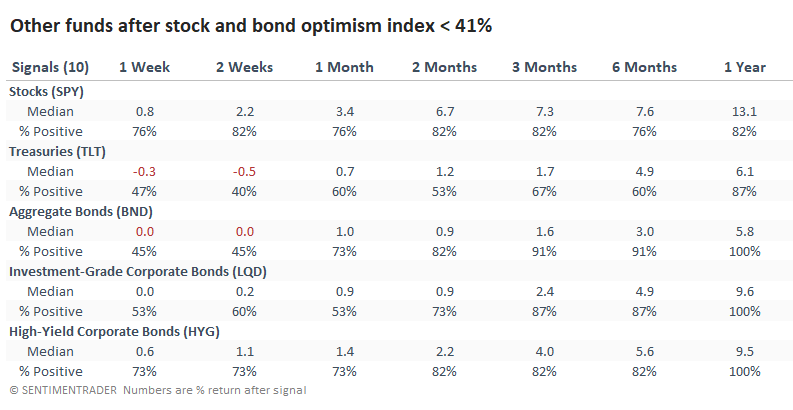

Returns in popular stock and bond ETFs were almost all good outside of the very short-term. The worst-performing of the funds focused on Treasuries.

There aren't very many opportunities for longer-term investors who try to balance their portfolios broadly by stock and bond allocations when investors in aggregate sour on both markets. While pessimism in either market isn't yet extreme, it's pretty stretched. That's curious given the relatively small losses, but maybe some pessimism makes sense when investors haven't suffered nary a blip for a year.

Regardless, when both markets see a lack of optimism as we see now, it's typically been a pretty good time to put money to work, with balanced funds being a good option.