Optimism is high after completely reversing last year's panic

Key points:

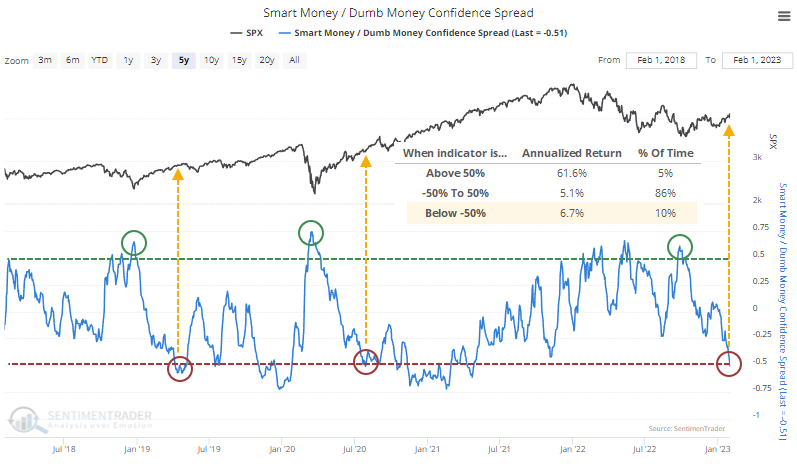

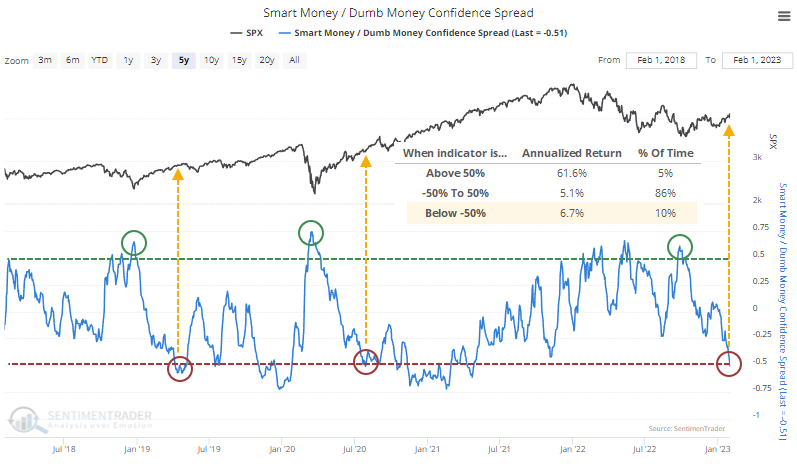

- The Spread between Dumb Money and Smart Money Confidence has cycled to extreme optimism

- This occurred after a reading of extreme pessimism last fall

- After similar cycles, S&P 500 returns were good, with the three failures all giving short-term clues

After a year of deep pessimism, sentiment has completely reversed

Early last October, investors were in full-on panic mode. Dumb Money (mostly trend-followers) was selling ferociously, while Smart Money (mostly corporate insiders and institutional traders) was buying.

Since then, a persistent and remarkably broad-based rally in financial assets has dramatically shifted sentiment. The Spread between Dumb Money and Smart Money confidence in a further rally has fully cycled from one extreme to the other.

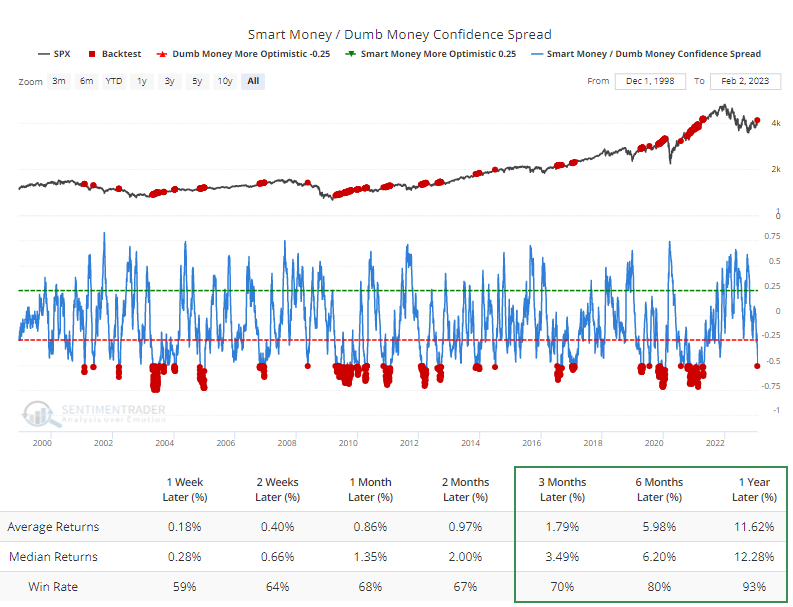

The Backtest Engine shows that when the Spread is very high (Dumb Money is selling and Smart Money is buying), forward returns in the S&P 500 have been consistently positive. But the opposite is also true. When the Spread is very negative, the S&P's returns have also been quite positive.

Well, that sounds pretty useless. If returns are above-average, whether the model is at either extreme, then what's the point? But it gets down to the heart of what we've been highlighting for 20 years - sentiment works differently in bull and bear markets. We can see in the chart above that the S&P's annualized return is better at the extremes than it is when sentiment is in the mushy middle.

Since we began computing this in 1998, whenever the Spread was below -0.5, the S&P 500 was positive over the next year 93% of the time, averaging 12.3%.

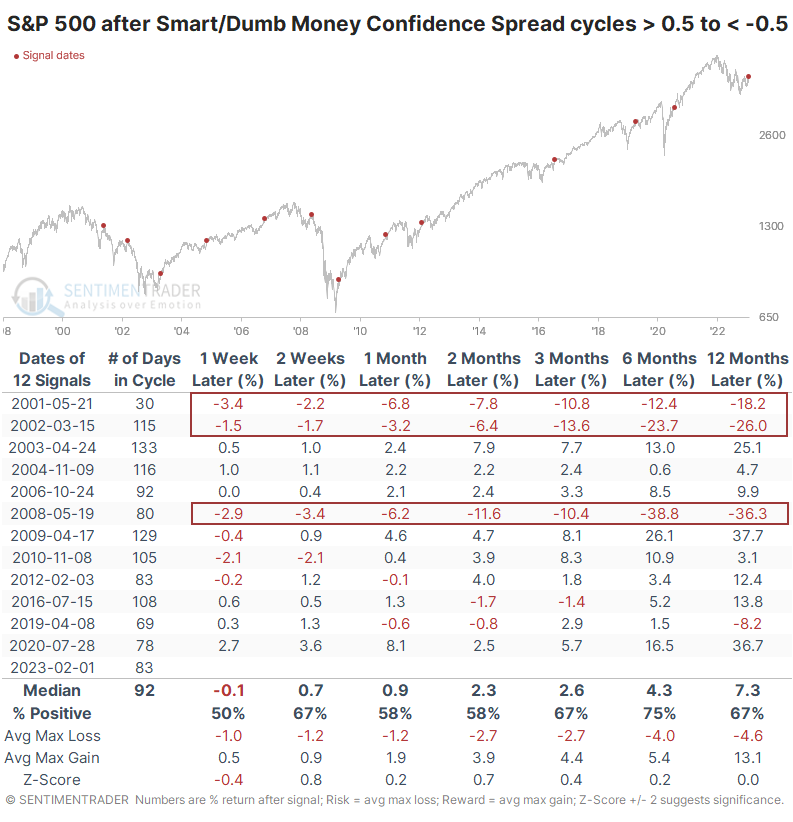

Perhaps the best way to look at this is by comparing it to other sentiment cycles. These are times when the Spread cycled from above +0.5 to below -0.5, from deep pessimism to high optimism. The current cycle occurred in about the average number of days, so nothing was outstanding there.

Over the next six months, the S&P showed a positive return after 9 of the 12 cycles. What seems notable is that the three outright failures all failed immediately. While a negative return over the next 1-2 weeks did not guarantee a negative long-term return, a negative long-term return was precipitated by a negative short-term return each time.

What the research tells us...

Contrarian-minded investors are wired to want to sell every time they see signs of optimism among other investors. During bear markets, that's often a pretty good bet. Other times, not so much, as bull markets require a persistent attitude of optimism to keep rising. The key is whether we're still in a bear market environment, and the arguments for that have weakened considerably in recent weeks. We do not see breadth readings as we have lately during bear markets. Indeed, this could be a rare exception, but it hasn't paid to use that as the base case.