Optimism Flat As Buying Surrounds Holiday Break

With stocks staging another impressive rally, a few of our shorter-term indicators are moving to optimistic extremes, but not as many as we'd think.

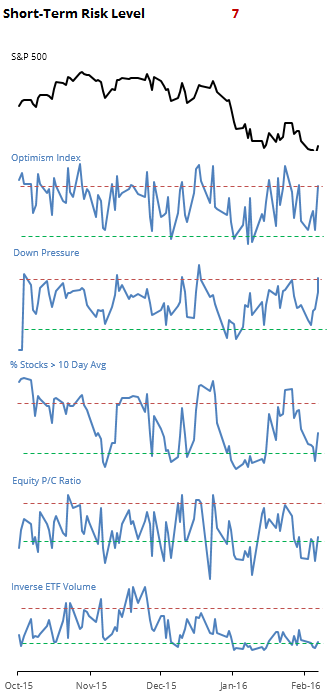

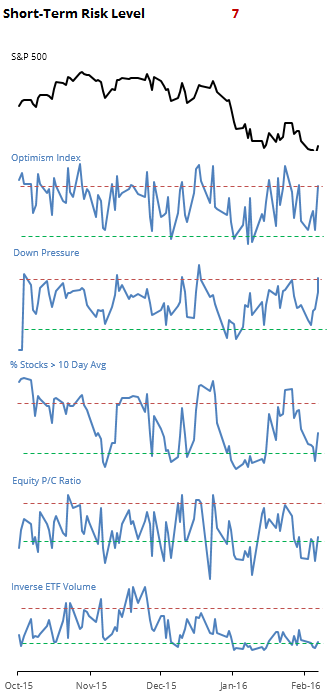

Using preliminary pre-close data, here is what our main short-term guides look like:

The Optimism Index is about where it was on Friday, and the Risk Level didn't rise. Put/call ratios are still relatively muted, and there is a surprising amount of volume flowing into inverse ETFs, not something we usually see after two days of fairly large gains.

Looking at those gains, there have been 39 times since the S&P became a 500-stock index in 1957 that it rallied at least 1% on consecutive days heading into Wednesday. The next day (Wednesday) was positive 38% of the time and the return from Tuesday's close through Friday's close was positive only 44% of the time averaging -0.3%.

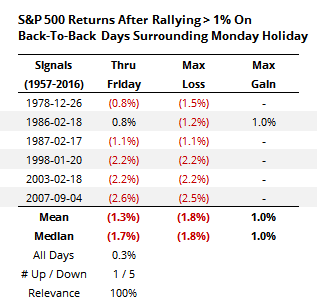

When Monday had been an exchange holiday, then there were only 6 occurrences. All six closed lower on Wednesday and only one gained through Friday. The returns below are from Tuesday's close through Friday's close, using closing prices only.

It's a bit silly, but it does suggest that a strong short-term rally into mid-week tended to back off. We'd be more concerned about that if the Optimism Index was really spiking. If buyers step in again on Wednesday and push Optimism further into extreme territory, then we'd be more anxious to reduce short-term exposure.