Opportunity is Where You Find it - The Agricultural Edition

One of my favorite phrases in all of trading states:

"Opportunity is where you find it."

Which I basically stole to create:

Jay's Trading Maxim #15: All of trading can be boiled down to two steps:

- Spot opportunity

- Exploit opportunity

Essentially, everything that you do as a trader fits into one of these two categories.

And if you do this long enough, you eventually learn that things don't always work the way you might intuitively think they would or should. Which - just for the record - can create opportunity. Take, for instance, "Ag Risk Levels."

AG RISK LEVELS

As the name implies, the Ag Risk Levels indicator is intended to identify when risk is high or low in the agricultural-related markets. After a lot (and I mean "a lot") of testing, I have found that:

- Extremely high AND extremely low readings are both useful at identifying impending unfavorable action in the agricultural arena.

This may seem counter-intuitive to a lot of traders and might even make them uncomfortable. And that is perfectly understandable.

But - repeating now - "opportunity is where you find it."

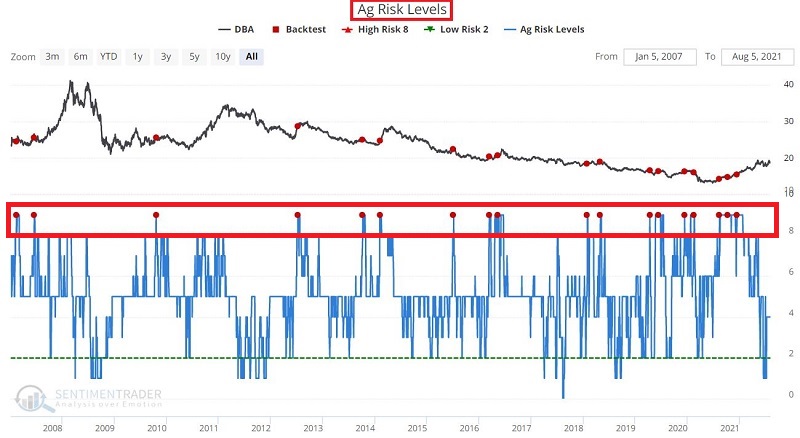

Let's take a closer look at the potential opportunities available using Ag Risk Levels. For testing purposes, we will use ticker DBA (Invesco DB Agriculture Fund). This ETF holds futures contracts in a wide variety of agricultural-related markets. See the figure below.

READINGS ABOVE 8

For our first test, we will look for those times when Ag Risk Levels:

- Is above 8 for the first time in 2 months

We find that results are slightly positive right after a signal but deteriorate over time, with 2-month through 1-year returns averaging a loss.

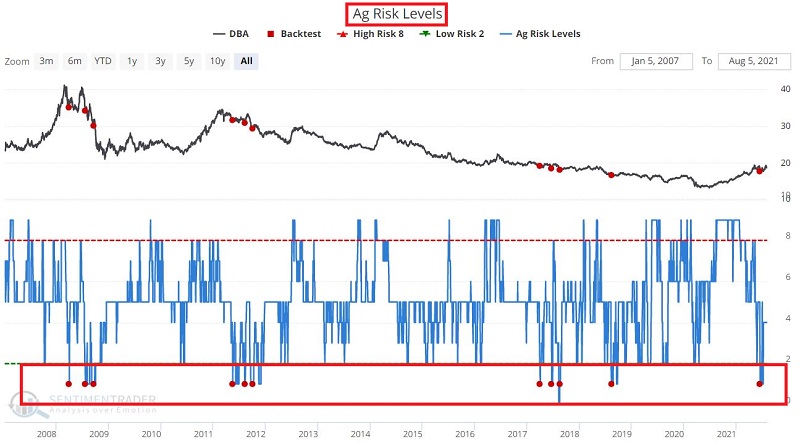

READINGS BELOW 2

For our next test, we will look for those times when Ag Risk Levels:

- Is below 2 for the first time in 2 months

What we find is an even more extreme version of the results above. Returns are generally fairly positive for the first month after readings below 2. After that, things tend to go downhill, with 6-month and 1-year returns decidedly negative.

The last signal occurred on 6/17. So far, performance is holding to form, with DBA sporting a decent gain. Given the reversal and strong rally in commodities as an asset class in the past year and recent inflationary fears, it is possible that "the tide has turned" and that this strength will continue.

But this study suggests that alert traders should remain prepared to take advantage of opportunities playing the short side should commodity price weakness unfold in the months ahead.