One reason gas price may head higher again

Key points

- Unleaded gas tends to be a highly cyclical market

- This market is entering a typically favorable seasonal period

- ETF ticker UGA offers an alternative to trading riskier unleaded gas futures

Gasoline is a highly seasonal market

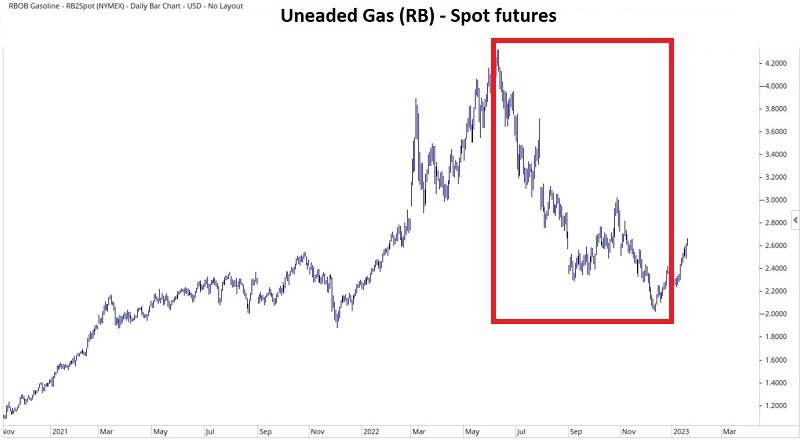

The chart below displays the annual seasonal trend for unleaded gas futures (ticker RB).

The chart above shows that this market tends to experience significant weakness in the year's second half. Despite all the dire prognostications regarding gas prices early in 2022 as the Russia-Ukraine war broke out, gas futures followed their typical seasonal pattern. They fell hard during the year's second half, as shown in the chart below (courtesy of Optuma).

The most important thing to note is that unleaded gas is re-entering a typically favorable seasonal period. How favorable? Let's take a closer look at history.

Entering a seasonally favorable period

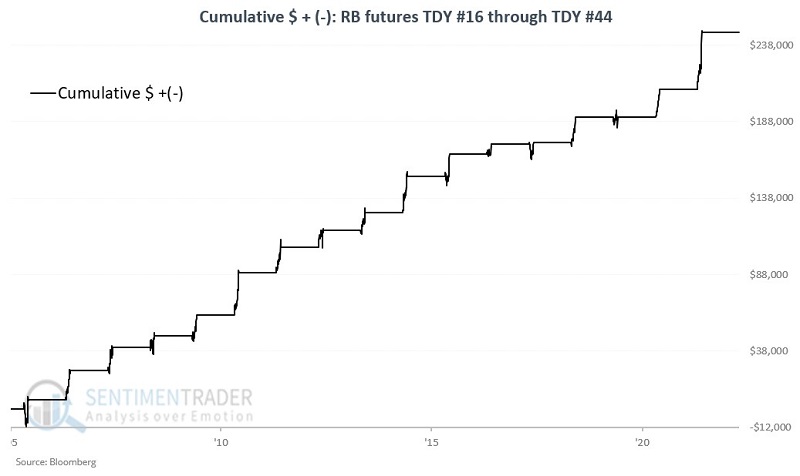

The seasonally favorable period extends from the close of TDY #16 through the close of TDY #44. Note that the contract we follow from Bloomberg tracks spot RB and includes all dates when electronic trading takes place (which typically means most weekdays, including most holidays).

For 2023, this period extends from the close on 2023-01-24 through 2023-03-03.

The chart below displays the cumulative hypothetical gain from holding one long unleaded gas futures contract only from TDY #16 through TDY #44 every year since 2006 when the current configuration of RB futures started trading.

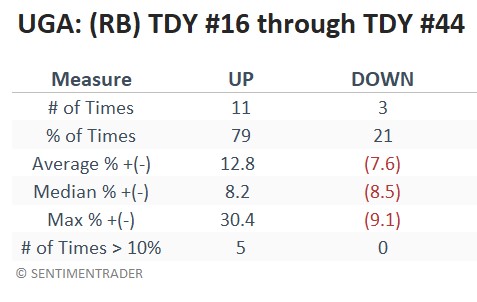

The table below summarizes performance results during this favorable seasonal period.

The good news is that historical results have been consistently favorable. The bad news is that there is no guarantee that future results will be similar. Likewise, the fact remains that unleaded gas futures are inherently very volatile and require very deep pockets (and a solid understanding of the unlimited risk inherent in futures trading) to trade.

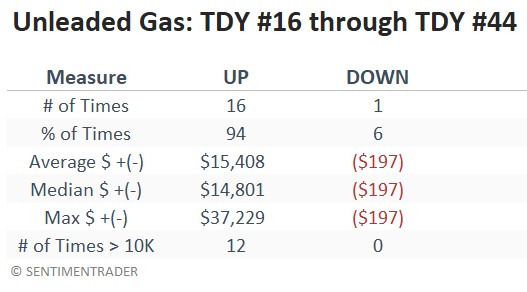

Using an ETF as an alternative

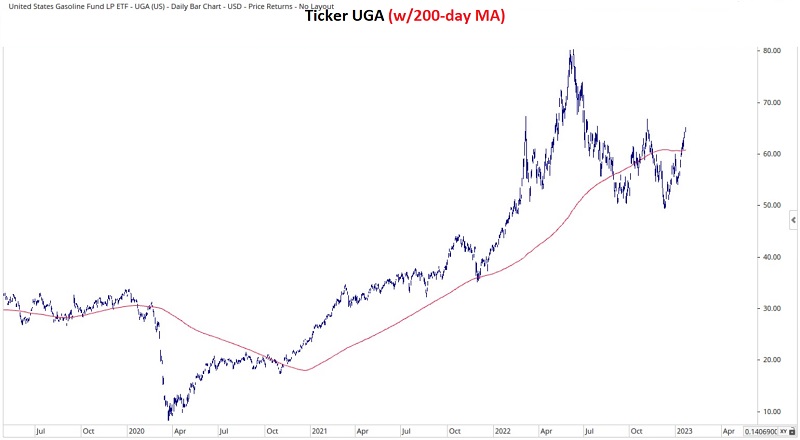

The United States Gasoline Fund® LP (UGA) is an exchange-traded security that is designed to track in percentage terms the movements of gasoline futures prices. UGA issues shares that may be bought and sold like shares of stock. This ETF allows investors to participate in the movement of unleaded gas prices without exposing themself to the risk associated with trading futures contracts.

The futures contracts held by ticker UGA are based on their proscribed roll schedule. This means that the daily percentage fluctuation in UGA may differ from those of the spot contract we used above to track RB futures directly.

NOTE: To compare apples to apples, we use the same buy and sell dates for UGA that we did for RB futures above.

The chart below displays the growth of $1 invested in UGA only from TDY #16 through TDY #44 for gasoline futures.

The table below summarizes performance results during this favorable seasonal period.

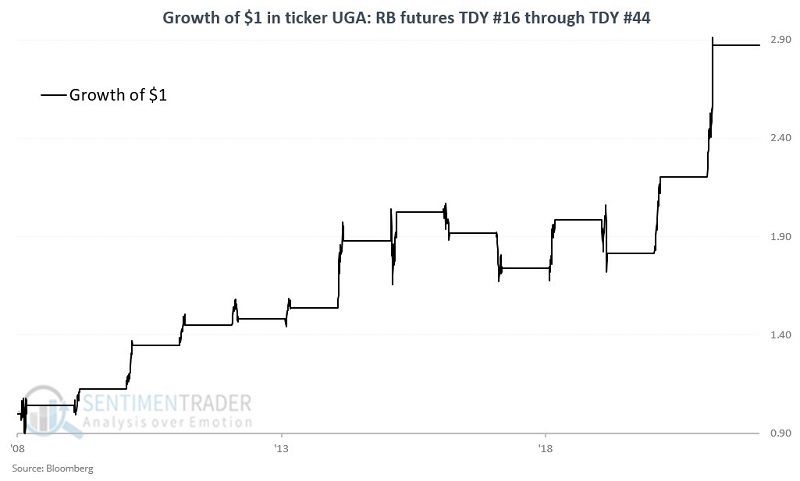

The image below displays a daily chart for ticker UGA along with a 200-day moving average. Note that the price is once again back above the 200-day average. Whipsaws are always a possibility when it comes to trend-following. Nevertheless, for as long as it holds, this configuration lends some favorable price trend confirmation to the favorable seasonality detailed earlier.

What the research tells us…

Unleaded gas is a highly cyclical market. It tends to show strength in the first half of the year and weakness during the second half. However, there is no guarantee that this pattern will play out as expected in any given calendar year. This market is now entering a period that has seen RB futures show exceptional strength. That said, traders must recognize the exceptionally volatile nature of unleaded gas futures. Non-futures traders who wish to play the long side of unleaded gas can look to ticker UGA, with the caveat that returns for the ETF have not been as robust as those for the futures themselves.