One of the "Sharpest" Rallies in 60 Years Is Rolling Over

For investors, nirvana is a market showing steady and impressive gains without much risk. That pretty much sums up the past year.

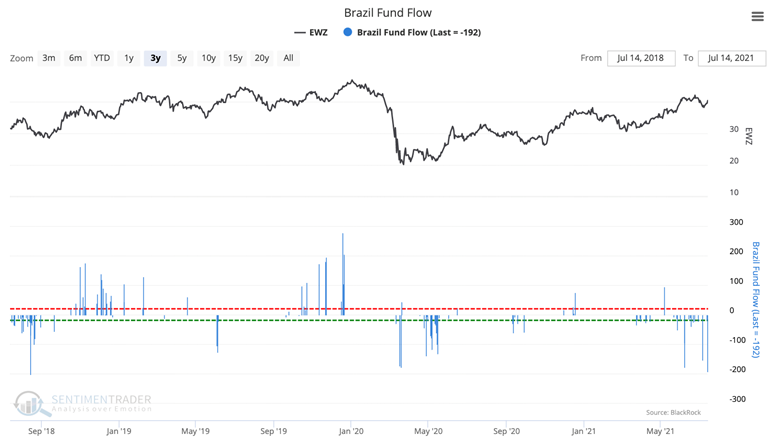

Using a version of the Sharpe Ratio, the S&P 500 has seen the best risk-adjusted returns since late 2017 and ranking among the best ever. From Investopedia (edited for brevity):

The Sharpe ratio was developed by Nobel laureate William F. Sharpe and is used to help investors understand the return of an investment compared to its risk. The ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. Volatility is a measure of the price fluctuations of an asset or portfolio.

Subtracting the risk-free rate from the mean return allows an investor to better isolate the profits associated with risk-taking activities.

Generally, the greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.

Methodologies for calculating the ratio can vary, and using it as a measure of portfolio managers' acumen is subject to fierce debate. It's still a handy way to determine just how ideal market conditions have been for investors.

For the S&P, its Sharpe Ratio is just now rolling over from an extremely high level.

After other times the ratio got as high as it recently was and started to roll over, the S&P saw some weakness over the medium-term.

If we focus on the next 1-6 months, only two signals saw the S&P continue its trend uninterrupted. The others either saw weakness at some point during that time frame or only minor gains.

What else we're looking at

- Full returns in the S&P 500 following a high Sharpe Ratio that's rolling over

- Sector and factor returns following a high and declining Sharpe Ratio

- Two industries are giving opposite reversal signals

- Options ideas to trade a pause in the rally in crude oil

| Stat box The 5-month trading range in the small-cap Russell 2000 is one of the tightest in 50 years. It has seen similar ranges 18 times, leading to an average 3-month future return of 0.6%, positive 50% of the time. Not very exciting for either past or future (average) returns. |

Etcetera

Maybe it'll float. The NASDAQ Titanic Syndrome triggered again on Thursday. This is the 3rd signal in the past 6 sessions.

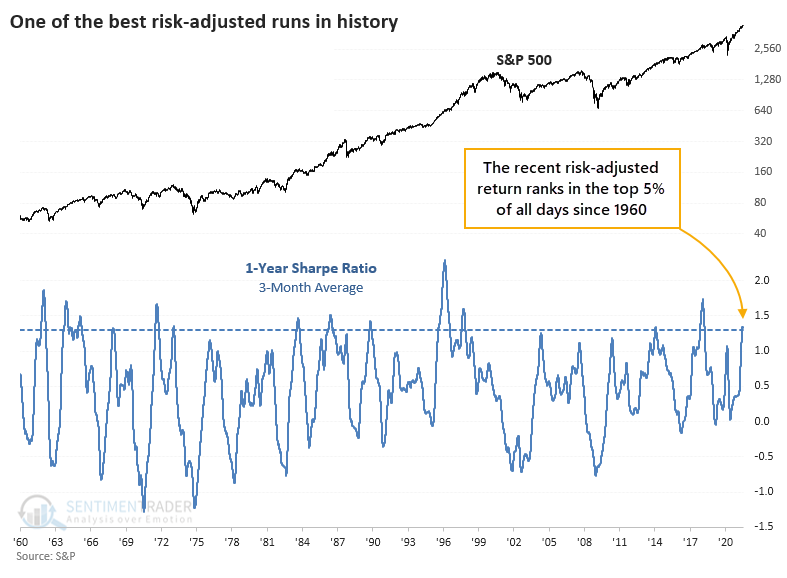

Mirror market. Total assets in bullish index funds at Rydex are at their highest level since November 2000, reaching $3.4 billion.

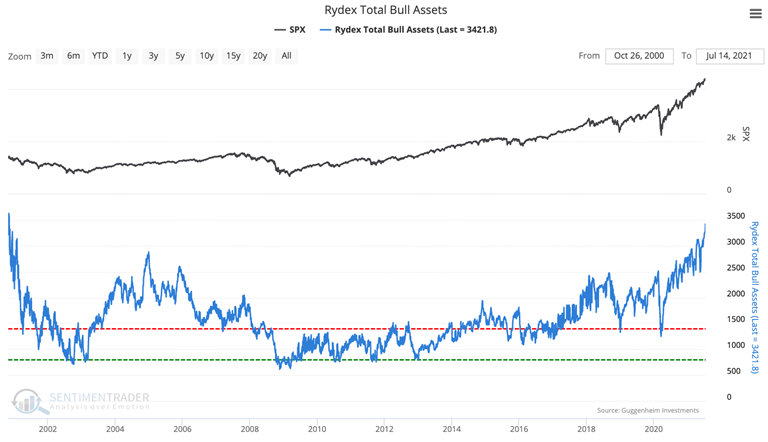

Waxed. The most popular ETF focused on Brazilian stocks, EWZ, has had its largest outflow since Aug. 2018, losing $192 million in assets in a single session.