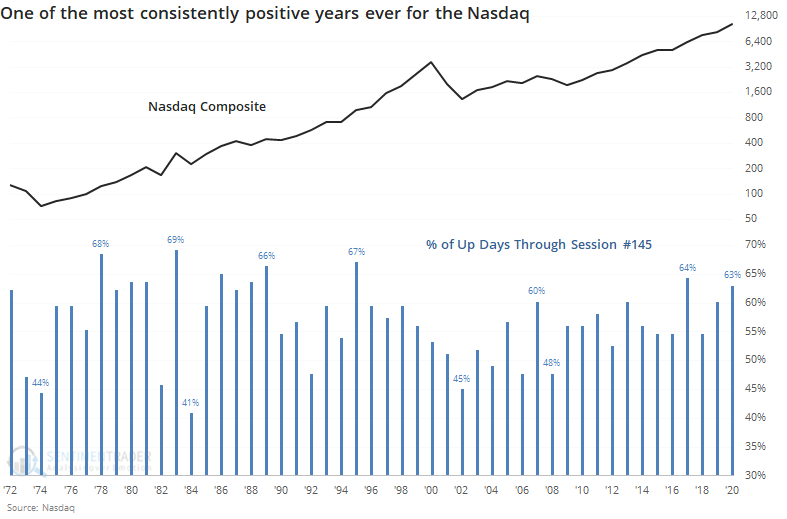

One of the most consistently positive years for the Nasdaq

This has been a heck of a year for, well, pretty much everyone. Investors haven't been left out of the drama.

After the fastest-ever bear market and biggest-ever rebound, most of the broad equity indexes are back near their former highs. Those with a healthy smattering of tech stocks have done even better, of course.

Bloomberg reporter Sarah Ponczek noted that more than 62% of all trading days in 2020 have seen a gain, per JonesTrading. Through this many days in the year, this is the 2nd-largest percentage of positive sessions in 25 years.

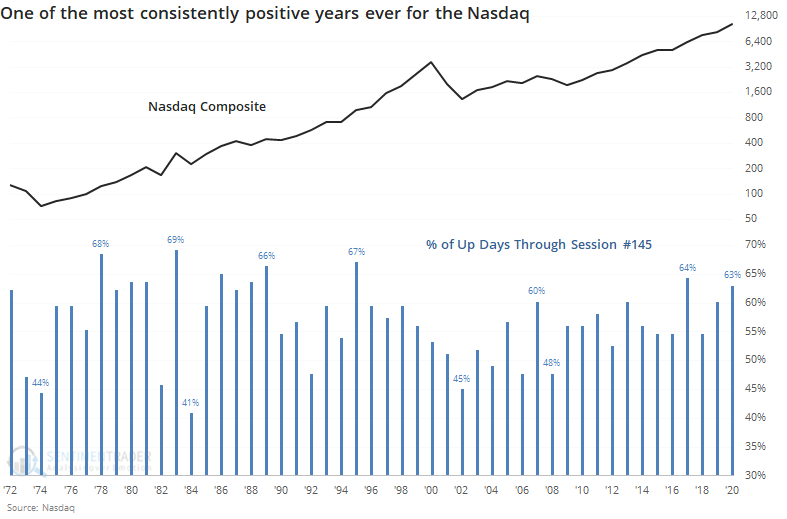

The biggest question is, "so what?" and the answer is "not much." Below, we can see the Nasdaq's forward returns after the largest percentages of up sessions through this point of the year.

Short-term returns were decent as the Nasdaq continued to drive higher into early August. After that, it petered out and by three months later, barely showed a positive median return. Its return was below average from three months and beyond, with a poor risk/reward ratio.

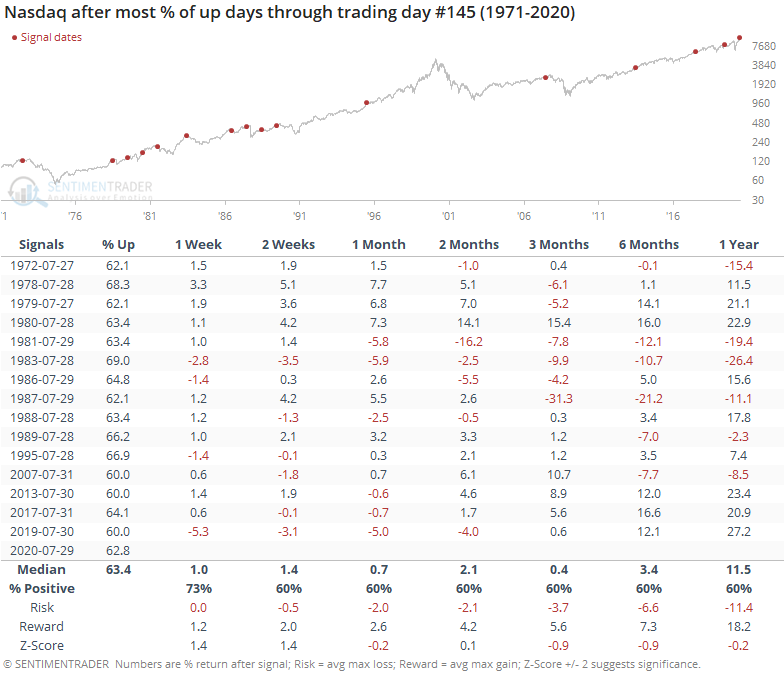

We can contrast that to its returns during the years with the smallest percentages of up sessions.

During these years, the Nasdaq's short-term returns were significantly worse than during the good years, but its medium- to long-term returns were a bit better.

Momentum is a tricky thing, which is why we look at it from so many angles. Nothing can defeat sentiment extremes like momentum. While the Nasdaq is certainly showing a good amount of it, when we combine it with seasonality, it's not necessarily a reason to think that it can roll right over displays of excessive optimism at this point.