Oil's historic reversal

Traders in the oil patch finally got a bit of relief on Monday after an early scare.

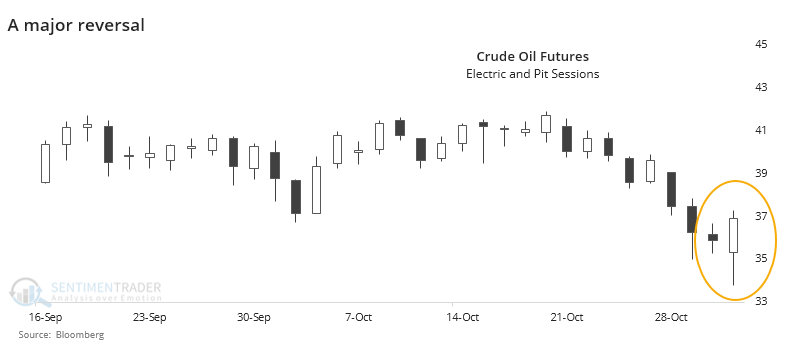

The price of crude oil plunged more than 5% (again) and hit its lowest level in more than 90 sessions (again) before reversing enough to erase all of the intraday losses and then some. Oil futures ended up closing nearly 3% higher than the previous close.

In commodity markets, the concepts of "open" and "close" aren't as clear-cut due to pit versus electronic trading and which specific contracts are being used. For these purposes, we're using front-month, roll-adjusted crude oil futures, including pit and electronic sessions, as computed by Bloomberg.

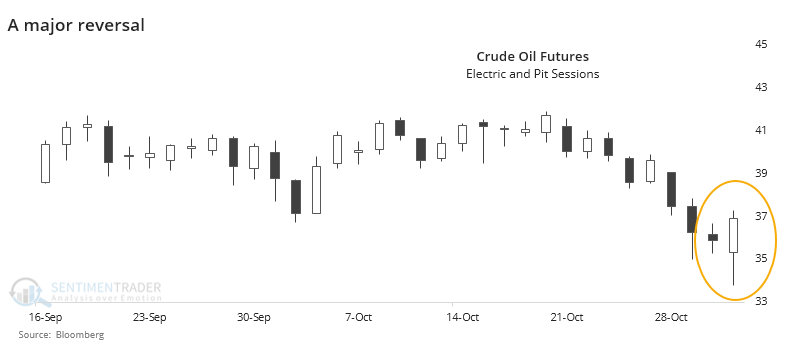

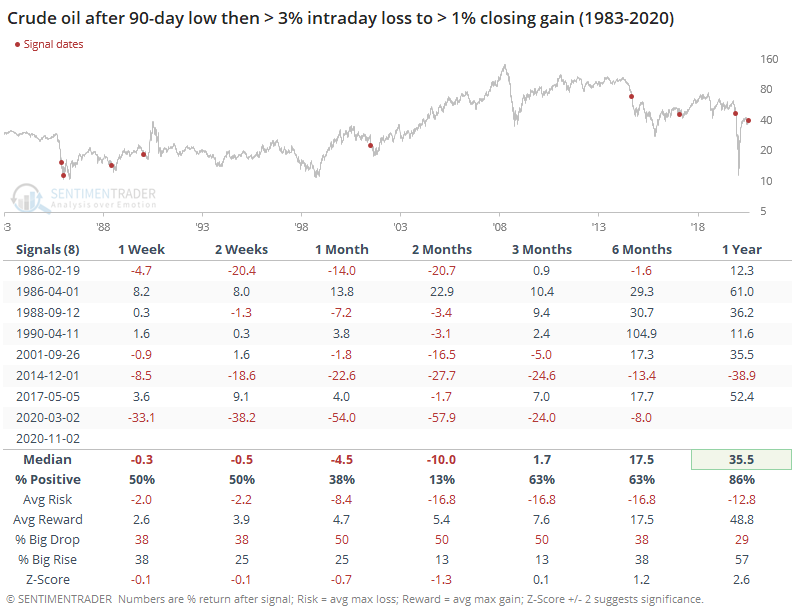

Using these parameters, Monday's reversal was one of the most impressive ever for crude. The few other times it managed such a feat proved to be a good sign going forward.

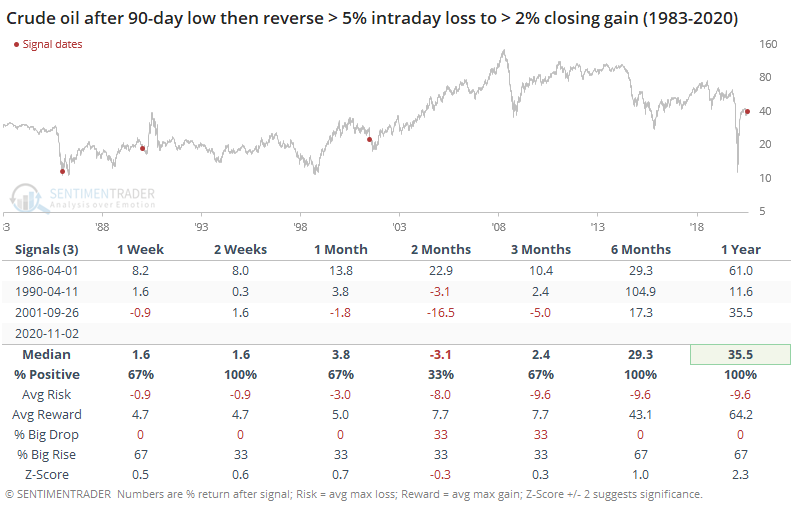

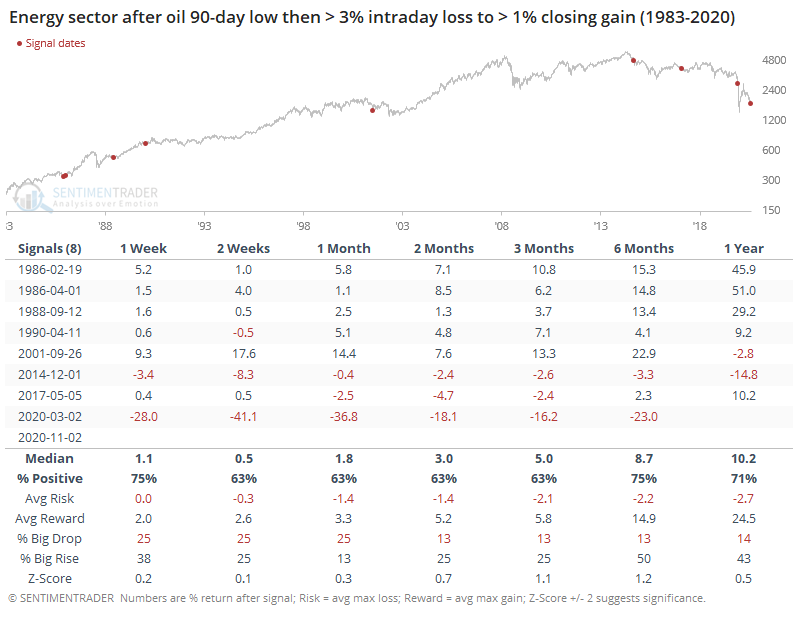

It was an even better sign for those companies most dependent on the price of oil. Over the next 2-6 months, energy companies enjoyed large gains with very limited losses.

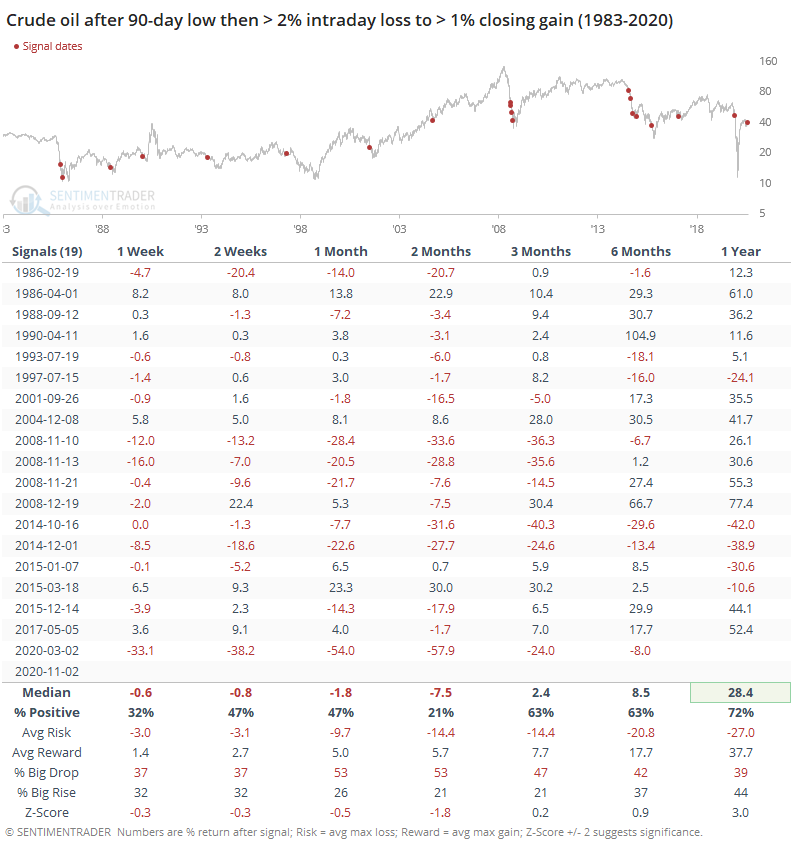

A sample size of 3 is hard to rely on, so let's expand the sample by relaxing the parameters. Here, we'll look at intraday losses of 3% or more, with a reversal to close higher by more than 1% for the day.

These were...not so great. Over the next 2 months, oil reversed the reversal almost every time, with only April 1986 proving to be a lasting bottom.

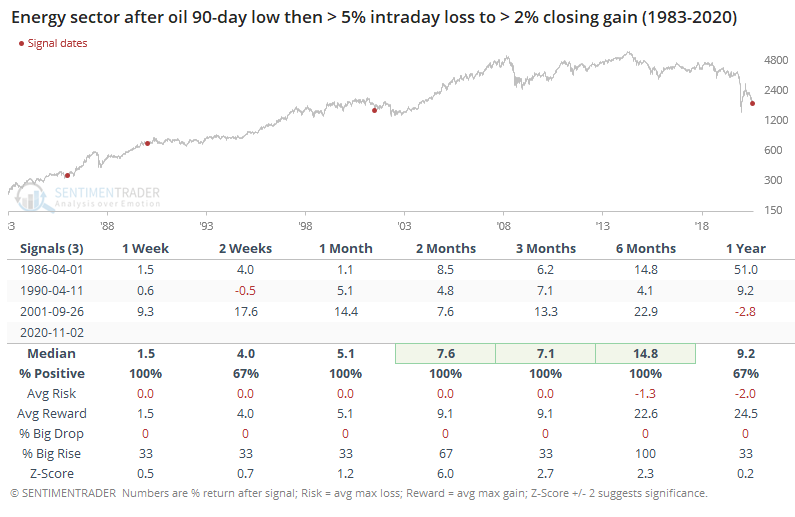

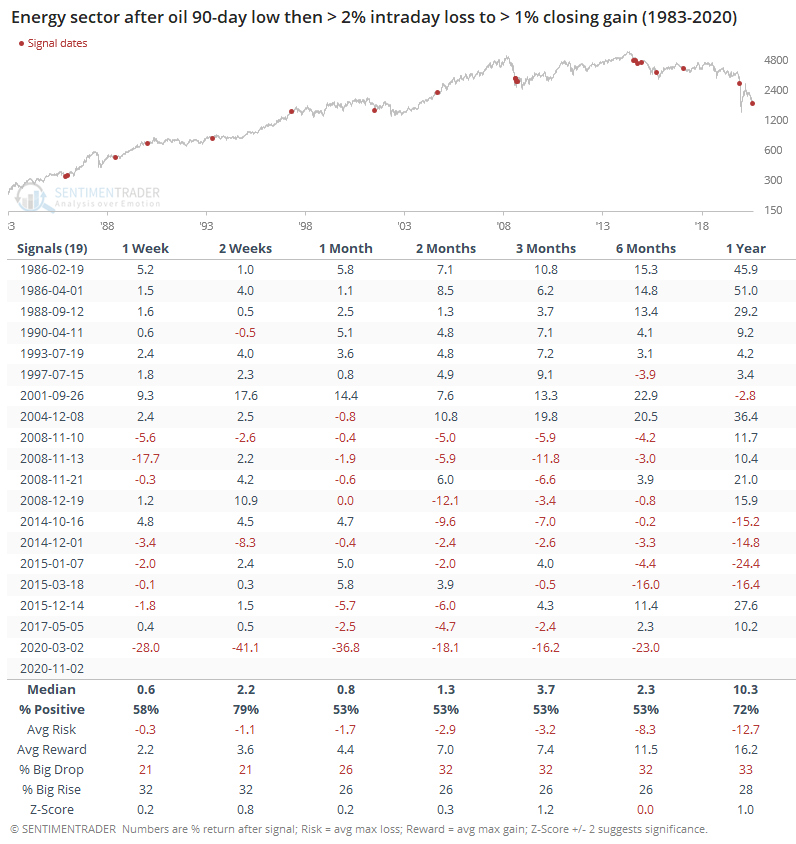

Despite the losses in oil, energy companies mostly held up okay. The biggest exception was the most recent when the sector was grossly oversold then Russia and Saudia Arabia engaged in a geopolitical spat.

If we relax even further to generate a larger sample, the same pattern holds true. These smaller reversals were not a reliable sign that selling pressure was exhausted in oil.

Energy companies typically rallied anyway, but the positive overall averages are almost entirely due to signals before 2008. Since then, forward returns were almost exclusively negative thanks to the extended bear market in these shares.

It's tempting to look at Monday's reversal and extrapolate it. Perhaps it's big enough, from such a place of despair, that it will trigger short-covering and more evidence that conditions are shifting from horrible to not-quite-so-horrible. There just isn't enough evidence here to include it as a positive going forward.